Union Bank of India launched the super app – Union Vyom app, on 11 November 2022. This app is a one-stop solution for all banking financial products, where customers can transact beyond traditional banking services. Other than online transactions, the Vyom app is designed to provide a unique banking experience to the customers, such as Retail, MSME loan, credit card, make an investment in many mutual fund schemes, and can easily buy different types of insurance products.

Moreover, the customers can also avail of the various services for lifestyle category products, such as flight booking, hotel booking, gift cards, cabs, donations, and much more.

If you have opened a bank account in the Union Bank of India, you should know about the super user-friendly Vyom Union Bank Mobile Banking App. This post will help you with the Vyom Union Bank of India Mobile Banking App registration process. So stay tuned for an exciting read ahead.

Vyom Union Bank Mobile Banking APP Registration

Suppose you are already a customer of Union Bank of India and want to complete the Vyom App registration process. However, if you are still trying to figure out how to do it, you should read this article until the end. You will be excited to know that we are going to cover complete facts and crucial information here in this regard. Just follow the below-mentioned simple and easy steps to learn the complete solution for your queries, such as:

Step 1. First, download the Vyom – Union Bank of India mobile app from the Play Store or Apple App Store and open the app. And then open the app.

Step 2. Provide all required permissions to the app: such as allowing Vyom to access this device’s location, enabling Vyom to make and manage phone calls, and so on.

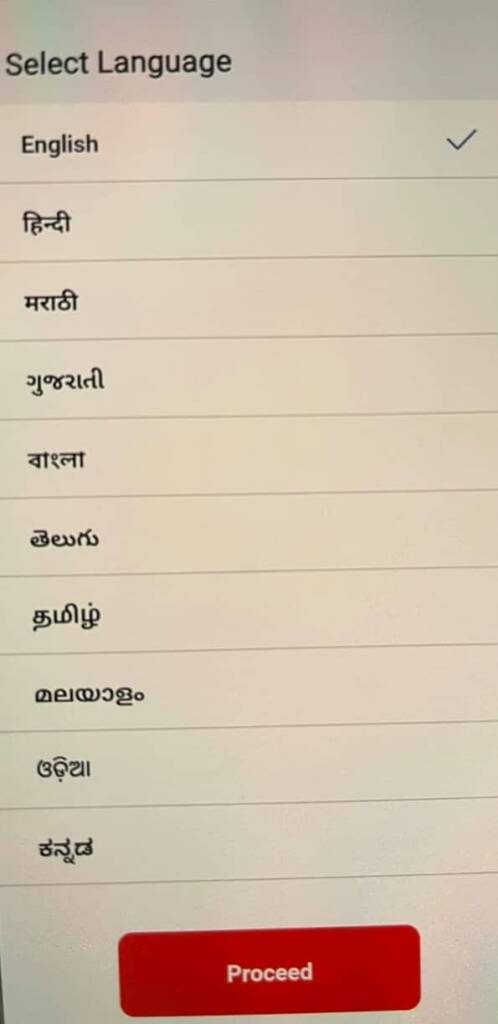

Select your language to use the app and click the Proceed button.

