If you are a blogger or a freelance in India, you must be wondering now about service tax when you are already paying the income tax on your blogging or freelancing income. You must be thinking that Service Tax is paid by the businesses or companies, and you are just a mere individual service provider. Well, here’s the actual catch. Our Service Tax guide designed for bloggers and freelancers would help you understand the concept and its application better.

Businesses, firms, companies, organizations or individual are just entities. As per the Indian taxation laws, any entity that sells or provides service to other individuals or businesses and getting a remuneration from it, then that entity is liable to pay the Service Tax if the revenue from the service goes beyond Rs. 10 Lakh during the assessment year.

Professionals such as Chartered Accountants, Doctors, Dentists, Lawyers, and many others have already been paying a service tax on their revenue. Similarly, self-employed professionals whether Bloggers or Freelancers offering services such as Consultancy, Development/Designing, SEO/Digital Marketing, Ad Revenue or any other service.

A Quick Service Tax Guide With Rates and Limits

With effect from June 2015, the Government of India has revised the service tax @ 14% and an additional 0.5% was added on 15 November 2015 for Swacch Bharat Cess. So, the current service tax applicable in India is 14.5% as prescribed by the Revenue Department of India. Service Tax is applicable to any business or individual at the prescribed rate only if the business or individual offering the service generates revenue more than Rs. 10 Lakh p.a.

As per the laws written under the Service Tax act, Bloggers and Freelancers, who despite being self employed are liable to pay service tax if they are generating a revenue more than Rs. 10 Lakh p.a. Considering the fact that bloggers earn revenue from Sale of Ad Space on their website, whereas freelancers offer different types of service to their clients, both these professionals fall under the radar of Service Tax based on their annual revenue.

Does Google Adsense Income Fall Under Service Tax?

Well, Google Adsense Income does fall under the Service Tax laws as it is a business of advertising and selling Ad spaces on publisher websites. However, there’s a slight advantage for the Adsense publishers as Google is already taking care of the Service Tax applicable for the sale of each ad unit.

Also, Google won’t be paying the Service Tax from its own pocket either, but it will added into the invoice for each bill generated for the advertisers. So, being a blogger solely relying on Adsense income, you must not worry about Service Tax, irrespective of your revenue. The Service Tax is also exempted on Affiliate Income as it falls under Brokerage income.

In short, unless and until, you are selling ad space on your website directly to the advertisers, you are not liable to pay Service Tax. And, if you do, then go through our service tax guide to understand the whole concept of service tax.

Is Service Tax Applicable on Freelance Income From Outsourced Service?

After reading our service tax guide, you must be confused whether service tax is applicable on freelance income generated from outsource service. Well, again there’s a slight relief for the freelancers. Given the fact that most of the freelancers in the internet industry outsource their services from India to several different countries, they are exempted from Service Tax. As per the Service Tax laws, the Government of India has exempted any Service Tax from all services that are exported out of India.

However, there are certain laws and eligibility criteria to determine whether the service provided falls under “Export of Service” category or not. It is advisable to consult a Chartered Account and he/she may help you further understanding the whole scenario.

Read the service tax guide further to understand how service tax is calculated in India.

How is Service Tax Calculated?

Now, if you have already gone through our income tax guide for bloggers and freelancers, you must have read that Income Tax is levied on the Net income earned after cutting down all the expenses.

However, on the contrary to Income Tax, Service Tax is levied on the Total Revenue generated during the 1 year period. Although, we have clarified the difference between Revenue and Income in the previous Income Tax guide, we would share it once again.

Revenue: Total earnings generated from sale of service during the 1 year period.

Expenses: All the expenditure such as hiring, utility bills, and other necessary spending by you while providing the service.

Income = Revenue – Expenses

To keep it simple, if the total earnings generate from sale of services during the 1 year period is more than Rs. 10 Lakh, then you are liable to pay Service Tax on the Revenue @ 14.5%.

