An individual or a business account issues a cheque when they need to make significant payments to someone. There are different types of cheques, which are based on various elements, such as: who is the drawer (the person or entity whose transaction account is to be drawn.) and who is the payee (whom the bank will pay). By issuing a cheque, you request your bank to pay the specified amount to a certain person, business, or group of people as per the given instructions.

However, an Order Cheque can be issued to make payments. If you are giving an Order Cheque, then you should know the meaning of an Order Cheque. So let us find out its meaning in deep detail.

Order Cheque Meaning

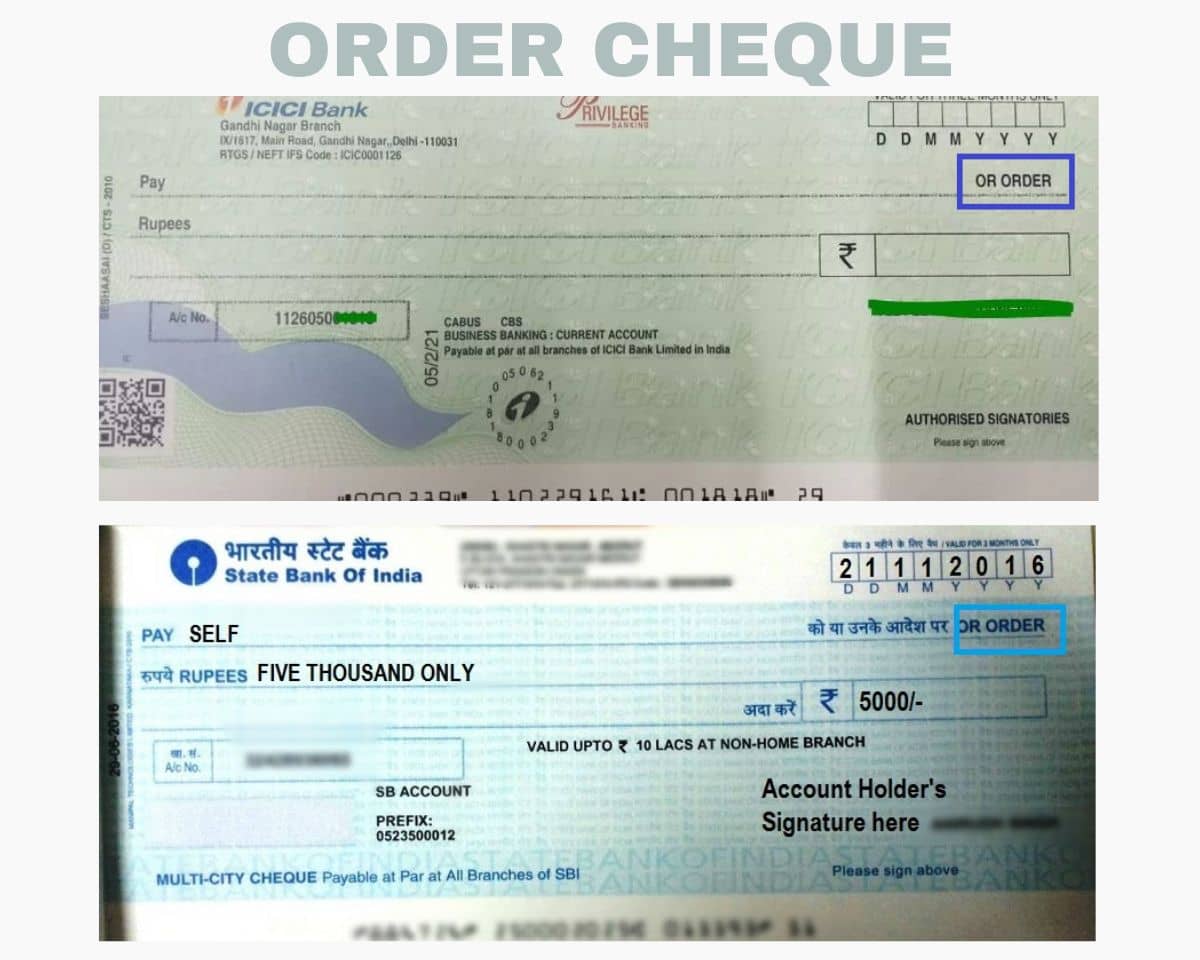

An Order Cheque can be any Cheque that consists of the words “or order” following the payee’s name or any other cheque having the word “Carrier” or “Bearer” crossed out. Such types of cheques can only be issued to a person or a business whose name is written on the cheque, and the bank will confirm the details of the payee to authenticate the cheque bearer’s identity before releasing the payment.

Moreover, by signing on the back of the cheque, the payee can pass this cheque to another party who can receive the payment on behalf of the payee. Therefore, the payee may either receive the money against the cheque themselves or may, in writing, appoint, authorize or endorse another person to accept the specified payment amount.

In an Order Cheque, both the payee’s signature as well as the authorized or appointed person’s signature is essentially required on it. Otherwise, the latter will not be permitted to receive the specified amount of payment if they both don’t sign on the Order Cheque.

Main Features of an Order Cheque

Generally, you can see that the banks used to issue some chequebooks which already had order cheques, where a word, like “or Order,” was printed on the cheque pages. When you see these cheques, you can quickly know it is an Order Cheque, which can be converted into other types of cheques by striking out the word “or Order.”

However, there are some other prominent features of the Order Cheques, such as:

- An Order Cheque is a negotiable instrument, which means that it is a cheque payable either to the order or to the bearer.

- An Order Cheque May or may not have written the word “or order.”

- An Order Cheque can be exchanged for money by the payee only or by an authorized person.

- The only individual who can encash the payment is a person whose name the drawer has listed as the payee on the cheque. Moreover, the specified amount may be transferred to anyone the payee allows for. It means that an Order Cheque can be endorsed by authorization.

- An Order Cheque can be deposited into the payee’s bank account or can be encashed by the authorized person.

- Generally, an Order Cheque requires identification formalities for payment.

- If an Order Cheque is not crossed, whether it is made payable to the bearer or order, it is generally known as an Open Cheque.

Afterward Takeaway Thoughts

So this way, you can easily and quickly learn about the meaning of an Order Cheque.

However, you should know that an Order Cheque will usually remain valid for up to three months from the date mentioned in that order cheque. Therefore, your Order Cheque will become invalid after three months from the date on the cheque, and it will not be cleared or encashed after that.

My name is shukri jillo from kenya. I hope this cheque is mine . Put amount and write my name and a count 7162317