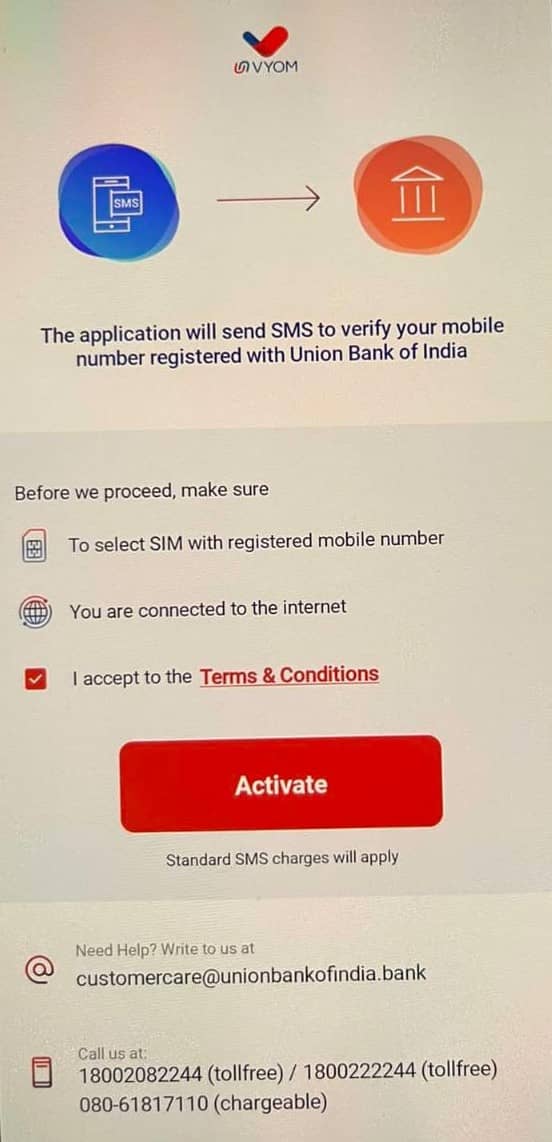

Step 3. Now, a new page will open before you, showing you that “The application will send SMS to verify your mobile number registered with Union Bank of India” and “Before we proceed, make sure:

- To select SIM with a registered mobile number

- You are connected to the internet

- I Accept the Terms & Conditions

Click the Right mark in the given box to accept the Terms & Conditions, and then click on the ACTIVATE button.

Now, you will receive a message on your mobile screen stating, “Allow Vyom to send and view SMS messages?” then click on the Allow option button.

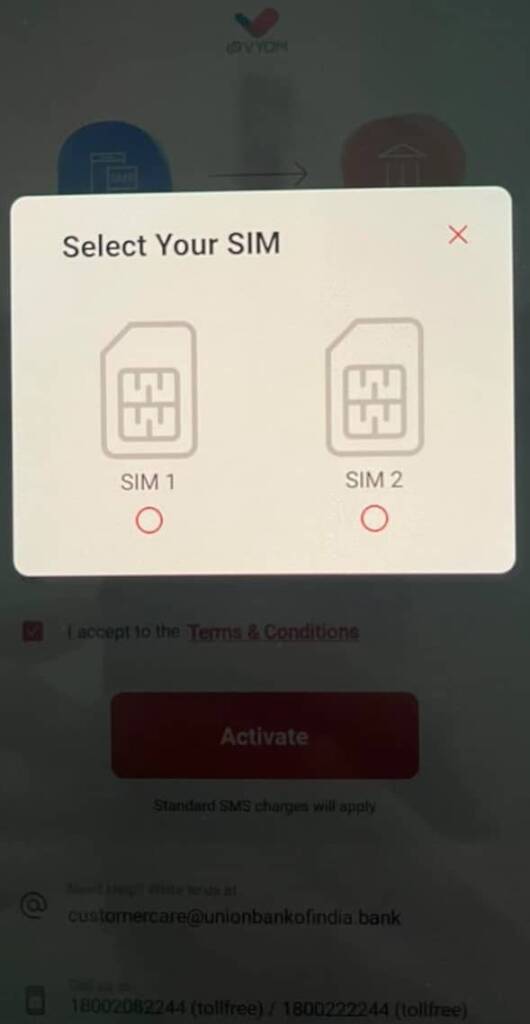

Step 4. If you have two mobile SIM cards in your mobile phone, then you will be asked to select one of them. Click to choose your registered mobile number option.

Please note that some balance amounts should be available on the selected SIM card.

