Nowadays, digital banking is widely used everywhere across the world, which includes Internet Banking, Mobile Banking, UPI, Debit Card, Credit Card, and other forms of digital banking.

Indian Bank offers a mobile banking application, IndOASIS, to its customers to cater to their banking needs with various financial and non-financial banking services.

Indian Bank also provides a UPI (Unified Payment Interface) service for their bank account holders to ease and assist online transactions using UPI or by scanning a QR code. This UPI service is a part of the mobile banking application and is known as BHIM Indian Bank UPI. It provides a hassle-free, safe, and secure platform for the quick transfer of funds between bank accounts.

Indian Bank’s customers can conveniently avail themselves of the benefits of its UPI service, and it can be accessed from anywhere and at any time. The UPI service makes it possible for the account holders of the banks to create a single UPI user ID, which can be added to multiple bank accounts held by the customers in Indian Bank or any other bank.

UPI ID is one of the essential features of the UPI service, which makes the payment process less complicated by eradicating the need to remember and provide the bank account details, such as account number or IFSC code, unlike using other methods of fund transfer, such as IMPS or NEFT, etc. If you want to use the BHIM Indian Bank UPI service, you will first have to download this application and create a Virtual Payments Address (VPA), which is also known as UPI ID.

In this article post, we have talked about the critical and profound information regarding the Indian Bank mobile banking application IndOASIS, BHIM Indian Bank UPI, and how to create a UPI ID in Indian Bank. Stick around and stay tuned with us to learn more information about the above subjects. Now, it’s time to get started to delve deeper into the entire article quickly.

Steps To Create UPI ID in Indian Bank through IndOASIS App

Suppose you are a registered customer of Indian Bank, having a savings bank and/or a current account with the bank. You are planning to create a UPI ID in Indian Bank. But you are unaware how to get it done. Don’t worry. Simply a few easy steps will assist you to help in this regard. Just follow these steps as instructed hereunder:

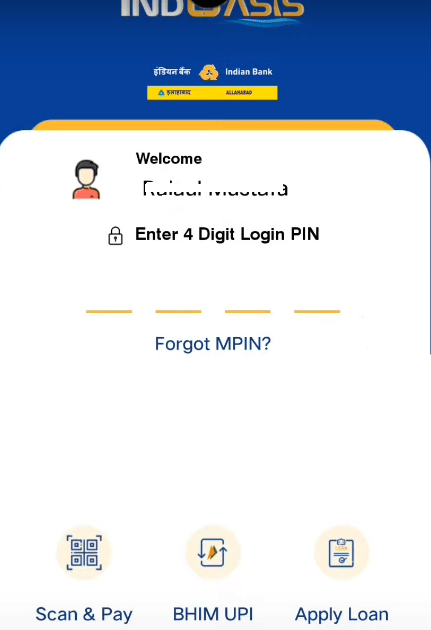

Step 1. Open the IndOASIS mobile banking application on your mobile phone and enter essential information to log in to it.

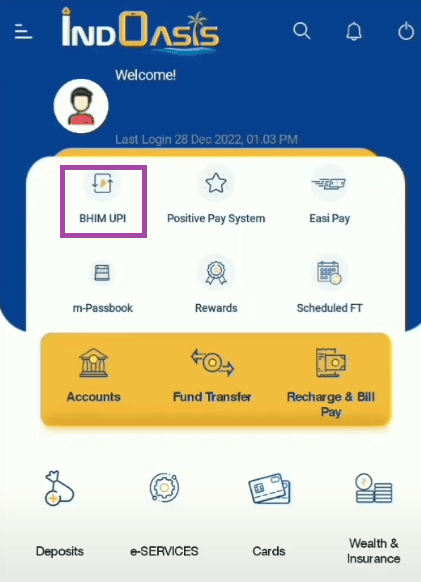

Step 2. Next, click on the BHIM UPI option on the next screen.

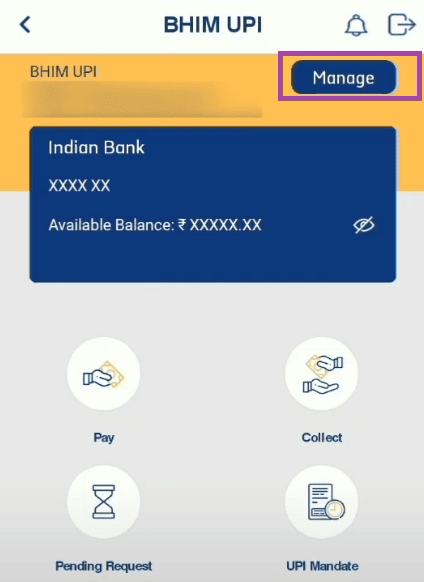

Step 3. Next, click on the “Manage” option on the next screen.

