Banking services are one of the important necessities of our daily life. A bank is the most trustworthy organization where you can manage all the monetary savings or earnings in a very proper and organised form. Banking service runs with some specific procedural activities to keep your savings secure and provide you with satisfactory benefits out of it. One of such services of the banking sector is a Cancelled cheque.

What is a Cancelled Cheque?

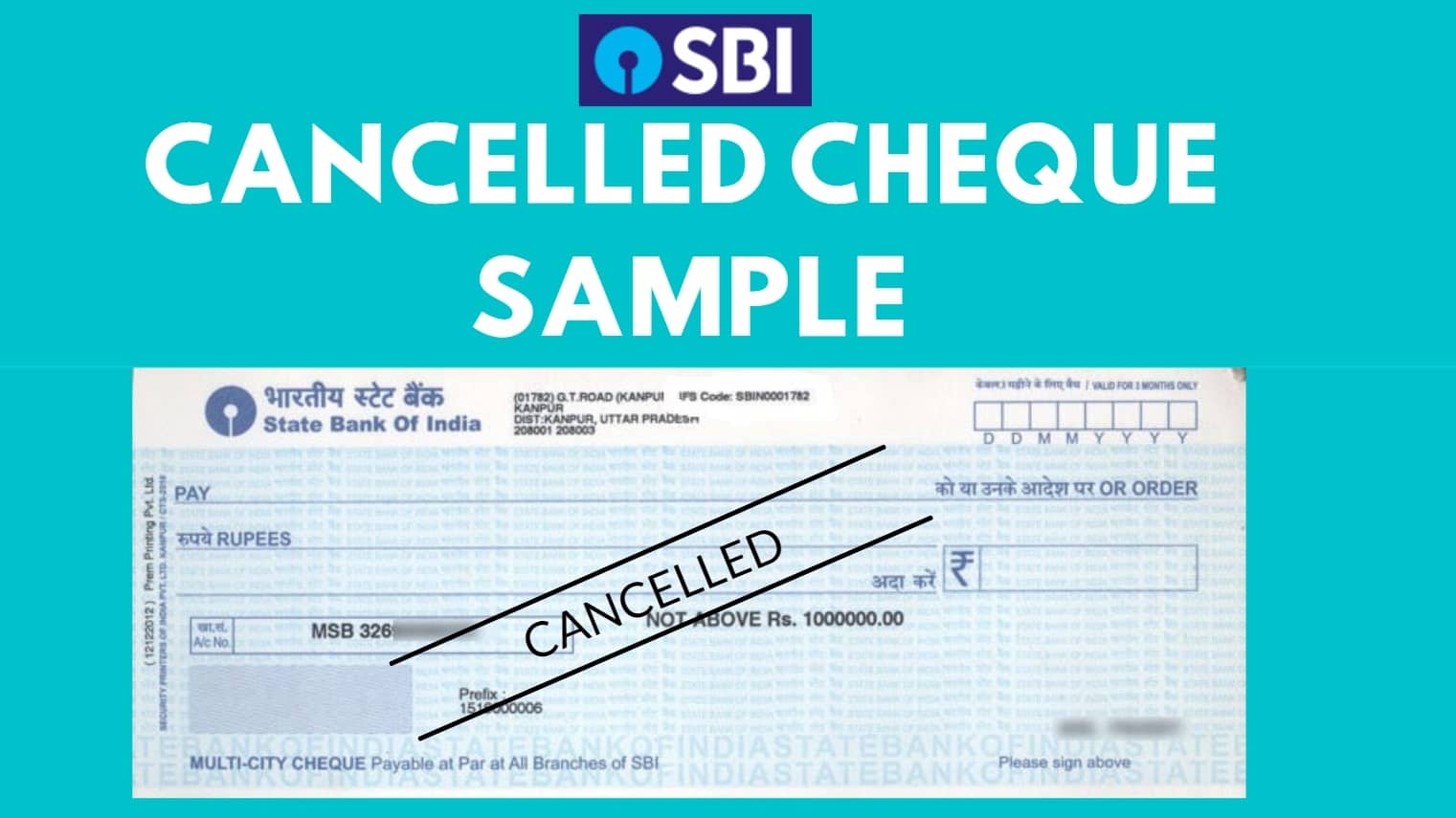

A Cancelled cheque is a cheque from your Cheque book associated with a particular bank where two parallel lines are drawn diagonally. The word ‘CANCELLED‘ in the Capital letter is written between the two parallel lines. A Cancelled cheque contains:

- Your bank account number.

- The name of that bank.

- The account holder’s name.

- IFSC.

- The bank’s MICR code.

Why is a Cancelled cheque required?

A Cancelled cheque holds its importance in banking services. When you issue a Cancelled cheque, it means that you are actually an account holder of that bank with your details. A Cancelled cheque is not only issued at the bank, but you can issue it in other relevant sectors too when necessary. The benefits of issuing a Cancelled cheque are discussed below in a brief way:

- Proof: A Cancelled cheque actually determines that you are an account holder of that respective bank where you claim that you are associated with the bank as a customer.

- Proper Details: A Cancelled cheque provides proper details about the information associated with you and your bank. When you issue a Cancelled cheque, it means that you are providing very accurate information about your account associated with a particular bank. The detailed information gathered from a Cancelled cheque is the bank’s name and branch, the account holder’s name, the bank account number, IFSC (Indian Financial System Code), and the MICR( Magnetic Ink Character Recognition) code.

How to issue an SBI Cancelled Cheque?

The methods of issuing a Cancelled cheque are pretty simple and are discussed below:

- Cheque Book holding: To issue a Cancelled cheque, you need to possess a Cheque book of SBI with a proper Chequebook facility.

- Parallel Lines Input: With a black or a blue pen, you need to draw two parallel lines diagonally across an SBI cheque from one end to the other end. There should be enough space between the two lines so that you can write in between them.

- Writing: Write the word “CANCELLED” between the two parallel lines on the SBI cheque in all caps form or sentence.

- Signature issues: You should not sign your SBI cheque, which you are canceling. This may lead to may fraud intentional cases.

Conclusion

Thus, we can conclude that the method of making a Cancelled cheque is associated with SBI. SBI Cancelled cheques have many utilities but can also be misused in certain ways. So, it would help if you took necessary precautions before you proceed with this issue.

Be the first to comment