Of the many other concerns, the most important one for NRIs is sending money back to India. Although many NRIs have settled in the foreign countries, there are individuals who regularly send money back to India to their parents, family or for investment. However, these NRIs fail to maintain a Rupee account in India while they send money back to India.

To overcome these problems, Government of India have come up with an option of opening an NRE (Non-Resident External) account for NRIs. As per the Foreign Exchange Management Act (FEMA), there are no specific limits or restrictions on the most remittance sent by NRIs back to India. Hence, NRIs can send any amount of money to India instantly without any trouble.

Let’s know more about NRE account in detail:

What is an NRE Account?

What is an NRE Account?

NRE account is a kind of savings account is ideal for any NRI to repatriate funds with interest rates to India. Basically, NRE account aids in repatriating funds that is earned in foreign countries. The account also helps an NRI to transfer your earnings to India without much trouble in the most secure way possible. NRE account helps NRI to maintain their foreign currency in INR as all the money transferred to an NRE account in any foreign currency will be converted into Indian Rupee.

Benefits of Opening an NRE Account in India:

Being an NRI, you can get a lot of advantages by opening an NRE Account in India. There are several benefits of opening an NRE Account in your home country:

- Transfer any amount of money you want to India.

- Get complete control of your hard-earned money abroad.

- Easily transfer your funds to and fro using NRE account.

- Multicity chequebook facility helps you make payments at multiple locations.

- With the help of “Mandate” or “Letter of Authority Facility”, you can assign your relative or friend to access your bank account to withdraw or transfer funds on your behalf.

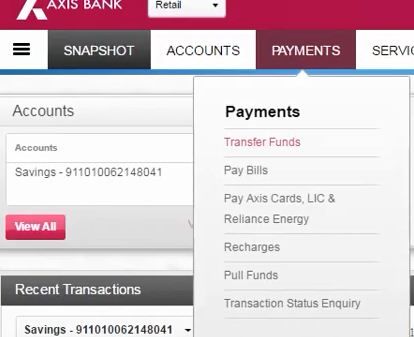

- Internet banking facility helps you access your account securely 24/7.

- Pay your utility bills and shop online using Internet Banking facility.

- Easy Cash Withdrawal.

- Transfer your funds easily from the NRE account back to your foreign account.

- Easily use the funds from your existing NRE Savings Account to open NRO/FCNR accounts.

- Open an NRE joint account with another NRI or a Resident Indian.

- You can add a nominee for your NRE Savings Account.

- The Reserve Bank of India provides the option of transferring funds from a non-resident ordinary (NRO) account to an NRE account for NRIs.

7 Reasons an NRI must open an NRE Account:

For an NRI who wants to send money to India on a regular basis, it is highly advisable to open an NRE account in India for the following reasons:

- Transfer your funds freely to India.

- With two-way transferability, you can transfer the funds to India as well as transfer the funds from your NRE Account back to your foreign account.

- No income tax, wealth tax, or gift tax in India for an NRE account funds transfer.

- Interest earned from an NRE savings account is tax-free.

- The minimum balance requirement for NRE Account is only Rs. 10,000.

- You can convert an NRE account to a regular resident account easily.

Tax Benefits on NRE Account Funds Transfer:

The best thing about an NRE Account is that the account is tax-free which means there will be no income tax, wealth tax or gift tax in India when the amount is transferred to your NRE account. Adding further benefit, there won’t be any tax on the interest earned from your NRE account.

For example, if you are an Indian who is employed in the US then your salary will be termed as an income earned outside India, hence it won’t be taxable in India. However, you have to pay the mandatory taxes for the income in the US under their tax laws. Once you have paid the taxes in the US, the money then transferred into India is non-taxable income. Also, any interest earned on both the savings NRE account and Fixed Deposit NRE account will be tax-free too.

In the meanwhile, if you anyhow qualify as a resident in India, the interest earned on the NRE account will become taxable irrespective of where it is earned. Whereas if you qualify as a non-resident, your income will be taxable for any money earned within India. Also, any interest earned on your deposits may be tax-free in India but taxable in the US.

A person automatically qualifies as a resident of India if he or she is in India for 182 days or more during the current year.

Is INDIAN BANK provides open online NEW NRE account?