The State Bank of India (SBI) is one of the largest banks in India. This bank provides a wide range of customer-friendly services, such as deposits or withdrawals and financial or non-financial transactions, that can be conveniently used to take advantage of its Savings Bank Account holders and/or Current Account holders.

SBI has generously made more than adequate provisions for its customers. The bank has made arrangements beforehand for a facility for its account holders to transfer funds through a number of methods. For example, an account holder can follow any of its available methods for transferring funds online or offline, such as NEFT, IMPS, RTGS, and UPI.

However, in this article, we will discuss how much time NEFT transfer takes in SBI to other banks.

What is the SBI NEFT Service, And How Does It Work?

The term NEFT stands for National Electronic Funds Transfer. As it sounds, it is an electronic fund transfer service, availing of which an SBI bank account holder is enabled to transfer funds from his bank account to another account, either in SBI or any other bank account, make various types of payments, such as credit card payments, and pay bills, etc.

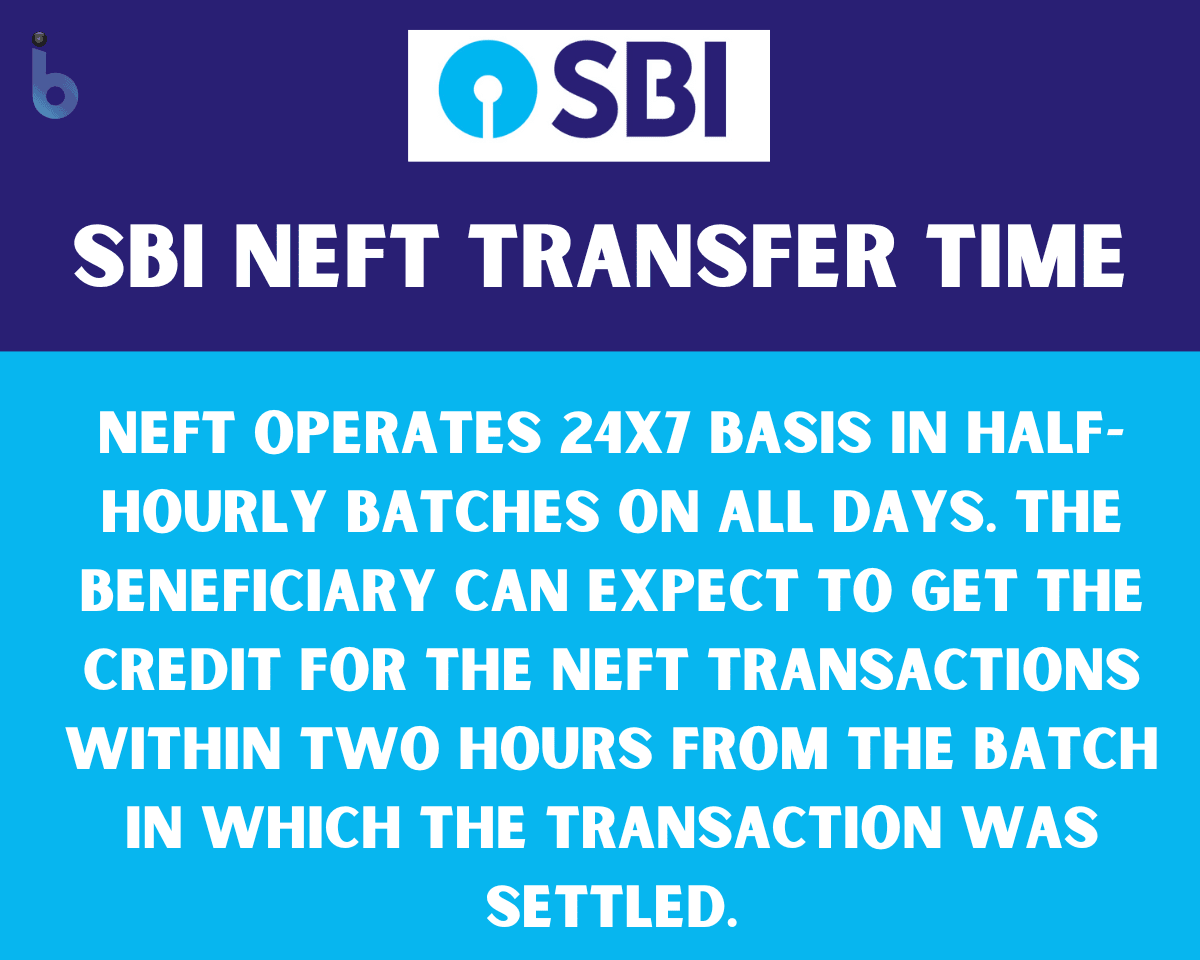

The SBI NEFT transfer payment is settled in half-hourly batches, for which the Deferred Net Settlement basis is adopted. On this basis, once the transactions are made, they are automatically settled in the next batch.

