PhonePe Private Limited is a leading digital wallet company in India. It provides an e-commerce/fintech payment platform to the users. PhonePe has initiated a safe and secure mobile payment platform, the PhonePe mobile application, that works on the Unified Payments Interface (UPI) system. UPI is a 24×7 service and can be conveniently used even on bank holidays and weekends. PhonePe app can be used to help cater to all your banking needs at any time and from anywhere, that includes sending and receiving money, recharging mobile phones, data cards, and DTH digital satellite services, making utility payments, paying at shops and restaurants, invest in various tax saving funds and other things, and much more to do several financial activities, with access to the internet.

It is necessary to link a bank account with the PhonePe account. If you don’t add an active and valid bank account to it, you will not be able to use the PhonePe application. PhonePe mobile application can be downloaded on both Android and Apple (iOS) phones. In this article, we have provided you with detailed essential information about the PhonePe mobile application, India Post Payments Bank (IPPB), and how to add an IPPB account to the PhonePe account. Just stick around and keep reading this post to find out more information regarding the above subjects.

So, without wasting any time, we will quickly get started to dive deeper into the complete details of this article. However, before proceeding further, we will quickly learn about the significant features of the India Post Payments Bank.

Significant Features Of The India Post Payments Bank

These are some essential features of the India Post Payments Bank, as talked about hereunder:

IPPB provides an easy-to-use, straightforward, safe, and secure mobile banking service through a mobile app, IPPB Mobile, to access your IPPB account and make transactions using your mobile phone. It offers small-scale banking services to its customers as compared to the other traditional banks in India, that are available for the following people,

- A common man earning a low income

- Social sector beneficiaries who are directly linked to the social mission of a social organization and obtain the main benefits out of its actions

- Individuals who belong to an unorganized sector and who usually offer their services on a temporary and seasonal basis as casual and unskilled workers or laborers

- Individuals who belong to the Micro, Small and Medium Enterprises (MSME)

- Individuals who belong to the Panchayats that operate in rural areas

- Individuals who belong to the under-banked or unbanked segments that operate in both the urban and rural areas

India Post Payments Bank offers three types of savings accounts to its customers: basic, digital, and regular. More importantly, the best thing is that there is no need to maintain a minimum account balance in these savings accounts.

Steps To Add IPPB Account in PhonePe

Suppose you are a genuine customer of India Post Payments Bank, having a savings bank account with IPPB. You are willing to link your IPPB account on the PhonePe mobile payment platform to carry out various transactions and financial activities. But you have no idea how to perform it. Don’t worry. Just a few easy steps will guide you to help the same. Simply follow these steps as written hereunder:

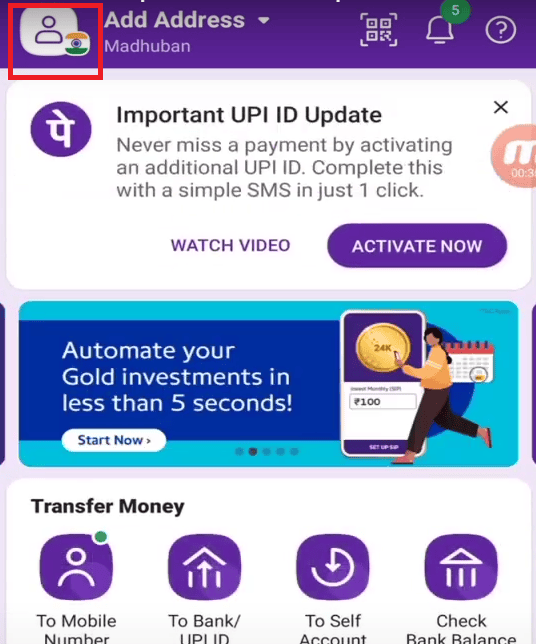

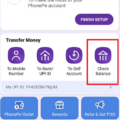

Step 1. Open the PhonePe application on your mobile phone and log in to it through your registered mobile phone number. Next, click on your PhonePe account profile icon at the upper left corner of your phone’s screen.

