Online Auto Sweep Facility in State Bank of India (SBI) enables you to earn a Term Deposit return from your Savings Bank Account. It is a combination of a Savings Account and a Fixed Deposit Account. Therefore, this facility provides you the tremendous benefits of both Savings and Fixed Deposits. In this case, a Savings Account is associated with the Fixed Deposit, and a money-related limit is defined and explained.

Whenever the cash amount in the Savings Bank Account gets exceeded beyond the defined limit, in that case, the extra amount is used to be automatically transferred into the Fixed Deposit. As a result, the balance amount in your Savings Bank Account can earn a higher interest rate.

In this way, you can easily enable Auto sweep for your SBI account to earn FD returns on your balance amount, and you don’t need to open an FD account to yield higher returns.

If you have a Savings Bank Account and are planning to avail of the auto FD for your bank account, then you should know about activating the SBI auto sweep facility online. So be with us and keep reading ahead to activate the auto sweep facility.

Steps to Activate Auto Sweep Facility in SBI Online

Suppose you are an SBI customer and need to enable the auto sweep facility for your Savings Bank Account and earn an FD return from your bank account balance amount. But for some reason, you are still doubtful and don’t know the procedure to activate the auto sweep facility in SBI. In such a case, don’t worry; just follow the below-mentioned simple and easy steps, such as:

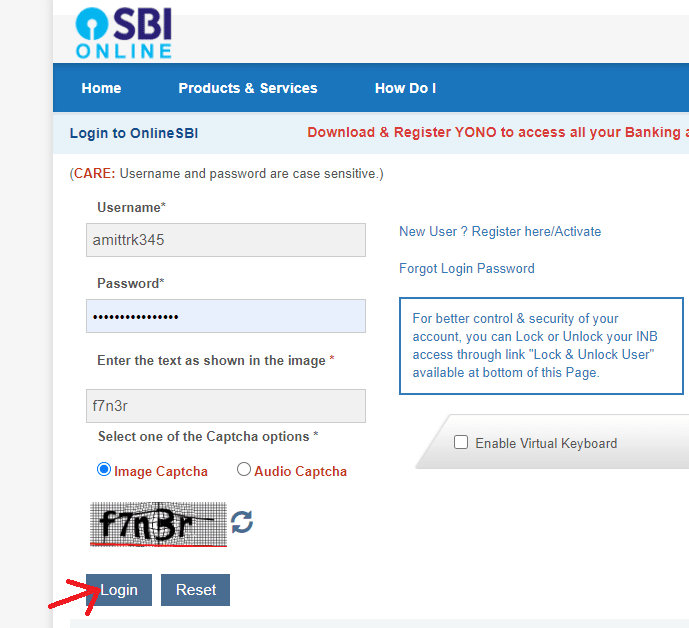

Step 1. First, open the SBI online application on your mobile phone or Computer and click on the “LOGIN” button. Then click on the “Continue” button. Now, a new page will open up before you, where you will be asked to enter your internet banking details, such as Username, Password, and the given Captcha code, then click on the “Login” button.

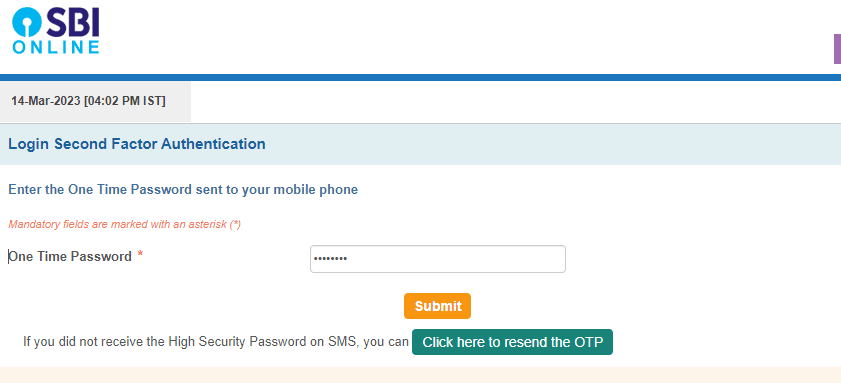

After that, you will receive a One Time Password (OTP) on your mobile number (registered). Enter the received OTP in the required space. Then click on the “Submit” button.

