It is essential nowadays to register and link customers’ mobile phone numbers with their bank accounts. Sometimes your SIM card containing your mobile phone number registered with your bank account may be lost or damaged, or you may have changed your mobile number for some reason. In such a situation, you are required to change your registered mobile number. But you have to update the new mobile number in your bank account to ensure you do not miss any essential updates.

This post elaborates on the need to keep your registered phone number updated and walks you through the process of writing an application to change the existing mobile phone number linked to your bank account. Let’s check.

Why It Is Essential To Keep Your Registered Phone Number Updated

It is essential to keep your registered phone number updated so that you can continue to benefit yourself with some customer-friendly banking services and facilities, such as: receiving SMS alert service, receiving OTP as a security measure at the time of making online transactions, or clearing online bill payments, etc.

In case you want to change or update your phone number previously registered with your bank account, then you will have to request your bank for the same by writing an application to your bank branch manager.

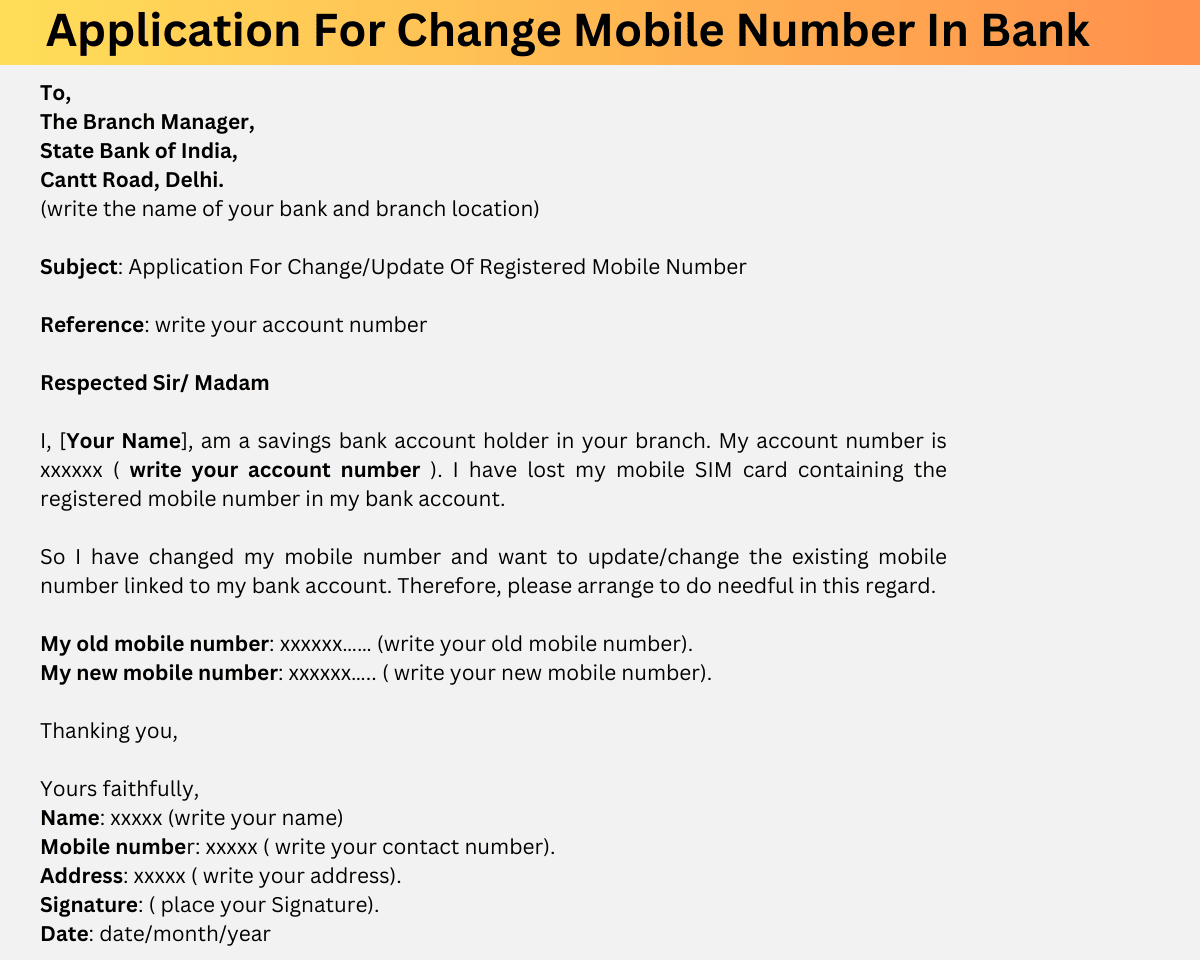

This application must be a formal letter in which you will mention some needful information, such as your bank account number, existing registered mobile number, the new mobile number you want to update or re-register, and a suitable reason for changing the previously registered mobile number.

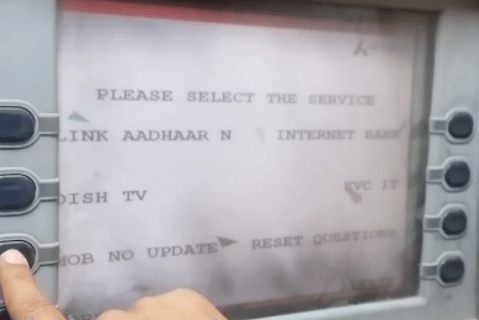

How to Change Your Mobile Phone Number In Your Bank Account

You can change or update the registered mobile number in your bank account in many ways. But the most sure and simple way to do it is to visit your home bank branch, fill up the application form to change your mobile number, and submit it to the bank branch manager.

However, you may not find such an application form most of the time in the bank, and the bank staff may ask you to write a request letter on paper for the same and submit it to the bank.

How to Write an Application To Change Mobile Number in Bank

You can follow the below-written format of the application requesting for mobile number change in your bank account, For Example: here we are writing a letter to SBI Bank.

To,

The Branch Manager,

State Bank of India,

Cantt Road, Delhi.

(write the name of your bank and branch location)

Subject: Application For Change/Update Of Registered Mobile Number

Reference: write your account number

Respected Sir/ Madam

I, [Your Name], am a savings bank account holder in your branch. My account number is xxxxxx ( write your account number ). I have lost my mobile SIM card containing the registered mobile number in my bank account. So I have changed my mobile number and want to update/change the existing mobile number linked to my bank account.

Therefore, please arrange to do needful in this regard.

My old mobile number: xxxxxx…… (write your old mobile number).

My new mobile number: xxxxxx….. ( write your new mobile number).

Thanking you,

Yours faithfully

Name: xxxxx (write your name)

Mobile number: xxxxx ( write your contact number).

Address: xxxxx ( write your address).

Signature: ( place your Signature).

Date: date/month/year

So there you are. By following the above-mentioned format, you can quickly learn about the process to write an application to change/update the existing mobile phone number linked to your bank account.

Main Concluding Thoughts

In this article, we have provided you with detailed information and simple guidance on how you can write an application to change the existing mobile number linked to your bank account, including why keeping your registered mobile number is essential, how you can change/update it, and how you can write an application to do it.

However, you should make sure that you write your application in a proper format without making spelling mistakes in it, and all the essential documents required to change the mobile number in your bank account are duly attached to the application.

Be the first to comment