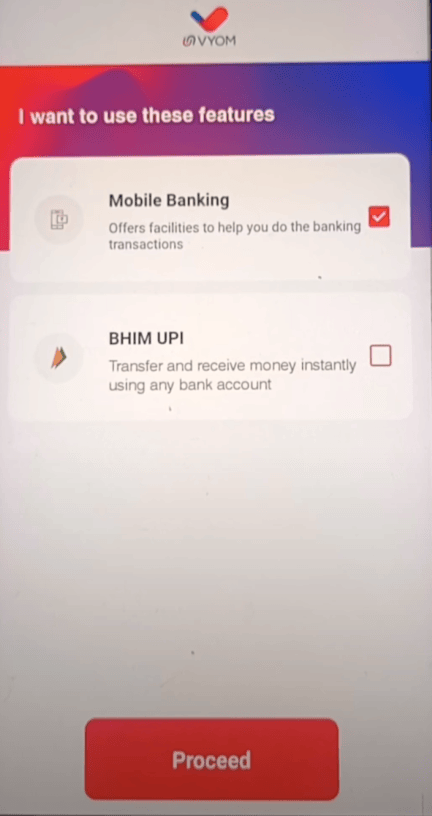

Step 5. Now, a new page will open before you, showing you that “I want to use these features,” “Mobile Banking – Offers facilities to help you do the banking transactions,” and “BHIM UPI – Transfer and receive instantly using any bank account.”

If you want to activate the “Mobile Banking” or “BHIM UPI” option, or both options, then click on the Right mark in the given boxes accordingly. Then click on the PROCEED button.

Now, you will receive a message on your mobile screen, showing that “You are about to register for Mobile Banking. Do you want to continue?”. Then click on the OK button.

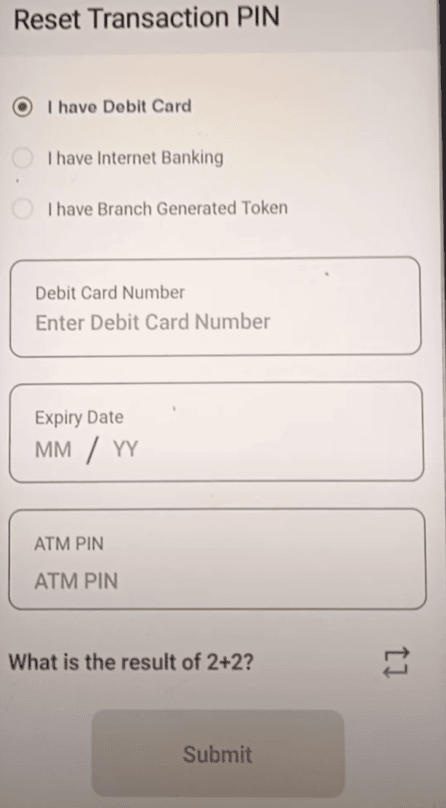

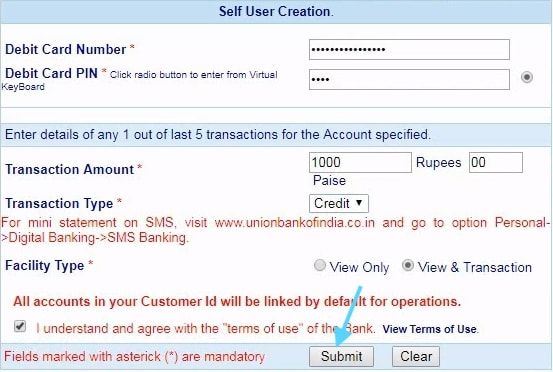

Step 6. Now, a new page will open before you, showing you “Reset Transaction PIN” and “I have Debit Card, I have Internet Banking, I have Branch Generated Token,” as three types of options. You will have to create a Transaction PIN here. If you have a Debit/ATM card, then you should select the “I have a Debit Card” option; otherwise, you can choose one of the remaining two options.

Suppose you select the “I have a Debit Card” option, then after creating your Transaction PIN, enter your Debit Card Number, its expiry date, your ATM PIN, and a given captcha code, as required. Then click on the SUBMIT button.

