Axis Bank offers a safe and secure mobile banking application to its customers, which is known as the Axis Mobile Application. This app comes with various customer-friendly features and services to fulfill the banking needs of the users by allowing them instant online transactions for their daily domestic requirements or business purposes.

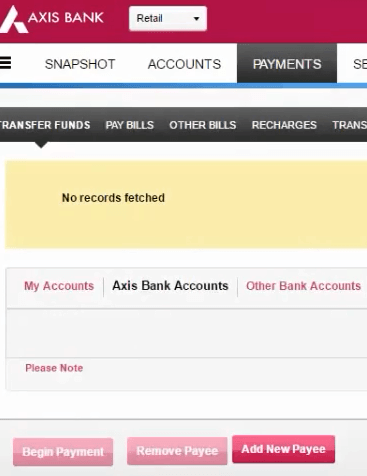

Through the Axis Mobile app, users can conveniently access their bank accounts in Axis Bank to receive money from others, transfer funds, pay bills, link other bank accounts, and a lot of other exciting features. All transactions can be quickly done on smartphones at any time and from anywhere, simply using a Virtual Payment Address (VPA) or Virtual ID/UPI ID. Axis Mobile app works on a Unified Payments Interface (UPI), wherein users are allowed to quickly transfer money without knowing the bank details of the beneficiaries or the sender’s bank details, and most importantly, transactions are settled in real-time, free of cost.

However, the Axis Mobile app users are required to create their UPI ID to avail themselves of the benefits of the exciting features and services from this app in Axis Bank.

This article post will guide you with critical information and straightforward guidance to help you learn what the Axis Mobile Application is, its uses and benefits, the need to create a UPI ID, and how to create an Axis Bank UPI ID through mobile banking app. Let’s read on to explore the detailed information on the same. So, without wasting any time, we should get started.

Steps to Create Axis Bank UPI ID Online

Suppose you are a bank customer in Axis Bank with a Savings or Current account with the bank. You want to avail yourself of the benefits of the exciting features and services from the Axis Mobile Application. You should know how to create your UPI ID to use the application mentioned above. If you don’t know how to do it, don’t worry. Simply follow the step-by-step guidance and easy instructions for the effortless process as follows hereunder:

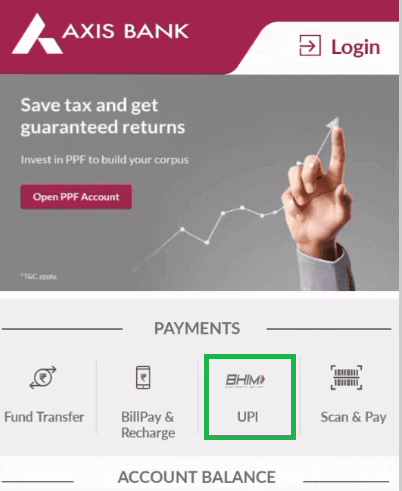

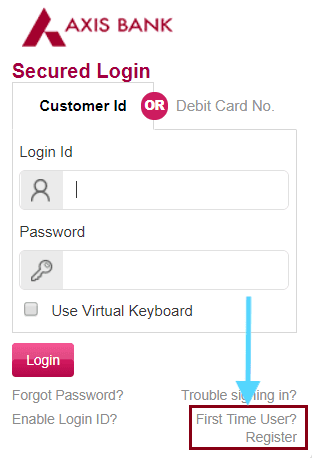

Step 1. Open the Axis Mobile Application on your mobile phone. Click on the “BHIM UPI” option.

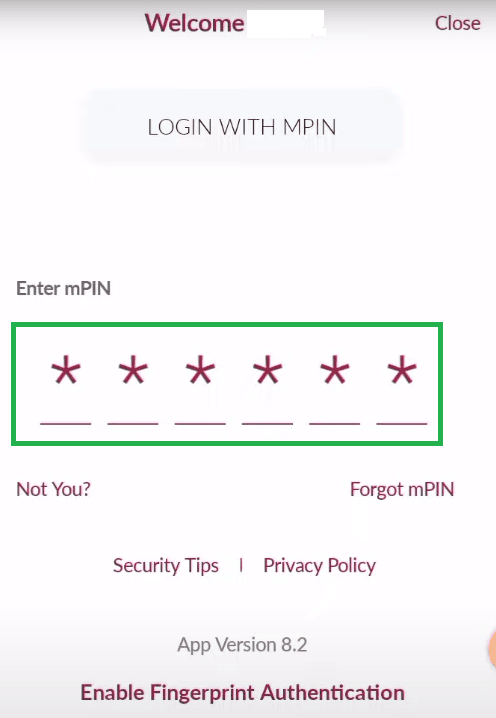

Step 2. Then, enter the 6-digit MPIN to log in to it.