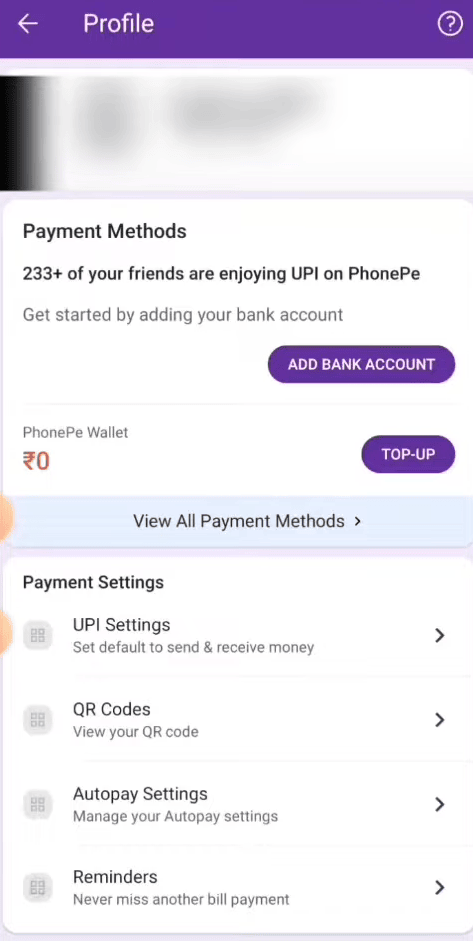

Step 2. Next, click on the “Add Bank Account” option on the next screen.

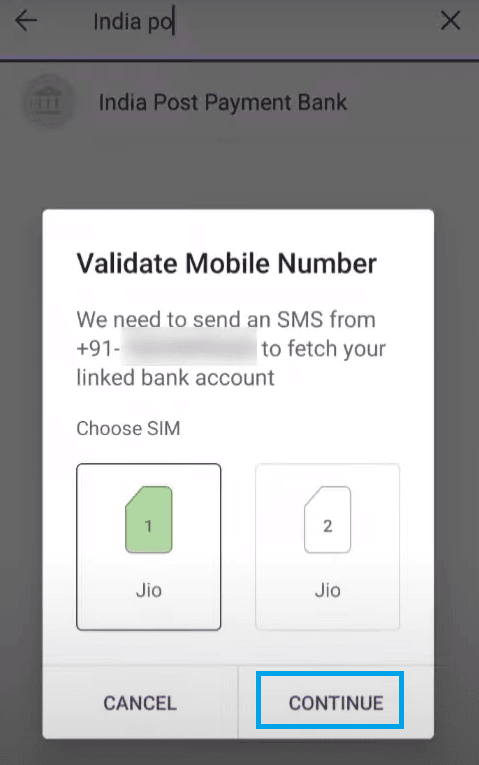

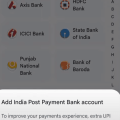

Step 3. Next, type and search “India Post Payments Bank” in the search bar on your mobile phone. Then click on it from the list of banks under the search bar. Next, select SIM 1 or SIM 2 on the next screen according to the mobile number linked to your bank account. Then click on the “Continue” button.

Next, a pop-up message will be displayed on your mobile screen, asking you to allow PhonePe to send and view SMS messages on your registered mobile phone number. Click on the “Allow” option to give your consent to proceed further.

After that, the registration process for UPI payments will be initiated, and it will start finding your bank account linked to the registered mobile number. Tap on the blue color right-mark button at the bottom-right corner of your mobile screen.

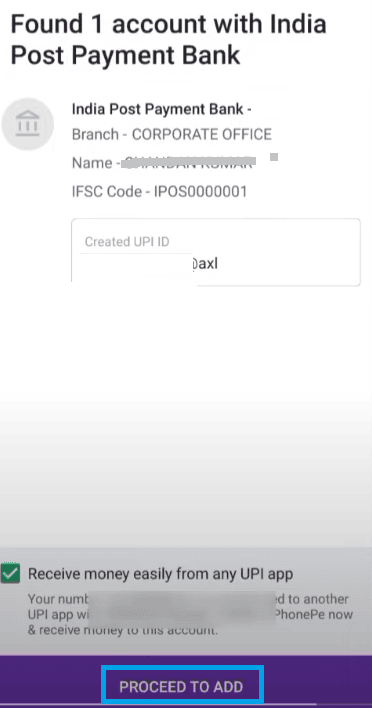

Next, a message will be displayed on your mobile screen stating that your IPPB account has been successfully initiated. After that, the details of the IPPB account to be added to the PhonePe account will be displayed on your mobile screen.

Step 4. Next, click on the small square box to accept the terms and conditions to receive money quickly from any UPI application. Then click on the “Proceed To Add” button. After that, a message will be displayed on your mobile screen stating that the IPPB account is linked to the registered mobile number.