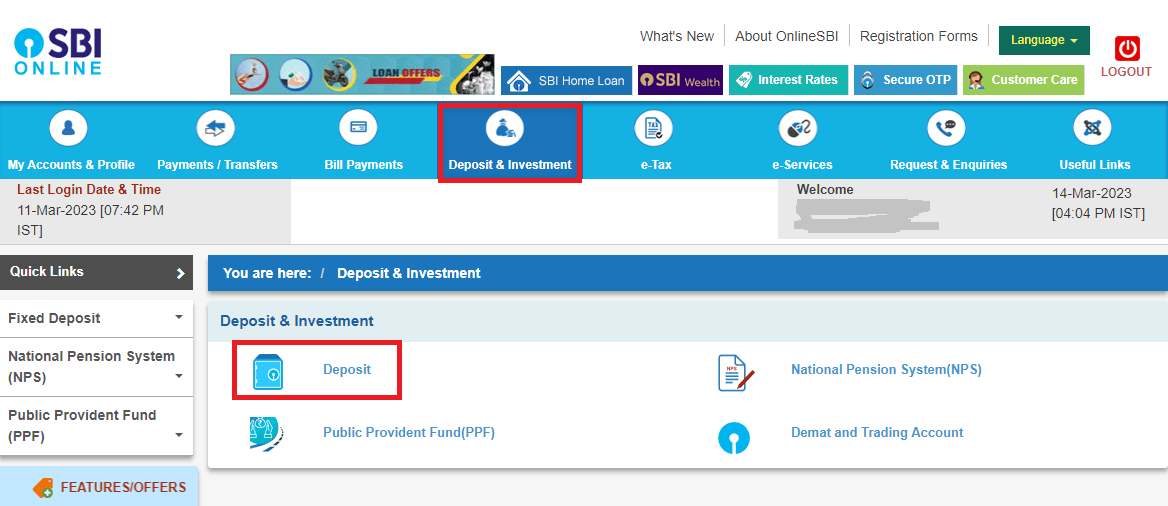

Step 2. Now, a new page will open up before you. Click on the “Deposit & Investment” option at the top of your computer screen. Then click on the “Deposit.” option.

