India is fast moving towards realizing its dream of becoming a cashless society and one of the significant steps taken by our Prime Minister Narendra Modi was launching the app called BHIM app. It is the shortened version for Bharat Interface for Money, and this app aims at making it easier for people to make cashless transaction.

At Digi Dhan Mela organized in New Delhi, our Prime Minister said that this was his gift to countrymen for New Year. In this article we will discuss about the basic features of BHIM App & how to download and use it.

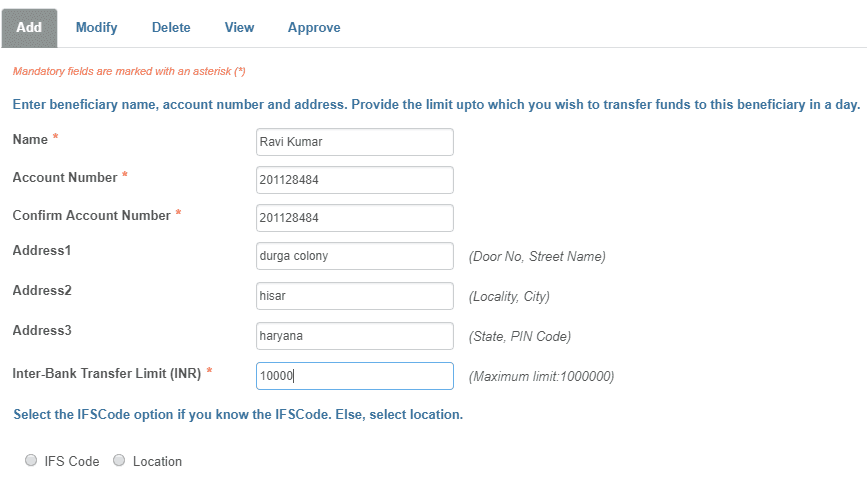

If you go to a medicine shop next time or go out to eat dinner at a restaurant, you don’t need to carry cash with you because you can send or receive money using BHIM app. To initiate a transaction through this app, you only need the payment address. The other details that were required earlier such as the bank account number, IFSC code, etc are not required anymore.

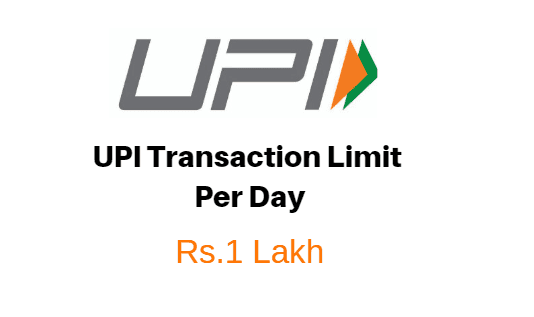

The payee also does not need to register and there are no limitations to send or receive money through this app. So, this is the most popular form of Unified Payment Interface.

Although there are other UPI apps available, BHIM app has left them behind in the race due to its simplicity, ease of use and great functionality. The simple and interactive user interface is easy for almost anyone to understand and use the app.

Features of the BHIM App:

- The app can be used to transfer funds to almost any bank account

- You don’t have to register the payee in order to complete the transaction hence this is a fast process

- With this app the transactions can be done immediately without any waiting period

- You can transfer funds at any time and from anywhere Transfer money anytime

- You do not need the bank account number or other bank details of the payee to initiate the transaction

- You don’t need to have netbanking activated in order to use this app

- You can transfer funds to the payee by simply using his mobile number which make this an effective system

- The app works on all phones, regardless of whether you have Internet or not

- The scan and pay feature makes it a hassle free method and highly secure too

- You can use the app to transfer funds to the virtual addresses

- You can use the app to directly call a bank representative in case of any problem

Interface of BHIM:

The features are being continuously updated since the release of the app to make it more useful and secure for the users. Apart from the standard features that have been mentioned above, the BHIM app also has a really neat and clean user interface.