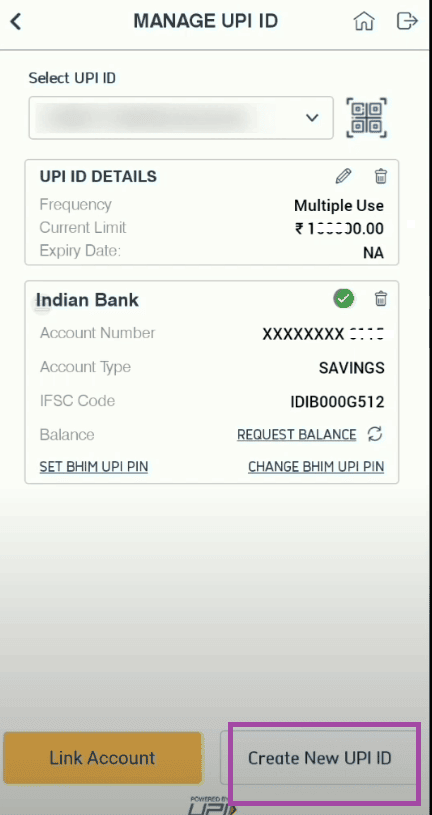

Step 4. Next, click on the “Create New UPI ID” at the bottom right of the next mobile screen.

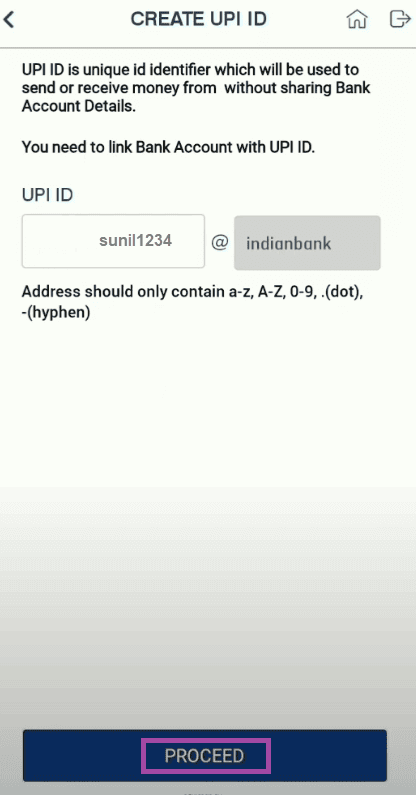

Step 5. Next, set and enter a UPI ID of your choice on the next screen. Then click on the “Proceed” option on the next screen.

Please note: You can set an alphanumeric UPI ID in the following format – “sunil1234@indianbank“, wherein only a-z, A-Z, “.” (dot), and “-” (hyphen) can be used to create it.

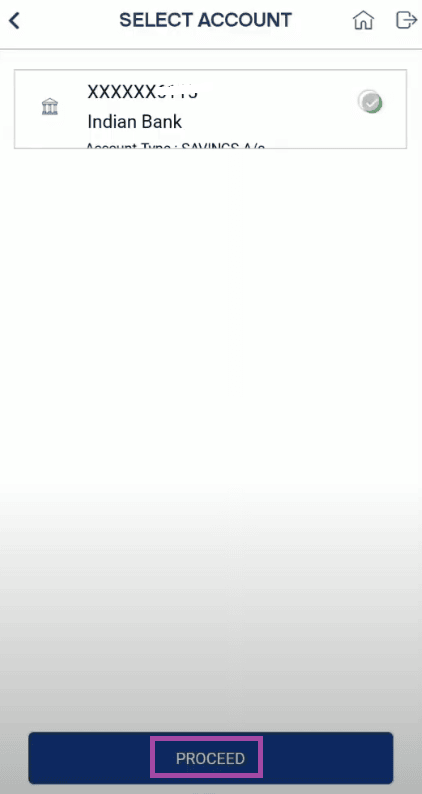

Step 6. Next, search and click on the “Indian Bank” option from the given list of banks on the next screen. Next, select your Indian Bank account on the next screen. Then click on the “Proceed” option.

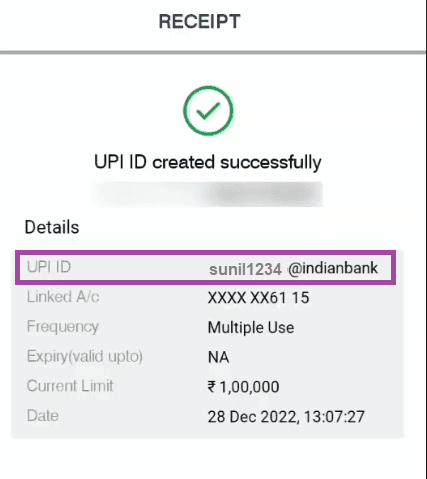

Now, a message will be displayed on your mobile screen, showing that your UPI ID has been successfully created, and you will see its details.

That’s it. By following the above-described straightforward process and easy steps, you can easily and quickly learn how to create a UPI ID in the Indian Bank.

The Bottom Line

We expect you will enjoy reading this blog post to learn about Indian Bank mobile banking application IndOASIS, BHIM Indian Bank UPI, and how to create UPI ID in Indian Bank app. And you will be able to create the above-mentioned UPI ID yourself.

Be the first to comment