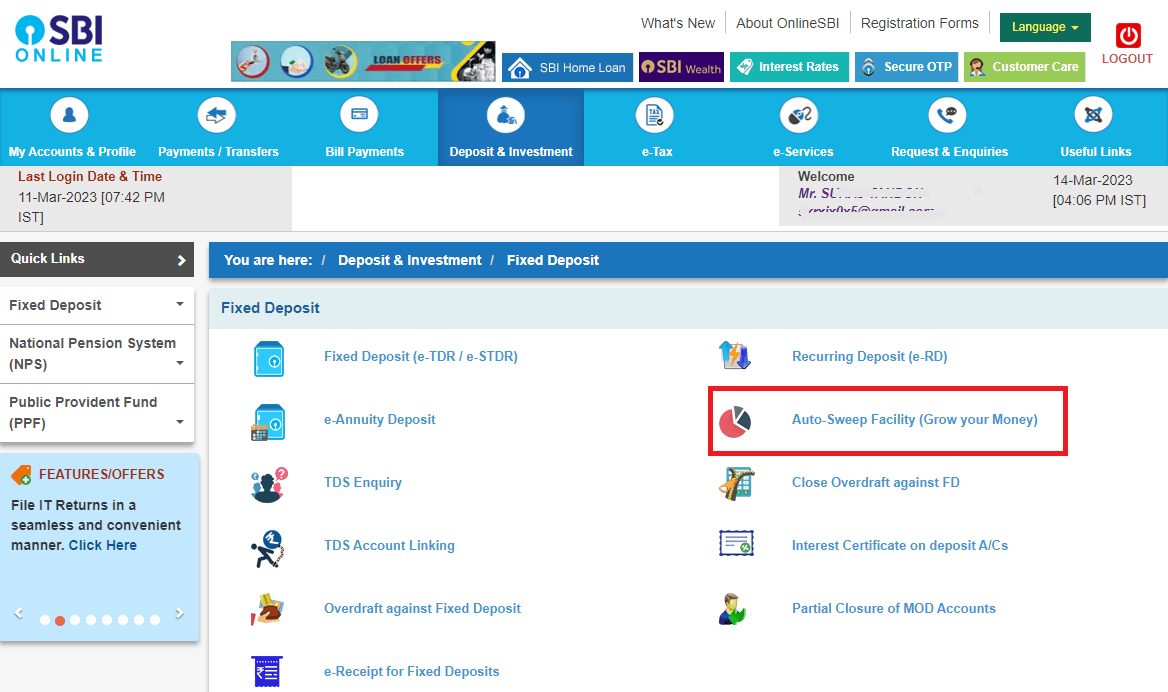

Step 3. After that, a new interface will open up before you click on the “Auto-Sweep Facility (Grow your Money)” option.

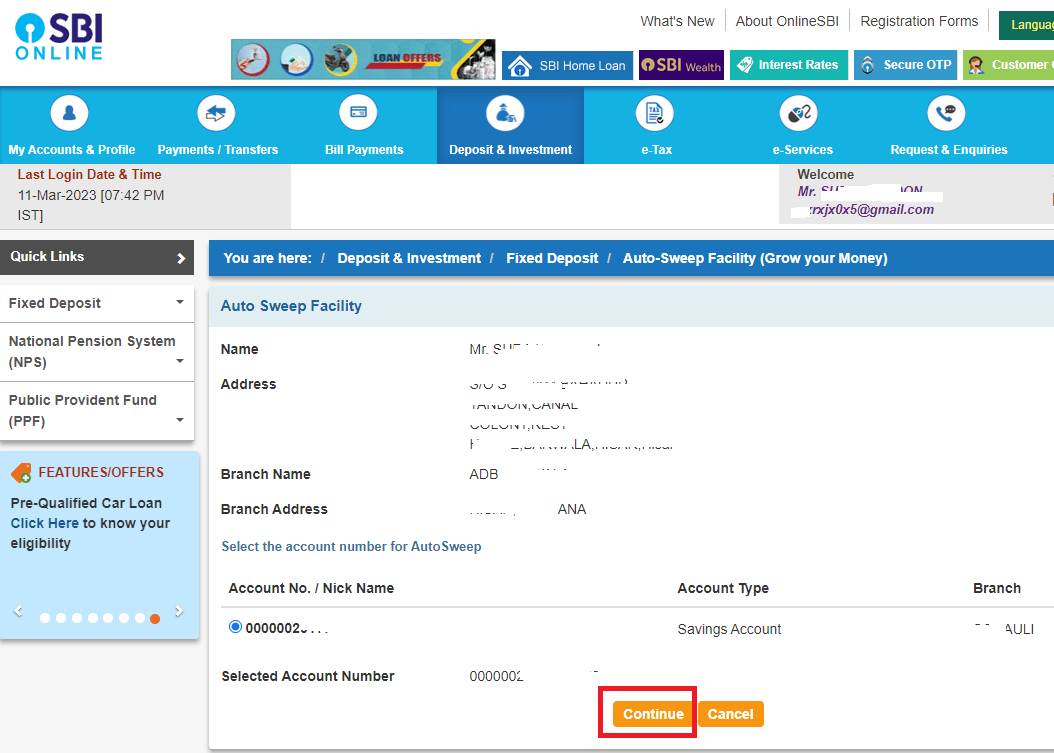

Step 4. Now, a new page will open up before you. Here you will see details of your bank account, such as Account number and Address. Here you will have to select your Account number, then click on the “Continue” button.