For example, if you generated a revenue Rs, 14,50,000 by selling ad space or offering freelancing services, then the Service Tax to be paid will be Rs. 210,250, which is 14.5% of Rs. 14,50,000.

A Quick Guide on How To Charge Service Tax to the Client

Before going through the guide, you must know the fact that Service Tax is actually to be paid by the person who is getting served and not the one who is serving. It may sound confusing, but this is the fact. Government of India claims a charge from the individuals who are getting served in the country as Service Tax.

Just because, it is difficult to charge and keep a record of such tax from the individuals, it asks the businesses or individuals offering the service or serving the clients to collect the Service Tax and pay it to the Government. Sounds simple now!

Assuming that, you understood the concept of Service Tax, let’s move on to the guide. There’s no super secret to charge Service Tax to your clients. To charge Service Tax, you must include an added “Service Tax” section on all your invoices for each bill generated at the prescribed Service Tax rates as per the laws, which is currently 14.5%.

Let me explain the same with an example on how would I charge Service Tax to my clients if I have to in future.

Being a content writer, I work for different blogs as a regular contributor and get paid as per the project. Assuming that, I am working on a blog project that requires me to write 20 articles in a month @ Rs. 1500 per article, the total project cost will be Rs. 30,000 as per normal calculation.

However, I need to collect the Service Tax from the client, so I would generate an invoice with an additional 14.5% of the total cost and bill Rs. 34,350 to the client mentioning “Inclusive of Service Tax”. So, despite the total cost being Rs. 30,000, the client would pay Rs. 4,350 extra as Service Tax.

Now, the above is just an example for our Service Tax Guide and I don’t charge any sort of service tax to my clients, but I am sure you got the idea. The real life examples can be witnessed, when you are buying a Pizza at Dominos, you can find an additional Service Tax added to your final bill.

However, if you don’t wish to charge any Service Tax from your clients, and you generate a revenue of more than Rs. 10 Lakhs during the year, then you will have to bear the expenses of service tax on that revenue.

How To Register for Service Tax?

Before you register for Service Tax, you must know that it is not compulsory. Registration for Service Tax becomes mandatory only when the revenue is more than Rs. 9 Lakhs p.a. Anything less than that, you can opt out from Service Tax registration.

