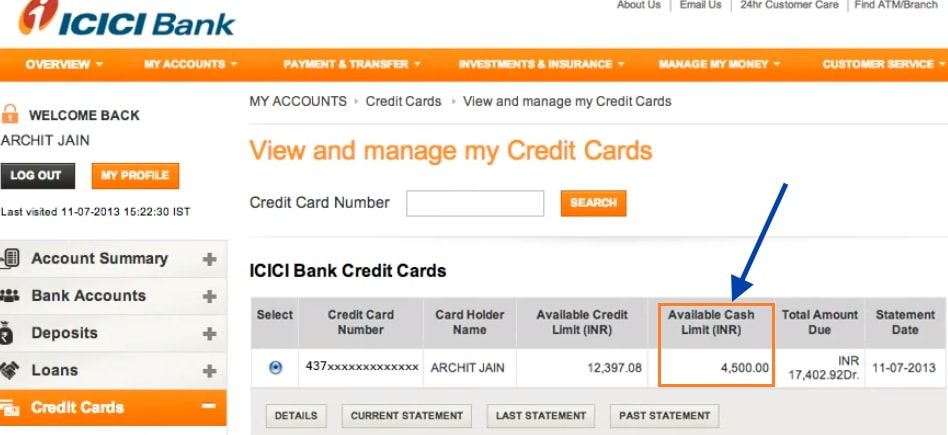

ICICI Bank offers a wide range of credit cards with different credit limits as per varying specifications of the cardholders. With every credit limit, the applicable interest rates vary.

Credit Cards, when used wisely, turns as a boon for the cardholders. The credit card users obtain financial freedom. The array of credit cards get designed to fulfill various financial needs of the users.

Do you use ICICI Bank Credit Card? Are you not satisfied with the maximum credit amount set for your credit card? Do you want to increase ICICI Bank Credit Card limit?

Applying for a new credit card with higher credit limit is not the only solution! You can increase the credit limit for the existing card without replacing it.

You need not even visit the branch to make a request! You can do it on your own! ICICI bank offers different ways for the cardholders to increase the credit card limit.

At first, you need to be eligible for requesting a limit enhancement. ICICI Bank sets certain eligibility criteria which the cardholders must fulfill.

Eligibility Criteria

- The cardholder must complete membership of 12 months.

- You must not be a defaulter in making credit card payments throughout the membership.

- You must fulfill the income criteria for the increased credit limit.

- You have to provide your income proof and income tax returns along with other financial documents as requested by the lender.

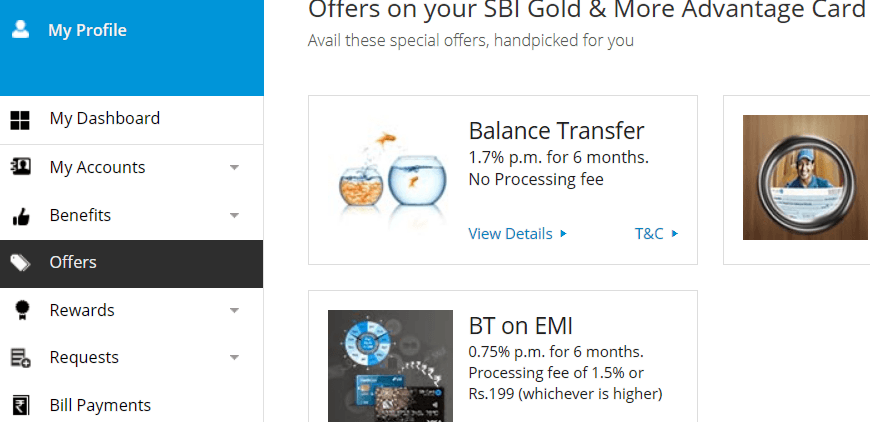

Automated option to Increase ICICI Credit Card limit

ICICI Bank analyzes the entire credit history of the cardholder and determines the eligibility. If you are eligible for credit limit enhancement, the bank will inform you about the same via call or SMS.

If you agree to the new terms and conditions, you can provide your acceptance over the phone or SMS. The cardholders with pre-approved limit enhancement can easily confirm their acceptance of the proposal.

Call the Customer Care Executive

If you haven’t received any call or SMS but you fulfill the eligibility criteria, you can opt for other methods and make a request for credit card limit enhancement.

- Dial the credit card helpline number from your registered mobile number. You can find the number printed on the backside of the credit card.

- The customer care executive would inquire about your banking details and card details to find out your eligibility for credit limit enhancement.

- If you are eligible, the executive will inform you about the same and you can request for credit limit enhancement over the call.

- You will receive the confirmation about the same via SMS within 24 hours and the newly set credit limit will activate within a day.