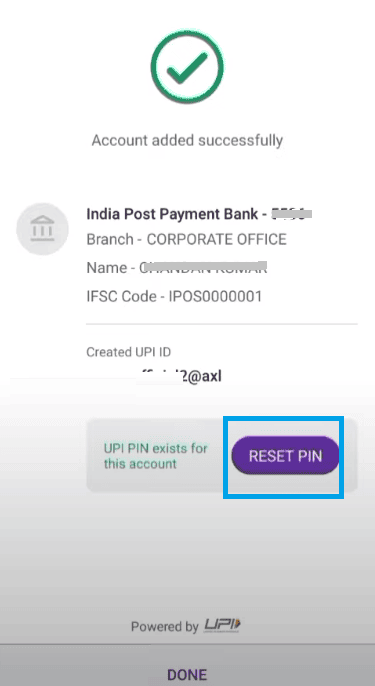

Next, a message will be displayed on your mobile screen stating that the IPPB account activation is in progress, followed by a message stating that the intended account was successfully added to the PhonePe account.

Step 5. If you are a first-time user of the PhonePe application, then click on the “Reset PIN” option and enter the necessary information as needed. Otherwise, you will not see the “Reset PIN” option.

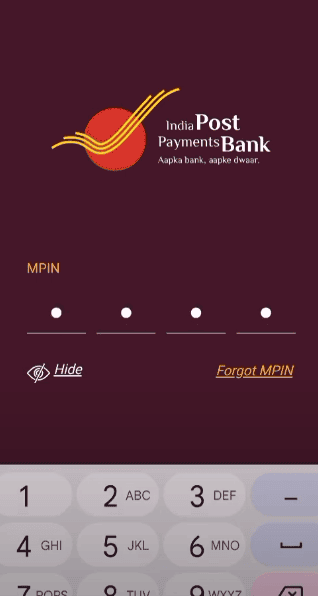

Step 6. Next, you will have to enter the last six digits and the expiry month and year of your IPPB Debit/ATM card as needed. Then click on the mobile exit button at the bottom of your mobile screen. Open the IPPB mobile application and enter your 4-digit MPIN to log into it. After that, the IPPB app home page will be opened on your mobile screen.

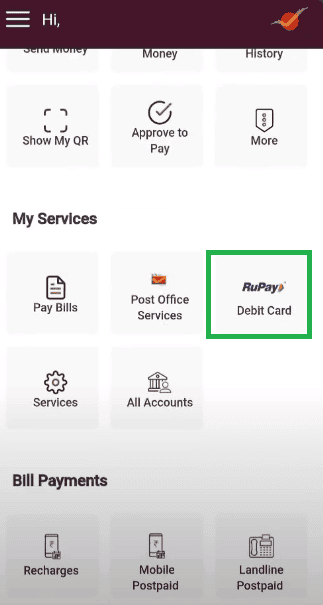

Step 7. Scroll down to the bottom of your next mobile screen to find and click on the “RuPay Debit Card” option under the “My Services” section.

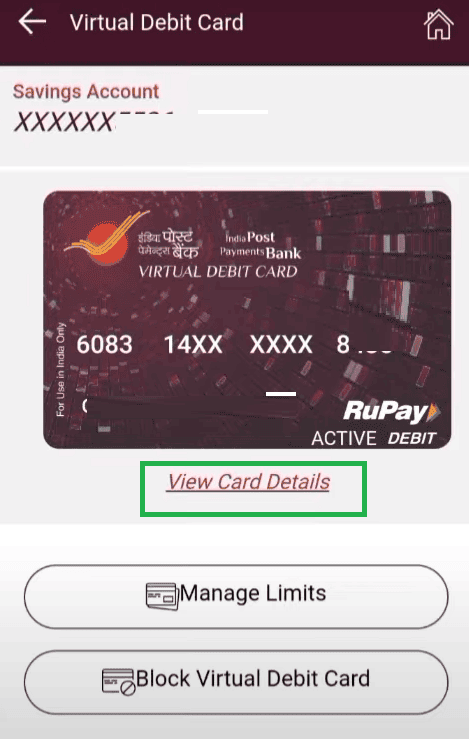

Step 8. Next, the image of your IPPB virtual/digital Debit card will be displayed on the next screen. Click on the “View Card Details” option under the image of your Debit card.

