There are many different nationalized and private banks which provide the facility of interbank fund transfer for the users. NEFT and RTGS are some of the main options which are chosen by people all over the country. There are about 45000 banks which are currently facilitating the RTGS method in the country and Bank of India is definitely one of them.

In order to have the fund transfer happen properly within the correct business hours, people have to fill out the RTGS form in the best way. However, before that, let us provide some important information about the form right here.

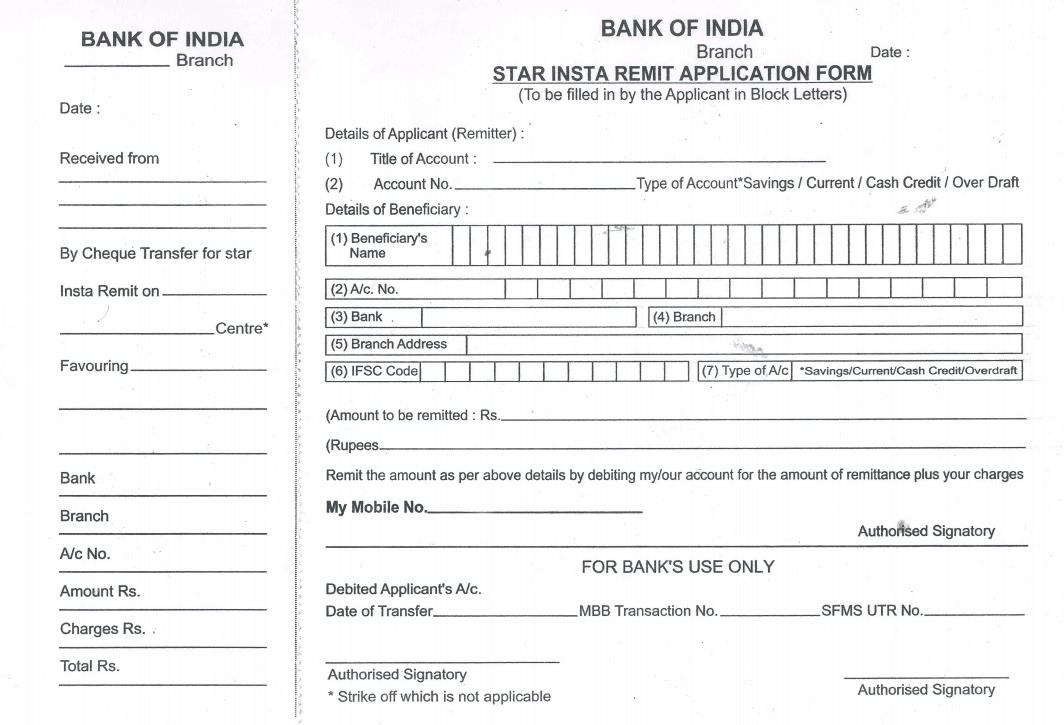

RTGS Form In Bank of India

As be the guidelines formatted by the Reserve Bank of India, the amount which is paid with the help of RTGS will be able to reach the account of the beneficiary within the time of 30 minutes in total.

In case the balance is not really credited to the account of the beneficiary, Then it will definitely be returned to the account of the send in the next 2 hours. When the user fills up the form for the RTGS Transfer, the processing of the amount will be a lot simpler and it will also save a lot of time for the applicant.

This also ensures that all the information about the transaction is provided to the parties at the right time. Bank of India RTGS form can be downloaded in pdf form from the link given below image.

Download Bank of India RTGS Form

Filling Out The RTGS Form For Bank of India

First, download Bank of India RTGS form in PDF form and take its print out. In order to fill out the application form for RTGS in Bank of India, the applicant needs to provide some important details. We are going to provide some information about the details right here so that you can have all the information that is essential.

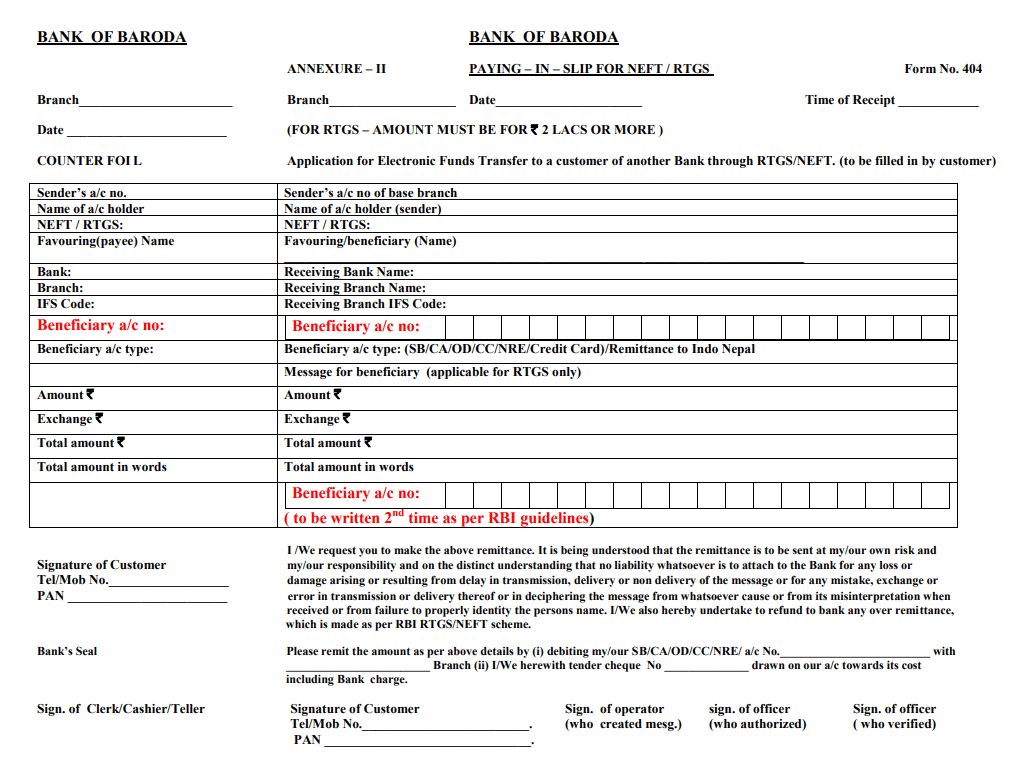

The payment information which includes the amount remitted, cheque number, contact number, account title, remitter information, and the account type should be provided.

Beneficiary information such as the Name, IFSC Code, name of the bank, address of the branch, account type, and number should also be provided in the application form.

The applicant will be able to edit the form for RTGS in Bank of India and will be able to fill it online as well. We would advise that the applicant always download the form and then take a print out of the copy and then submit it at the branch of the bank when they are filling out the form online.

This will easily initiate the transaction through RTGS in the best way. In case the applicant has the service of mobile banking or net banking in their account, then the form will easily be uploaded in order to properly initiate the transaction so that the beneficiary can get the amount during the designated time period of 30 minutes.

Bank of India RTGS Limits

It is important for the applicant to know about the RTGS limits so that they can decide the maximum amount that they want to pay through this process. Well, the applicant will be able to send about Rs. 2 lakhs minimum and Rs. 25 lakhs maximum to the beneficiary in Bank of India.

Be the first to comment