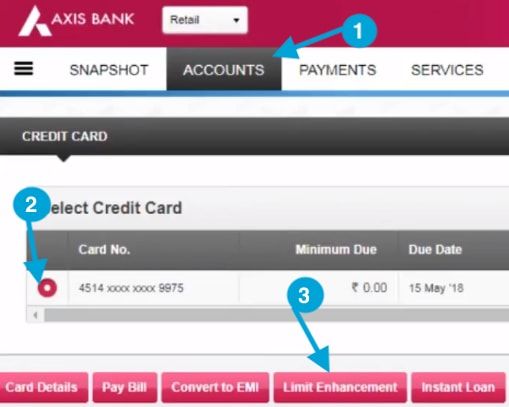

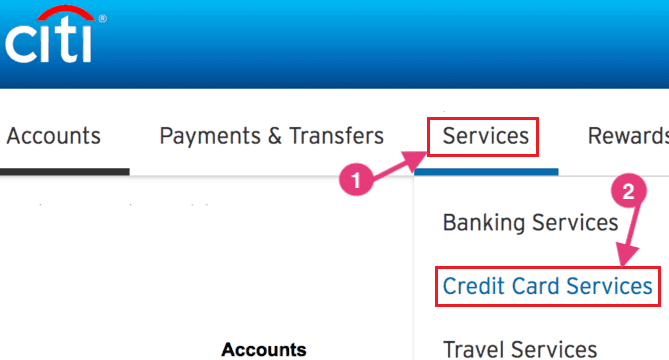

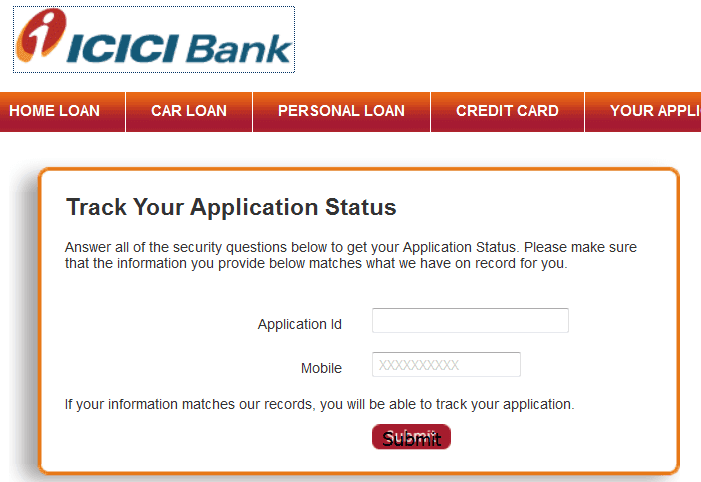

Requesting For Credit Card limit Enhancement via internet banking

- You can also request for credit limit enhancement via internet banking services. Visit the official page of ICICI Bank and enter the login credential, i.e. User ID and Password and enter Login.

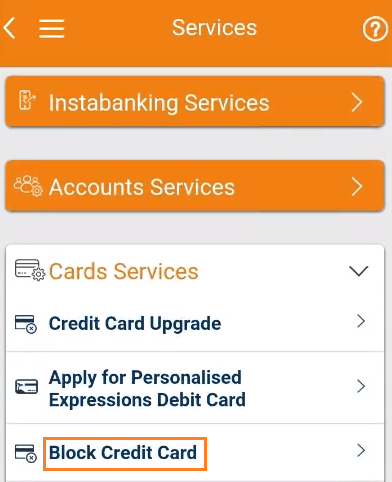

- Click on ‘Personal‘ tab and select ‘Products‘.

- Click on ‘Cards‘ and select ‘Credit Cards‘ tab.

- If you are an existing user, you will get several options displayed in a list. Click on ‘Credit Limit Increase‘ link.

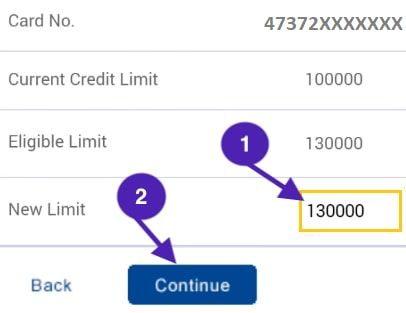

- Follow the steps to proceed ahead. You would require providing the card details and select the new credit limit.

- Upon completion of the process, you will get confirmation of the approval of your request for increasing credit limit.

Following the steps, without any errors, you can easily increase the credit limit for your card! You need not visit the bank and waste your time in requesting for credit limit increase. Do it yourself!

I want to increase my credit card limit without visiting the branch.

I am not able to increase my credit card limit please help.