Credit history is vital and one of the main factors besides your monthly income that is considered by a Loan Manager in order to decide whether you qualify for any loan or credit card. Generally, each individual should understand the importance of the Credit Information Report (CREDIT SCORE) and how to maintain one as this is a report that would be accessed by the lenders to evaluate your loan application.

CIBIL helps you get your Credit Score online instantly without much trouble. Approved by most of the banks and lending firms in India, you are liable to get financed whether for a new home, car or any other personal needs if you have a good CIBIL score. Hence, to get your loan approved, it is highly essential to maintain a good credit score.

To maintain a good CIBIL Credit Score, you must follow these 7 simple rules:

- Pay your loan EMIs regularly:

The most important and the best way to improve your credit score is to pay your loan EMIs on time without any defaults. Regular payment of your EMIs suggests that you are financially stable. In case, you are having more than one loan, then it is important to schedule your EMI payments to avoid any kinds of defaults.

- Make full payments of your Credit Card bill:

Our credit card bills offer two modes of payment. Either you can opt for full payment of your dues past month or you can pay the minimum amount due for the bill. Always make sure that you make full payment on your credit card bills. However, if it is somehow difficult to make the full payment, then do make sure to make the minimum payment without any delay.

Always remember that if you have a low credit score then it will take longer duration to improve your credit history with a loan as compared to your credit card. The main reason behind this is that the loans are usually taken for longer duration while the regular payment of your credit card bills can build your credit score quickly as long as you don’t miss any payments.

- Don’t apply for an Extra Credit Card or Loan if not necessary:

Never apply for an extra credit card unnecessarily. There are occasions when your bank relationship manager would call you offering great discounts or features if you apply for an extra credit card or a loan for instance. Beware that if you apply for an extra credit or loan unnecessarily without any urgent requirement would result into more credit exposure which would in turn affect your credit score negatively.

Also Read: Negative Factors That Affect Your CIBIL Credit Score

- Don’t use your Credit Card unnecessarily:

Credit Card is a utility product and not a luxury one. You must use it wisely instead of using it frequently for all your payments reaching the credit limits every month. Those who don’t utilize their credit limit very frequently enjoy a good credit score as unused credit cards are an indication that you are financially secure.

- Prepay your existing debts:

Always try to prepay your existing debts in order to improve your credit score. Incomes from bonus or monetary gift or some other source of savings can be used for such prepayments to enjoy a healthy credit score.

- Avoid being a Joint Account Holder in a Loan or Credit Card:

The biggest that many individuals make is become a joint account holder or a guarantor for a loan or another credit card facility. It may help the other party but would cut your credit score way too much for any defaults in the repayments.

- Avoid Loan Settlements:

Loan settlements or “write-off “your loan accounts is an indication that you are not able to pay your past dues. Any sort of loan settlements in your credit history is a red signal and would affect your credit score negatively.

- Review your Credit History Regularly:

In order to make sure that you’re on the right path with your credit history, keep reviewing it on a regular basis. The credit report is the mirror of your current financial status, hence you must caution yourself as your credit score goes down

At the end of the day, common sense should dictate what you do with your financial life and good financial habits along with awareness of credit scores will help you build a good credit history and a good credit score.

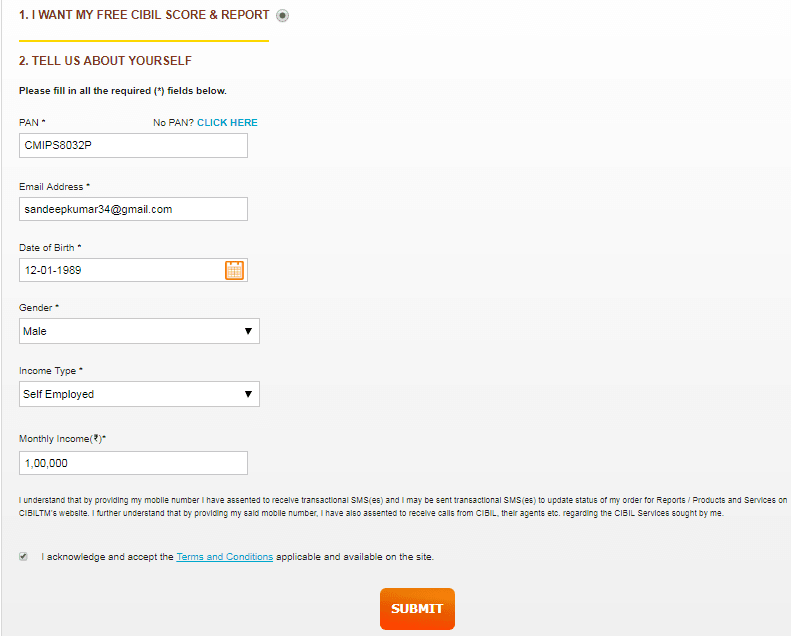

CIBIL score check free online by PAN number

Hello,

Thanks for sharing your nice and informative words. These tips are really helpful for improving cibil Credit score. Informative stuff keep it up. I would also like to share some useful stuff with your readers. Please also check How to improve Credit Score by 100 Points.

Thanks

Thomson John

Thanks for tips..these are good tips to improve cibil score.