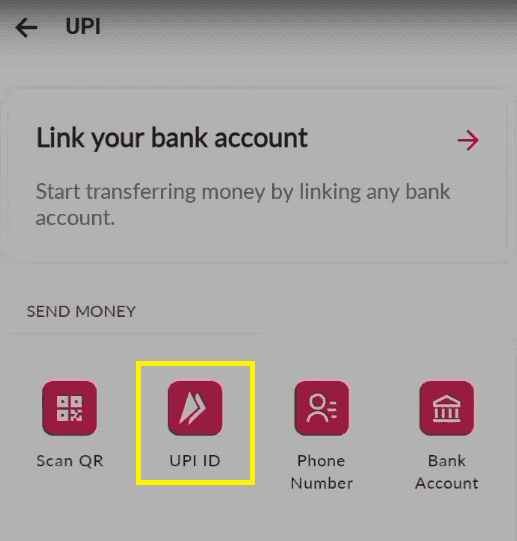

Step 3. Now UPI dashboard will be shown on the next screen. Click on the “UPI ID” on the next screen.

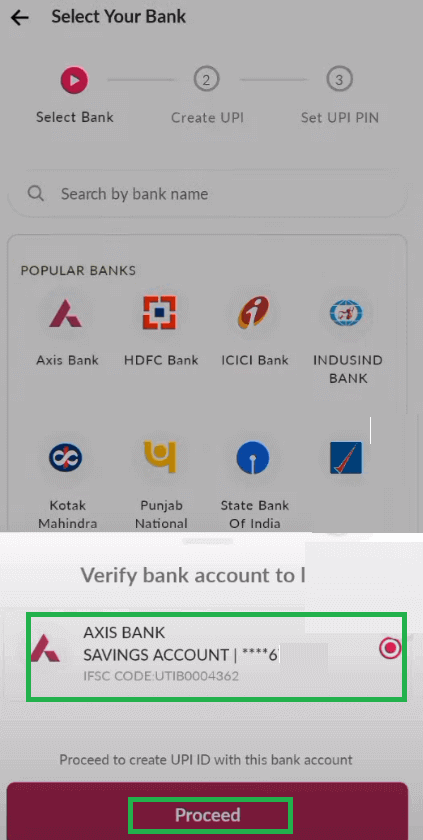

Step 4. Now you will be asked to link your bank account, just click on the ‘link bank account‘ button. Now, you’ll be asked to select the name of your bank and create a UPI ID on the next screen. Select Axis Bank from the given list and click the ‘proceed‘ button. You can choose other banks too.

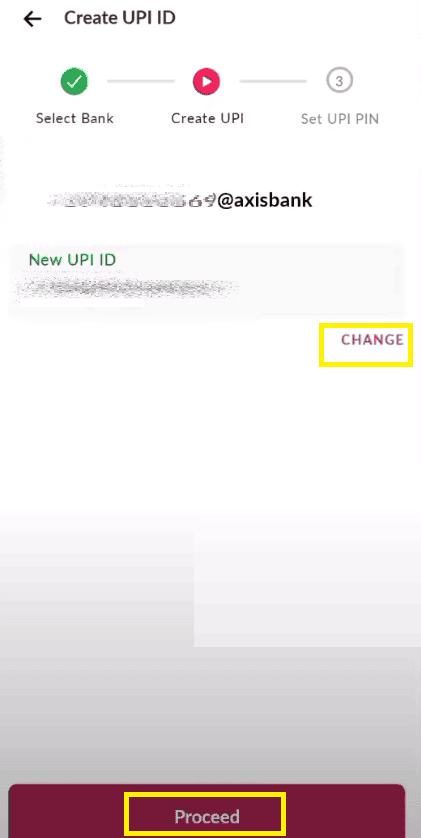

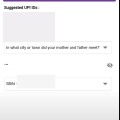

Step 5. On this screen, you will see two UPI ID options to select one of them for you, such as the first option is a UPI ID available for you, and the second option is to create a new UPI ID. Suppose you want to create a new UPI ID. Then click on the red color term “CHANGE” on the same screen.

Create and enter a new UPI ID on the next screen. Click on the “Check availability” button.

Please Note: While creating a new UPI ID, you can create a ten-digit mobile number with the suffix “axisbank,” such as 7985xxxxxx@axisbank, or it can be “yourname@axisbank”, such as rakeshsharma@axisbank. If the UPI ID you will create is available for you, set it as your UPI ID; otherwise, you will have to create another one, with the help of some suggestions or examples appearing on your mobile screen.

After entering the UPI ID available for you, click on the “Proceed” button.

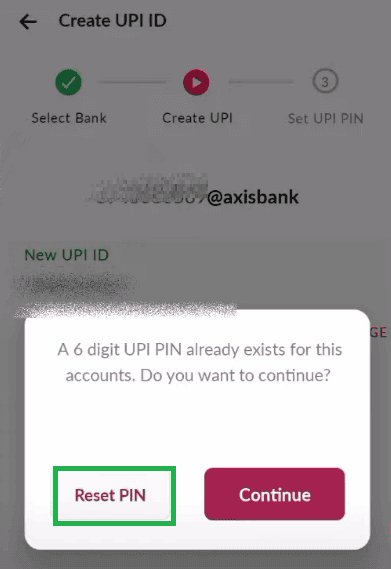

Step 6. You will receive a message regarding setting a new UPI PIN or continuing with the existing UPI PIN. Here, you will see two options: “Reset PIN” or “Continue.”

suppose you want to set a new UPI PIN. Click on the “Reset PIN” option.