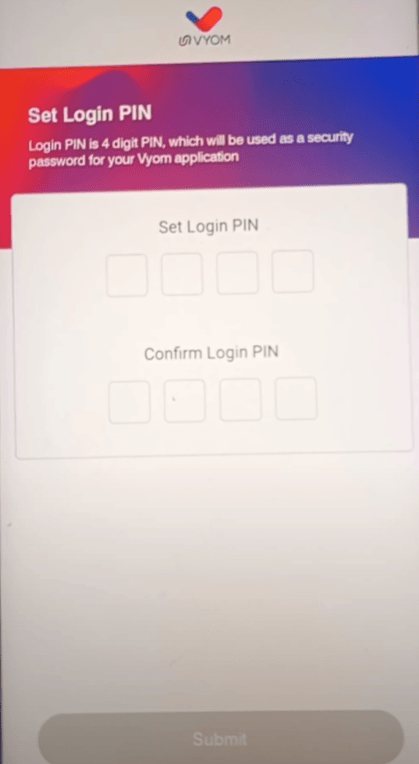

Step 7. Now, you will be asked to set a Login PIN. Here you will have to create a four-digit Login PIN. Now, you will be asked to set a 4-digit MPIN for login. After creating your Login PIN, enter it, then re-enter it for confirmation. Then, click on the SUBMIT button.

Now, you will receive a message on your mobile screen, showing you the “Success” and “Login PIN has been set successfully.” Click on the PROCEED button.

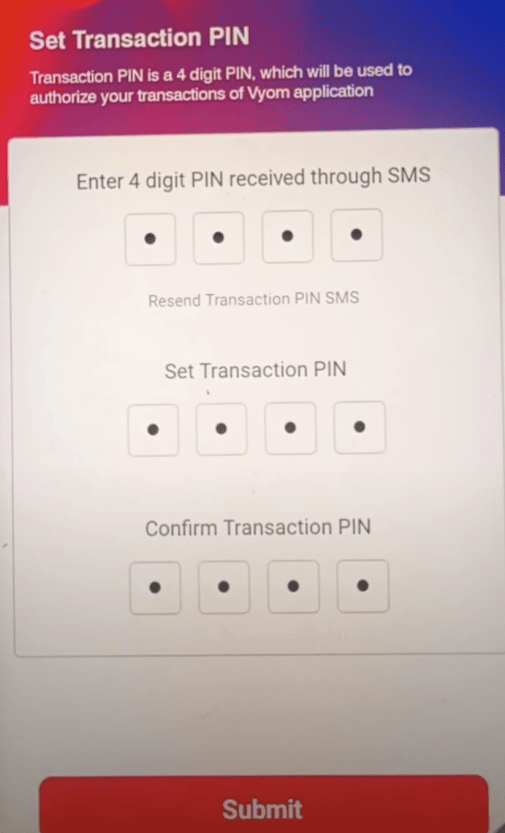

Step 8. Now, you will receive a 4-digit PIN on your registered mobile number through SMS. You will have to enter it, then re-enter it for confirmation.

Now, you will have to set a 4-digit Transaction PIN. Then enter it, and re-enter it for confirmation.

Please note that the Transaction PIN should be a different number than the four-digit PIN. Click on the SUBMIT button.

Now, you will receive a message on your mobile screen showing you the “Success” and “Transaction PIN has been set successfully.” Click on the PROCEED button.

Now, the login page of the Vyom app will open up before you. Click on the Login option. Then enter a 4-digit Login PIN. Provide all required permission to allow Vyom to access this device’s location, and will enable the app for android fingerprint authentication. Click on the YES option.

To activate your fingerprint login, you must place a finger on your device’s fingerprint scanner. Then select a theme. Click on the Apply button.

After that, a new page will open before you, showing you the bank account holder’s name and Deposits, Borrowings, and Savings options. Click on the Eye icon on the right side of your mobile screen. Then you can view and check your account balance amount.

| Services | Contact |

|---|---|

| Toll-Free Number | 1800222244 or 18002082244 |

| [email protected] |

So this way, you can quickly learn the complete knowledge and crucial information about Vyom Union Bank Mobile Banking registration.

Conclusion

So if you were anxious and doubtful about making a way out regarding Union Bank Mobile Banking registration, we are confident that we have provided you with the best possible simple and quick steps to help you quench your query. Now, by following the above-written steps, you can easily do the needful in the case of the Vyom Union Bank of India Mobile Banking registration process.

However, you should contact the Vyom Union Bank Mobile Banking customer support team if you still have any doubts or further queries.

How to add another account in Vyom app

I am retired staff I am unable to down load my form 16 when opening in vyom iam unable to get menu interests and taxes menu pl help

UNBLE TO USED VYOM AAP IN MY MOBILE