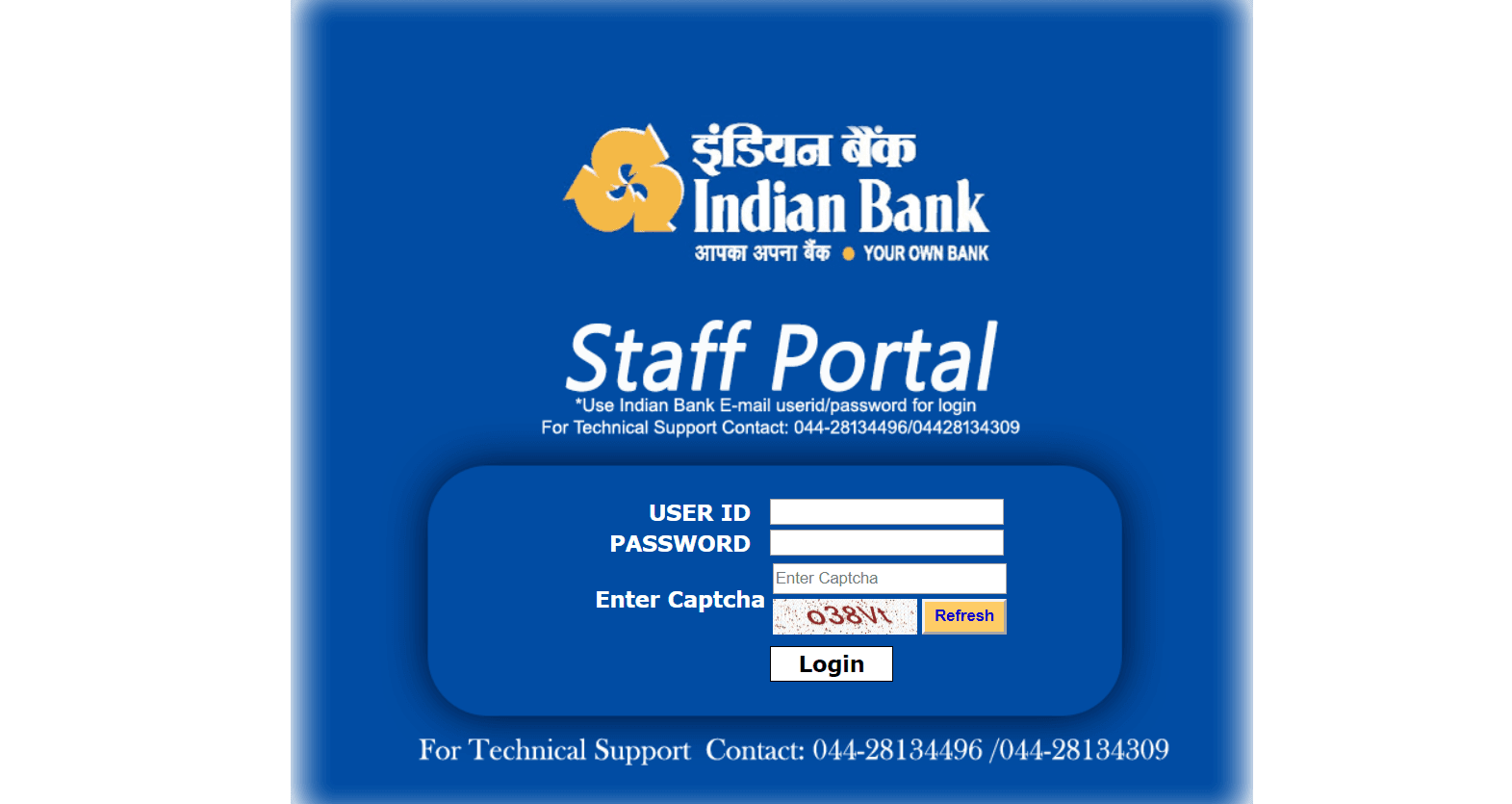

Well, to register for Service Tax, you need to apply for a Service Tax No. which is equivalent to PAN No. for filing Income Tax Return. With digitization, the overall registration process for Service Tax is simplified. All you need to do is visit the website of the Central Excise and Sales Tax Department and follow the simple automated process for Service Tax Registration.

Filing and Paying Service Tax

Just like Income Tax Return, there are prescribed due dates issued by the Revenue Department of India for the payment of service tax based on the type of entity.

However, unlike Income Tax Return, which is one-time process for each Assessment Year, Service Tax Return is required to be filed two times in the year, once in the month of October and second time in the month of April in order to describe the revenue earned during the year in the form of a statement.

Over to You!

Well, this service tax guide is exclusively to those bloggers and individuals, who are self-employed and generate a revenue of over Rs. 10 Lakhs per year. We hope that our service tax guide for bloggers and freelancers would be education to many you.

Let us know if you have any further queries related to Service Tax in the comments section below, especially in relation to your profession as a blogger or freelancer in India.

Nitassociates offers the best taxation service in Dombivli Mumbai. Our tax department deals with Income Tax, Sales Tax, Service Tax, GST, etc. We also deal with Accounting Services & Auditing, Internal Audit

Interesting blog ….good information very helpful to readers Tax registration services in oman …thanks for sharing keep posting..!For More Information Tax registration services in oman

Hello,

Thank you for the this article it’s really helpful for a freelancer like me, I am a freelancer working in designing industry. I am working for the foreign clients via http://www.upwork.com. There are few option for transferring the money from upwork to India( ie Local Fund transfer and Wire transfer/pay pal Payoneer. etc. ) Which option should i use to avoid service tax . Can i use Locan Fund Transfer ??

Great Post! Registration of service tax in India is very easy. If any self employed wants to register for service tax, they can take help from online corporate consultancy services. Thanks!