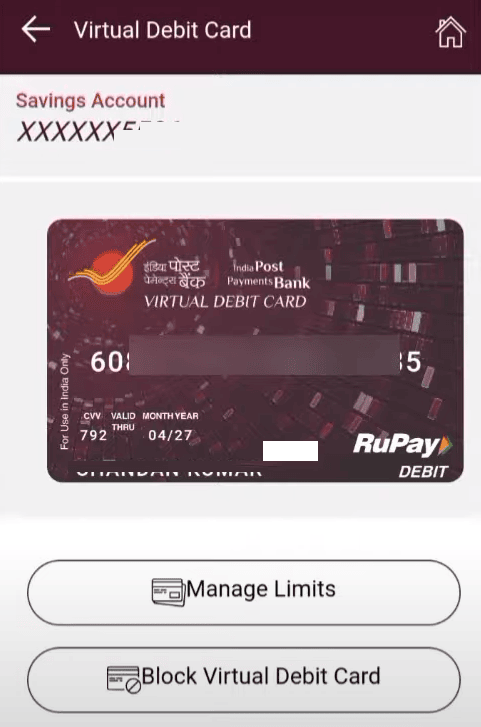

Step 9. After that, enter your 4-digit MPIN on the next screen as needed to authenticate with MPIN. Then click on the “Confirm” button. Now, an image of your IPPB Debit card with its number and the expiry month and year will be displayed on your mobile screen. Take a screenshot of it.

Step 10. Next, you will have to come to step number 6, as listed above, and enter the last six digits of your IPPB Debit card number and its expiry month and year as needed. Then click on the “Proceed” button. You can create ippb virtual debit card online through app easily.

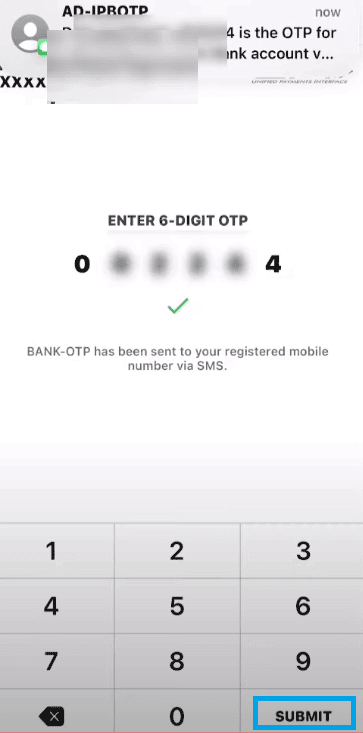

Step 11. Next, you will receive a 6-digit OTP on your registered mobile number. Enter this OTP as needed. Then click on the “Submit” button.

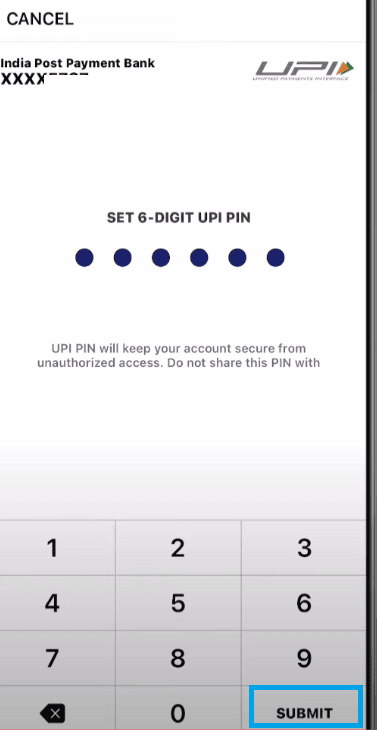

Step 12. Next, set and enter a UPI PIN of your choice on the next screen as needed. Then, re-enter the same MPIN to confirm it.

After that, a message will be displayed on your mobile screen stating that your UPI PIN is successfully set. After that, go to the PhonePe application home page. Now, you will be able to make transactions through your PhonePe account.

That’s it. By following the above-written easy steps and effortless process, you can quickly add your IPPB account to your PhonePe app.

To Wrap Up

We expect you will enjoy going through this blog post to learn about the PhonePe mobile application, India Post Payments Bank (IPPB), and how to add an IPPB account to the PhonePe account. This will help you to quickly and easily add your IPPB account to your PhonePe account yourself.

how to add another bank account in phonepe with different number