HDFC is one of the leading banks in the country and with increasing popularity, there are many features of the bank which all the customers must know of. One of such features is the IMPS.

What Is IMPS?

IMPS is an acronym for Immediate Payment Service. The immediate payment service scheme was initiated by the National Payment Corporation of India (NPCI). It was done for the facilitation of instant payment through mobile or net banking.

Its main key was to enhance the experience of money transfer through the internet. But the IMPS is used for a specific service – donation.

The immediate payment service is primarily used by devotees to donate to any religious finds. These fund transfers take place through the IMPS applications or net banking of the respective banks to the religious institutions.

What Are the Features Of IMPS?

IMPS has various features which are quite user-friendly. Some of the features are discussed here.

- The immediate transfer is one of the main star components of the IMPS scheme. Your beneficiary through immediate payment service (as the name suggests) will receive the fund instantly without any sort of delay.

- This money transferring option is available even on weekends and holidays.

- The IMPS option is very safe secure for money transfer. So, if you are thinking of donating a huge amount of money to your favourite religious institution, you can easily do that without thinking about the safety of the transaction.

What Are the Fees and Charges Of HDFC IMPS Transfer?

For the fees and charges of immediate payment service, there are two categories. Firstly, if you are donating a sum within Rs. 1 to Rs. 1 lakh then you would have to pay an extra charge of Rs. 5 + GST. Again, if you are paying from Rs. 1 lakh to Rs. 2 lakhs then your extra charges would be Rs. 15 + GST.

Thus, it is evident that for IMPS you have to pay very minimal charges and you can donate your money without any hassle.

| Amount to be transferred | Fee & Charges |

|---|---|

| Rs. 1 to Rs. 1 Lakh | Rs. 5 + GST |

| Rs. 1 Lakh to Rs. 2 Lakh | Rs. 15 + GST |

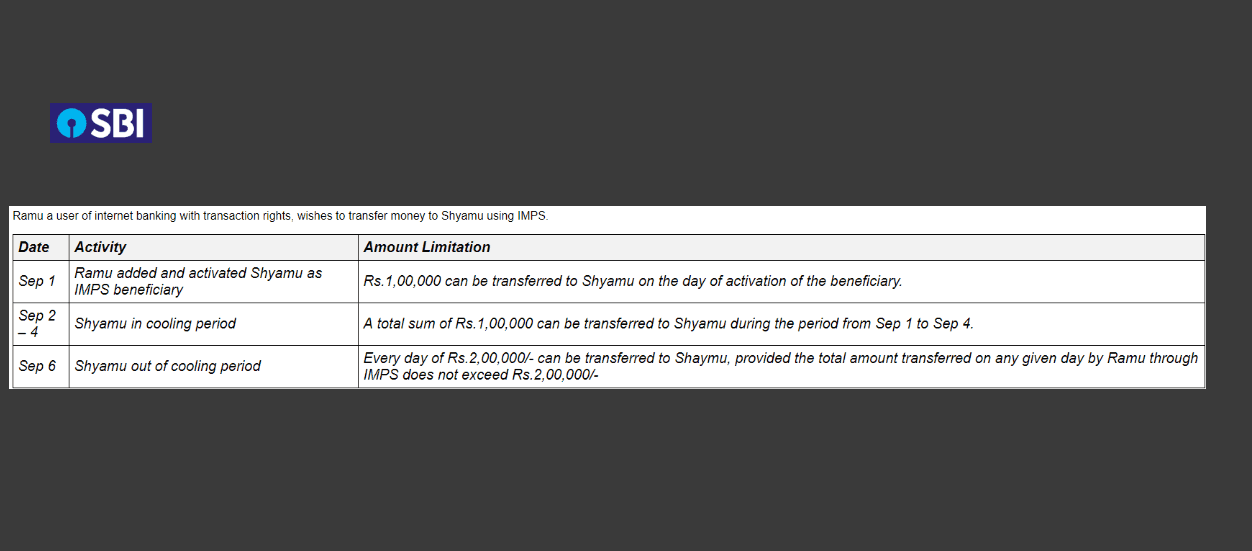

Is There Any Limit To IMPS?

Now, there are some transaction limits to IMPS. You must keep in mind that you can maximum up to Rs. 2 lakh per transaction. Although there are various methods of transfer as discussed below:

- IMPS Using Account Number: Here, the maximum limit per transaction is Rs. 2 lakh and the maximum amount you can transfer per day is according to the TPT limits.

- IMPS Using MMID: Through net banking or mobile banking, you can transfer an amount of Rs. 5000 per day Cust ID. This applies on either of the channel and not on both the channel.

- IMPS Using USSD: In the case of the USSD channel, the limit is Rs. 1000 for each of the IMPS fund transfer using the MMID and the IMPS fund transfer using the account number.

Thus, there are variations in the limit of money that you can transfer through IMPS depending on the mode of transfer.

Does IMPS Have Any Timings?

IMPS has no timings at all. You can use this feature all day long for your whole life.

Conclusion

As discussed above HDFC IMPS has got many advantages and you must use it for donation purposes once in your life!

Be the first to comment