Today Technology has driven the economy towards utilization of time in a better way. Nowadays, RTGS has become one of the fastest ways to transfer money to anyone. In recent years banks have contributed a lot towards enhancing facilities for their customers. They have undergone massive technological changes to make their customer experience better. Earlier NEFT was the most popular method of payment. Just like other nationalized banks, Union Bank has also come forward in providing better experience and facilities of transfers to their customers.

RTGS stands for real-time gross settlement whereas NEFT stands for National electronic funds transfer. Both of these methods are electronic payment systems and help the individuals for proper transfer of funds between banks. In opposition to RTGS under NEFT, the fund transfer takes place in batches that are settled in hourly time slots.

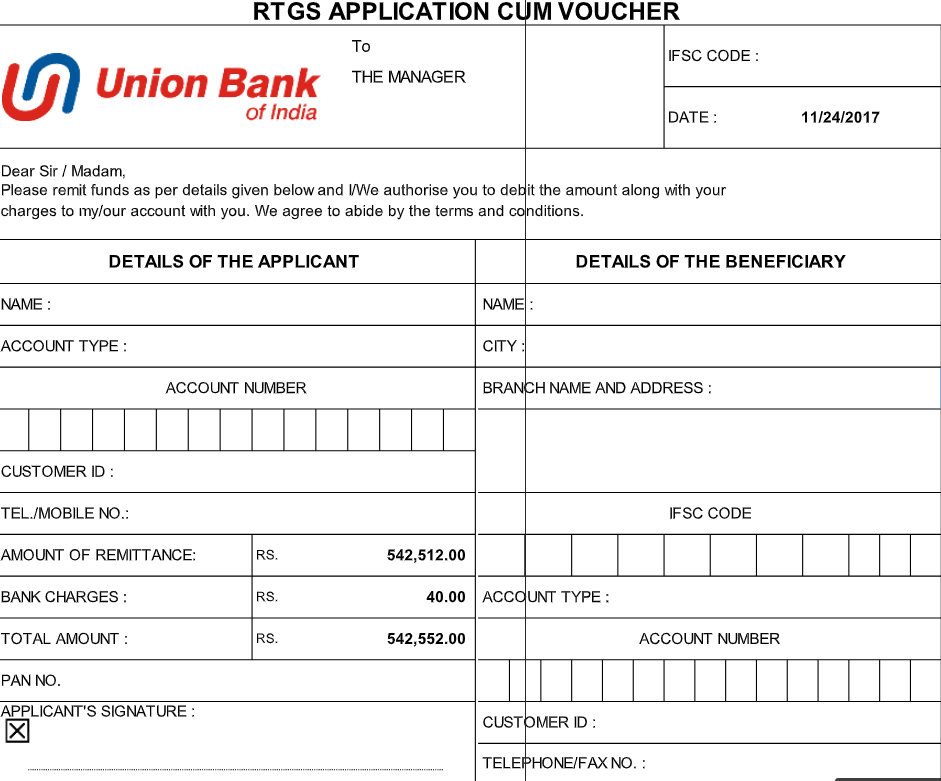

Details of Union Bank RTGS Form Download

The users can download the PDF format of the Union Bank of India RTGS form from the official website of the bank. They can use the following link for downloading the RTGS form pdf: https://drive.google.com/file/d/1ac6KAOCG5v288IbtO9d7rWSBLHzzEiBv/view.

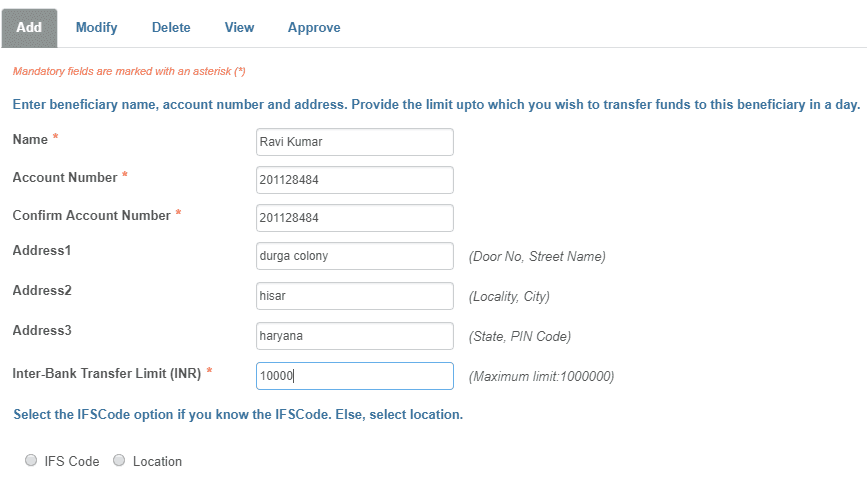

Union Bank of India RTGS form in PDF format allows the customer to mention personal details such as account number, IFSC code, and the amount of payee and payer person. under this process, a check leaf is enclosed with the form which is submitted to the concerned bank branch to the payer. There are a few more details that are required for completing an RTGS transaction. these are as follows:

- Name of the beneficiary or payee as mentioned in the bank account.

- The amount that is required to be transferred in Indian currency i.e. rupees.

- IFSC code of the beneficiary or payee.

- Account number of the payee or the beneficiary.

- Name of the bank branch and beneficiary Bank.

RBI takes all the measures to maintain the RTGS payment system which makes it a foolproof and secure system to be used by Indian citizens. It is a very reliable method of either receiving or sending money at any given point in time in India. RTGS has become more popular recently because it is one of the fastest ways to send money e to anyone across India. RTGS has become faster than the NEFT mode of payment too. Moreover, the charges of making and RTGS payment are very reasonable and range between INR 25 to INR 55 depending upon the RTGS amount.

What to do if the link is not working?

In case if the download link of Union Bank of India does not work for RTGS or NEFT form PDF, then the users can freely report this problem on the download page itself. They just need to select the appropriate action such as promotion content, copyright material, broken link, etc. In the case of Union Bank of India RTGS or NEFT form being a corporate material, its PDF or any other source for downloading cannot be provided at any cost.

it is because this information is confidential. The users can try to refresh the page, and they can also contact the banking authorities for further details of the issue. Usually, the issue gets resolved by refreshing the page two to three times, and if it doesn’t get resolved it can be considered that the server of the banking system is down at that moment.

Be the first to comment