Are you interested in opening a savings account with HDFC Bank? HDFC Bank is a trusted bank in the private banking sector of India with a huge base of customers. It offers a wide range of advanced banking services including savings account schemes with different features.

The bank privileges its customers with fast and convenient services. If you have the interest to open a savings account with HDFC Bank, you can compare the facilities and services and select the appropriate one that suits you the best.

On this page, you will be able to learn about different savings account at HDFC Bank and the interest rates offered with the specific account, the minimum account balance maintenance requirement and the charges for non-maintenance of minimum account balance.

Types of Savings Account

- SavingsMax Account

- Regular Savings Account

- Women’s Savings Account

- Kids Advantage Account

- Senior Citizen Account

- Family Savings Group Account

- Basic Savings Bank Deposit Account

- Institutional Savings Account

- BSBDA Small Account

HDFC Saving Account Interest Rates

HDFC Bank offers 4% Interest Rate on the available deposit amount above 50 lacs and 3.50% interest rate for account balance below 50 Lacs in the savings account. With these interest Rates, the account holders can earn benefits and grow their savings.

| Saving Deposits | Interest Rate (% p.a.) |

|---|---|

| Saving Account Balance Below 50 Lacs | 3.50 |

| Saving Account Balance Above 50 Lacs | 4.00 |

Minimum account balance maintenance for Regular Savings Account

- Minimum Account Balance Maintenance in Metro and Urban Branches is Rs 10000.

- For savings account in Semi-Urban Branches, the Minimum Account Balance is Rs 5000.

- For the savings accounts in Rural Branches, the Minimum Account balance is Rs 2500.

Minimum Account balance maintenance for other savings accounts

- The minimum account balance maintenance in SavingsMax Account is Rs. 25000.

- For the Kids Advantage Account and Senior Citizen Account, the minimum account balance maintenance is Rs. 5000.

- The minimum account balance maintenance for Family Savings Group Account is Rs. 40000.

- For Basic Savings Bank Deposit Account, Institutional Savings Account and BSBDA Small Account no minimum account balance maintenance is applicable.

| Type Of Saving Account | Minimum Average Monthly Balance | Penalty Charges |

|---|---|---|

| SavingsMax Account | Rs. 25000 | Penalty Charges for balance Rs. 20000 to below Rs. 25000 – Rs. 300 Penalty Charges for balance Rs. 0 to below Rs. 2000 – Rs. 600 |

| Regular Savings Account | Metro/Urban branches: Rs.10000 Semi-Urban Branches: Rs.5000 Rural Branches: Rs.2500 |

Rs 150 to Rs 600 ( refer official website for full details) |

| Women’s Savings Account | Metro/Urban branches – Rs. 10,000 Semi-Urban/Rural branches – Rs. 5000 |

“ |

| Kids Advantage Account | Rs. 5000 | Charges for balance Rs. 2500 to below Rs. 5000 – Rs. 150

Charges for balance Rs. 0 to below Rs. 2500 – Rs. 300 |

| Senior Citizens Account | Rs. 5000 | “ |

| Family Savings Group Account | Rs. 40000 | Rs. 600 |

| Basic Savings Bank Deposit Account | ZERO | NA |

| Government/Institutional Savings Account | ZERO | NIL |

| BSBDA Small Account | ZERO | NA |

| Government Scheme Beneficiary Savings Account | NIL | NIL |

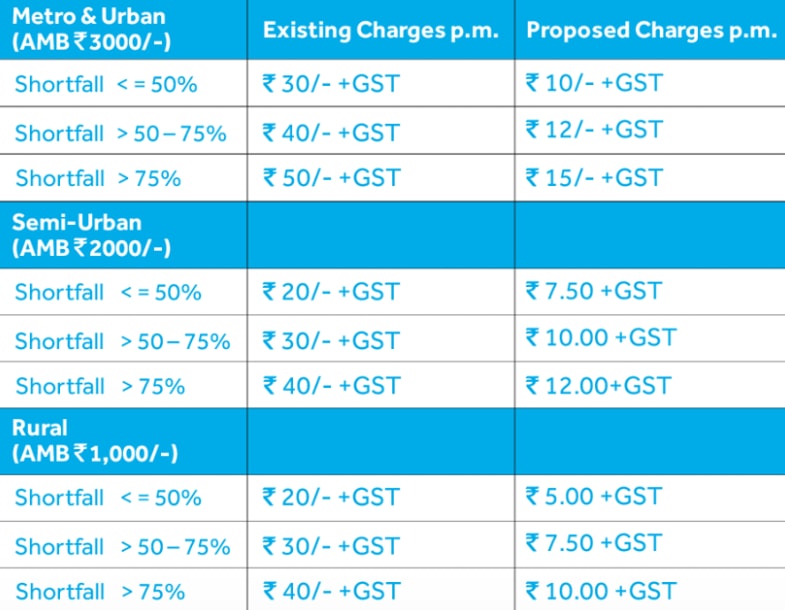

The charges applicable for non-maintenance of Minimum Account Balance

For Savings accounts in Metro and Urban branches with a minimum account balance of Rs 10, 000

- If the account balance remains within Rs 0 to 2, 500 Rs 600 would be the penalty charges.

- If the account balance remains within Rs 2, 500 to Rs 5, 000, the penalty charge is Rs 450.

- If the balance remains within Rs 5, 000 to Rs 7, 500, the penalty charge is Rs 300.

- If the account balance is less than Rs 10, 000 but more than Rs 7, 500, Rs 150 would be charged as penalty.

For Savings accounts in Semi- Urban branches with a minimum account balance of Rs 5, 000

- If the account balance is less than Rs 5000, but within Rs 2, 500, the penalty charge is Rs 150.

- If the account balance is within Rs 0 to Rs 2, 500, the penalty charge is Rs 300.

For Savings accounts in rural branches with a minimum account balance of Rs 2, 500

- If the account balance is less than Rs 2, 500 but is within Rs 1000, Rs 270 penalty charge is applicable.

- If the account balance remains between Rs 0 to Rs 1000, the penalty charge applicable is Rs 450.

Important Note: The penalty charges as applicable for non-maintenance of the account balance in all schemes of savings account involves additional costs of Service Tax and other taxes as appropriate.

While for the Metro, Urban and Semi-Urban, the minimum account balance maintenance gets calculated on a monthly basis, the minimum balance account maintenance for rural savings accounts get calculated on the quarterly basis.

Before you open a savings account with HDFC Bank, you must have the proper idea about the account opening charges, minimum account balance maintenance and the penalty charges for non-maintenance. With the best info, you can avoid penalty charges and enjoy multiple benefits offered by HDFC Bank for its savings account holder.

what are the charges for not maintaining minimum balance in hdfc bank