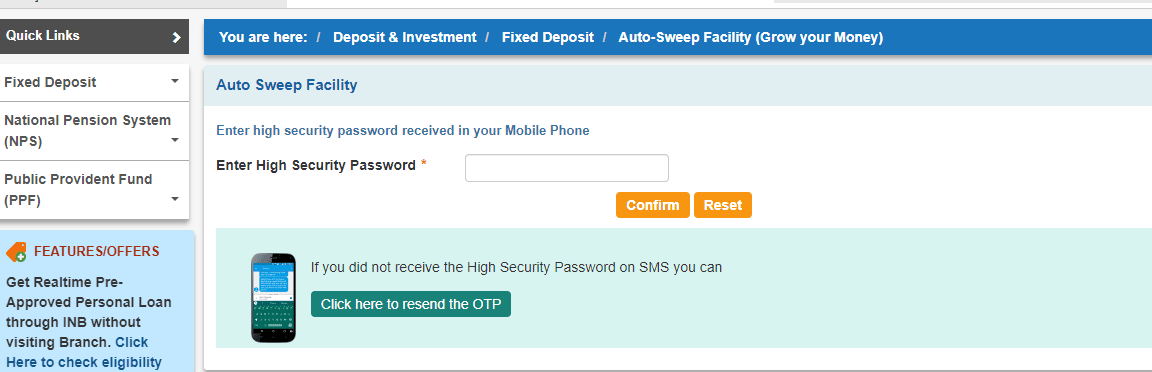

Step 5. After that, you will receive a High-Security Password on your mobile phone. Enter that password in the required space. Then click on the “Confirm” button.

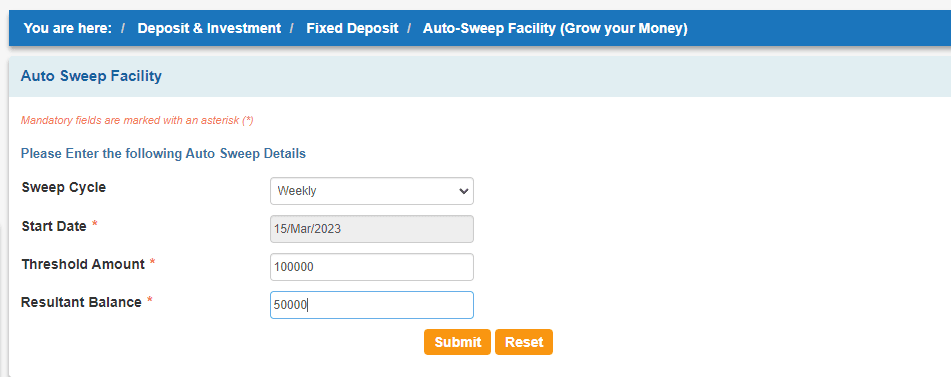

Step 6. Now, a new interface will open up before you. Here you will be asked to enter some Auto Sweep Details, such as Sweep Cycle (Enter Weekly or Monthly), Start Date (Enter the date from where you want to start the Auto Sweep; suppose you set 21 February 2023), Threshold Amount and resultant balance.

Please note that the Threshold amount refers to the amount at which the Auto Sweep will trigger. And Resultant amount refers to the amount which will remain as the balance amount in your Savings Bank Account.

You should also note that as per the RBI guidelines, the minimum Threshold amount is Rs. 35,000, and the minimum Resultant amount is Rs. 25,000.

Suppose, for example, you enter 45,000 as the Threshold amount and 35,000 as the minimum Resultant amount. Then, your Auto Sweep amount will be (45,000 – 35,000 =) 10,000.

It means that whenever the cash amount in your Savings Bank Account exceeds Rs. 45,000, a Fixed Deposit will be created for Rs. 10,000.

However, you may set any amount as a Threshold amount in excess of Rs. 35,000 and a Resultant amount in excess of Rs. 25,000, according to your need and convenience.

After you set a Threshold amount and a Resultant amount, then click on the “Submit” button. After that, you will receive a message that your account has been successfully converted from SB to the SB Plus category, and the Sweep Details have also been set for your account. So this way, you can quickly activate the auto sweep facility in SBI online.

Final Takeaway Important Thoughts

That’s all for now. We expect that this article is helpful for you to activate the auto sweep account in SBI. However, you should know that once you get your Savings Bank Account converted to a Savings Bank Plus Account, then it can not be changed back to the previous type of Bank Product.

So if you still want to change it, then you will have to visit your home branch to get it done.

I wanted to know how we can add auto sweep option in icici Bank through net banking