A cheque is a part of the active financial system in the country, which makes it an essential instrument to send and get money without any physical transfer of cash. In simple words, a cheque is a document that manages people to exchange money.

It is obvious that when the open cheques are presented by the payee to the bank over the counter, these cheques are always liable to significant risk.

For the reason that it may be stolen or lost, and unless the drawer (the cheque-drawing person is known as the drawer) has already asked the bank not to make payment for that particular cheque, in such a case, any unauthorized person can get it exchanged for money.

Therefore, to avoid the risk of losses incurred by open cheques wrongly used by the wrong parties, the practice of crossing the available cheques was initiated. If you are crossing a cheque before issuing it to someone, then you should know the meaning of a Crossed Cheque.

Crossed Cheque Meaning

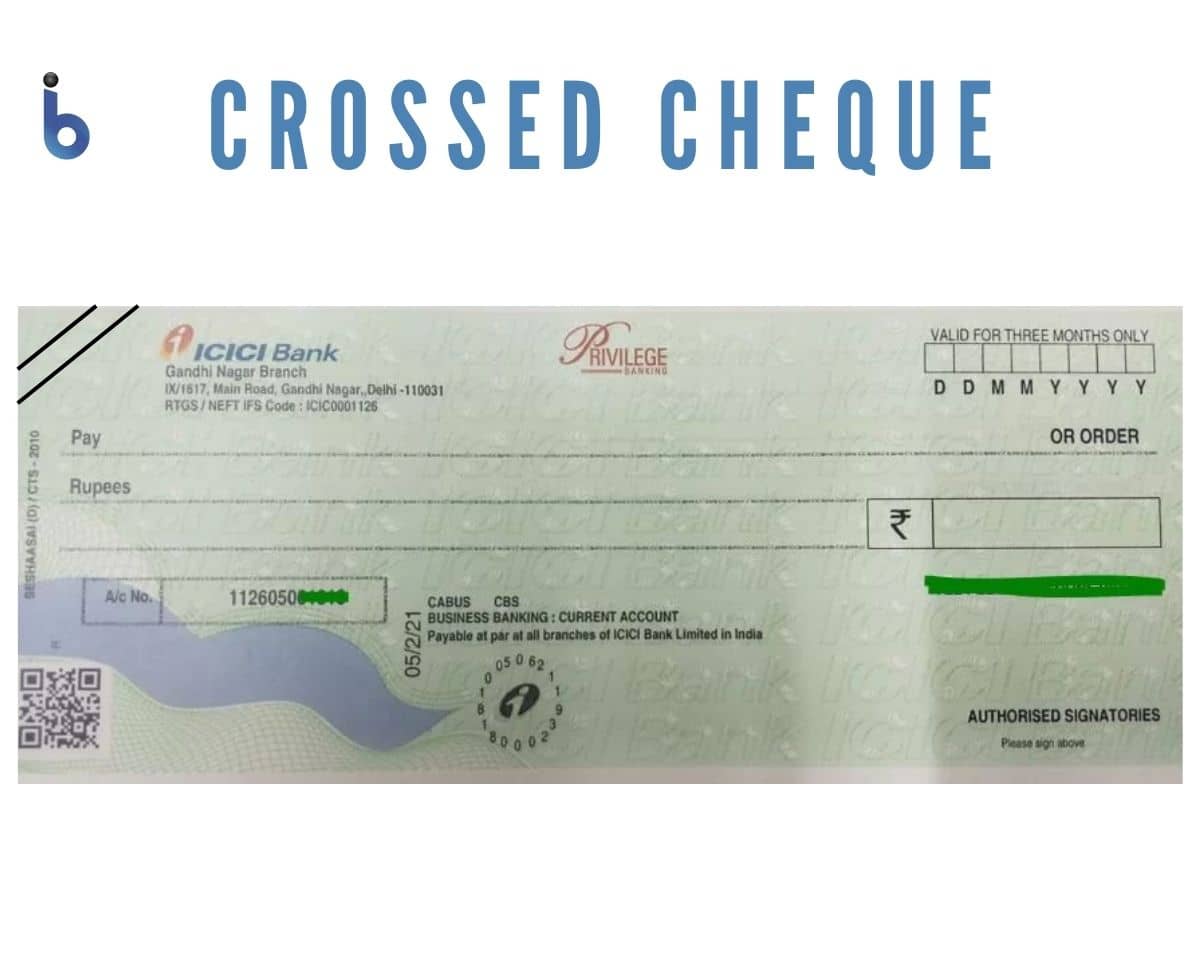

A crossed cheque can be any cheque that is struck with two parallel lines with the help of a writing pen. These lines could be drawn with the top left-handed corner of the cheque. Crossing a cheque means that the particular cheque can only be deposited directly into a bank account. Therefore, such cheques cannot be instantly exchanged for money by a bank or by any other credit institution.

By crossing a cheque you provide specific instructions to a financial institution regarding how the money should be handled.

This type of cheque is used to transfer money between banks or to pay various bills. You can also use them to pay for any specific goods and services or to borrow money from a bank. However, cross-cheques are also used as a way to protect against fraudulent actions.

Different Ways To Cross A Cheque

There are many different ways to cross a cheque, such as:

1. General Crossing

You can draw parallel lines anywhere on the cheque for General Crossing cheques. However, it is advisable to draw it on the top left of the cheque. The importance of this way is that the cheque payment can only be paid to the bank.

2. Special Crossing

For Special Crossing cheques, the paying banker can honor the cheque only if the cheque is ordered through the bank, which is mentioned within the crossing lines. However, in a special crossing way, the two parallel crosswise lines are not essential, but mentioning the name of the banker is most important.

3. Account Payee Crossing

An Account payee crossing is also termed a restricted crossing. In this way, the cheque consists of the words “account payee” or “account payee only .”Moreover, the cheque is required to be crossed either generally or especially.

The importance of this way of crossing is that the cheque is not negotiable anymore. It means that the cheque is no longer convertible in another form.

4. Not Negotiable Crossing

For Not Negotiable Crossing cheques, it must include the phrase “not negotiable .”Additionally, you must also cross the cheque Eithergenerally or especially. The importance of this way of crossing is that the cheque will stay non-negotiable, and even the title of the transfer would not be any better than the transferor’s title.

5. Double-crossing

The way of Double-crossing a cheque is used in extraordinary situations, such as: whenever a bank sends the same cheque to another financial institution for collecting as its representative, to which that cheque was crossed, then the double-crossing process is followed.

However, the secondary crossing of the same cheque should specify that it is working as a representative of the earlier bank to whom the cheque was mainly crossed.

6. Uncrossing a Cheque

You can well understand that when a cheque is crossed, then the cheque becomes non-transferable, which suggests that it cannot be delivered to a third party. But, there is a provision that only the drawer (the person or entity whose transaction account is to be drawn.) is permitted to place the cheque in a bank in their own name.

Hence, the drawer can release the cheque by writing a crossing “canceled” on the front side of the cheque. However, this is not an advisable practice because by following this way, the cheque issuer’s original security is removed.

The Final Resulting Thoughts

So this way, you can easily and quickly learn the meaning of a Crossed Cheque. We have even assisted you with the different ways by which you can cross a cheque for your use. However, the financial term “Cross Cheque” typically refers to an arrangement between two or more parties in which one party pays the other a specific amount of money by depositing the funds directly into their account.

Cross cheque can also be used for a number of different purposes, which includes things like business transactions and personal finances.

Be the first to comment