You should know that SBI NEFT works in half-hourly batches every day, even on a bank holiday. Also, we know that there are a total of twenty-four hours in a day, and two batches of NEFT transactions take place in one hour. Therefore, we can easily understand that NEFT transactions are settled 48 times a day. And for your information, the NEFT settlement starts at 12:30 AM and ends at 00:00 AM (midnight).

You should know that the objective of the SBI NEFT is to achieve an overall goal to accomplish the maximum amount of NEFT settlements in a day so that the SBI bank customer’s convenience is ensured as well as to encourage more online fund transfers and promote a digital mode of payment and transfer.

How Much time NEFT transfer takes in SBI?

Suppose you want to avail of the SBI NEFT transfer service. But for some reason, you are still confused and don’t know the time NEFT transfer takes in SBI to other banks, don’t worry. Just read this article till the end of this post. Definitely, you will be able to quench your queries, as we are providing you the information, such as:

- You should know that the objective of the SBI NEFT transfer is to achieve an overall goal of accomplishing the maximum amount of NEFT settlements in a day.

- You should know when the SBI NEFT payments are made offline, i.e., When it is done in an SBI branch, it is cleared within three banking hours. While using the internet banking method or mobile banking mode, it takes almost 2 hours to get completed.

- You should know that if an SBI account’s transaction by NEFT is done automatically after banking hours are over, then the STP (Straight Through Processing) mode is used to carry out the payment settlement.

So this way, you can easily and quickly learn how much time NEFT transfer takes in SBI.

Final Thoughts And The Highlights of the Article

Hopefully, after thoroughly reading this article, you cleared all your doubts and learned how much time NEFT transfer takes in SBI to other banks.

However, it is for your information that one of the major drawbacks of doing fund transactions through SBI NEFT or any other bank account is that payments are settled in batches. So it may take up to 30 minutes to complete the transaction as compared to RTGS, IMPS, or UPI, where funds are settled immediately.

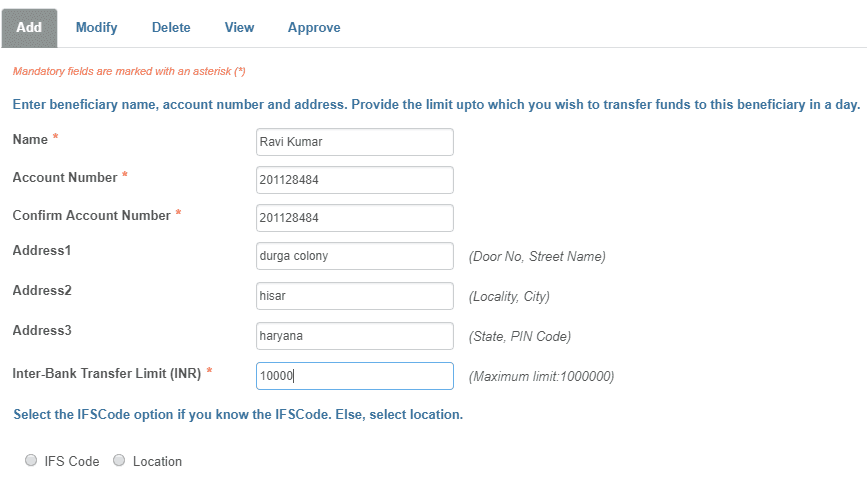

Moreover, you should also know that the person who does the fund transactions through NEFT has to add a beneficiary before making a payment to a new account. And the problem is that it may take from 6 hours to a full day (24 hours) before you can actually make payment using NEFT to a new account.

Additionally, you can’t overlook the fact that you have to pay a fee for initiating NEFT transactions. Whereas in the case of UPI transactions, no such fee is applicable.

Be the first to comment