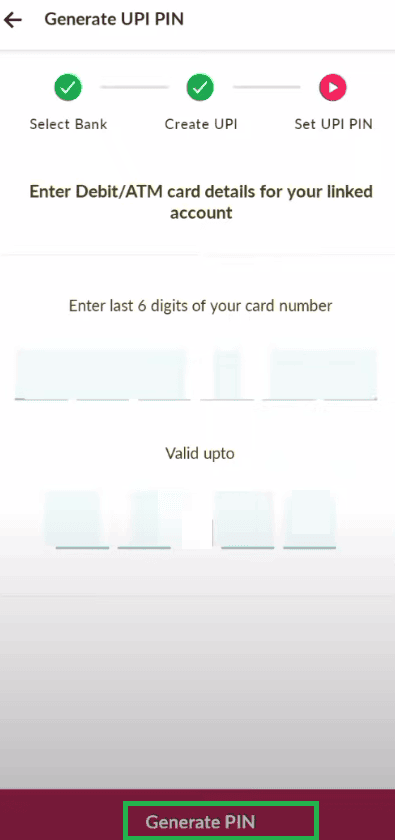

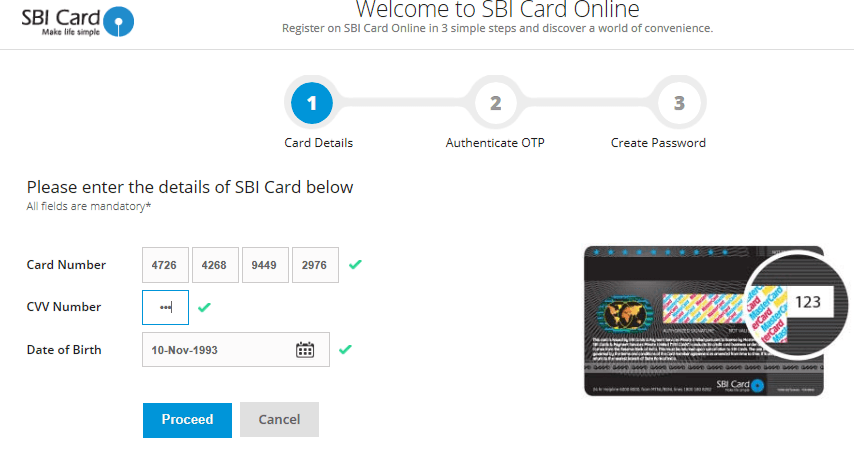

Step 7. Enter the information from your ATM/Debit card, such as the last six digits of your card and its date and month of expiry, as required, on the next screen. Then click on the “Generate PIN” button.

After that, an OTP will be sent to your registered mobile phone number, which will be entered automatically as required. Click on the blue color right-mark button at the bottom-right corner of your mobile screen.

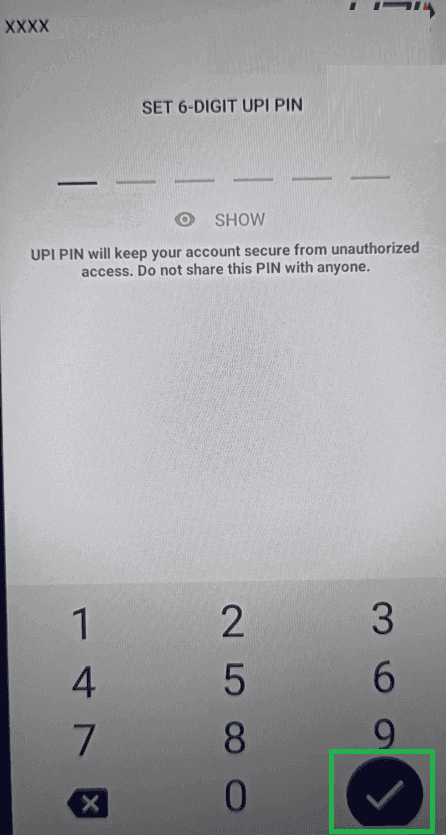

Set and enter a six-digit UPI PIN as required. Then Click on the right mark. After that, re-enter the newly set UPI PIN for confirmation as required on the next screen. Then Click on the right mark again. Now, your UPI PIN will be successfully set, and a confirmation message will be displayed for it on the next screen.

Here, you can see your bank account balance and your UPI ID. Now, you can use all the features and services available with the Axis Mobile Application. That’s it. By following the above written and well-instructed effortless process, you can effortlessly learn to create an Axis Bank UPI ID through app.

A Brisk Wrap-Up

Now you know how to create a UPI ID in Axis Bank. However, you should know you can have as many UPI IDs as you wish for different purposes. You can not only quickly activate the new UPI IDs online anytime and from anywhere, but you also can frequently change them just like you can easily change your password.

In this article, we have assisted you in understanding what is the Axis Mobile Application, its uses and benefits, and the need to create a UPI ID. Hopefully, after going through our blog post, you will find it helpful.

Be the first to comment