It has a white background and the fonts are big enough. The screen is not crowded and you can see all the available options at one glance. The app makes smart use of the icons to keep the design to minimum.

How to download BHIM app:

This is one app that you must download even if you haven’t used any apps before and this is the first app that you might be using. When the app was launched, it was only available for Android, but now BHIM is also available for iPhone.

There are many fake apps, so make sure the name is BHIM – Bharat Interface for Money by National Payments Corporation of India (NPCI). To be on the safe side, follow these links:

To download the app for Android you need to go to the Google Play. Follow this link – https://play.google.com/store/apps/details?id=in.org.npci.upiapp&hl=en

To download the app for iOS you need to go to the App Store. Follow this link – https://itunes.apple.com/in/app/bhim-bharat-interface-for-money/id1200315258?mt=8

Download the app on your iOS or Android device by clicking on the install button.

How to use BHIP app:

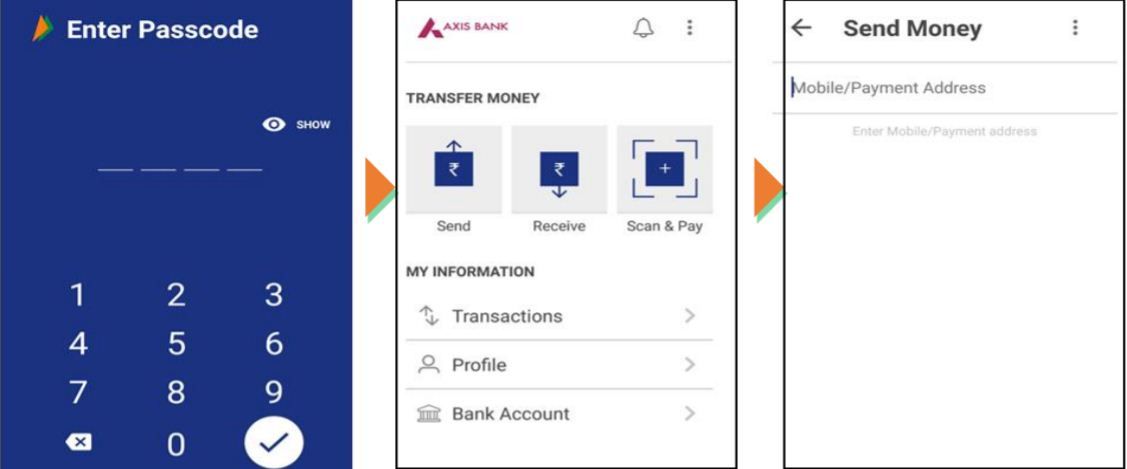

- After installing, the app will ask you to verify your phone number through an SMS. Enter your phone number and click on the Next tab. Wait for the verification process to complete.

- When the verification is completed successfully, you will be asked to enter a four digit passcode. After you have set the passcode, the BHIM will ask you to select the bank of your choice.

- After you select the bank, the app will now take your details automatically based on your bank account information. So, you need to select a primary bank account which can be used for all the transactions.

- The BHIM app will now display three different options – to send money, request for money, Scan/ pay. The transactions can only take place between the verified mobile numbers.

- If you want to send money to someone, you simply need to type their phone number and then enter the amount that you wish to send. Next, the app will request you to enter your MPIN, which will be four or six digit long. This will authenticate the process. You can also request for money by using the phone number of the person.

- The third option that you can use with the BHIM app is scan & pay. It allows the users to easily send money using a QR code. This is a two- dimensional barcode (white and black) that can be easily decoded by a tablet or smartphone. Each phone number comes with a unique QR code that can be accessed on the home screen.

There are over 35 banks that currently use the app, and more are being added to the list constantly. The best thing about the app is that it is so simple and easy to use that almost anyone can use it. As time passes by you can expect to see more updates and improvements to help the app overcome its limitations and get better.

Be the first to comment