ReKYC is an initiative taken by banks to verify the recent details of their customer. Many of our details get updated with time. ReKYC is the process of adding them to your bank account to avoid any dispute during transactions.

If you received any message from your bank regarding reKYC, it DOES NOT MEAN

- Your bank account will be closed

- Your transactions will be paused

- Any charge would be debited by the bank

All it means is that you need to reconfirm your details and if there’s any change in the details, update that with your bank account. This article includes the process of submitting ReKYC for Union Bank customers in a detailed manner.

Step-by-Step Guide to Submit ReKYC for Union Bank of India Account Online

Step 1. Open the Google search engine on your phone or computer and type ‘Union Bank of India‘. You can use any other secure browser as well. Click on the first link appearing on the screen.

For a better experience on mobile, go to the upper-right corner of the screen and click on the ellipse (⋮) to get a list. Check the box adjacent to ‘Desktop Site‘.

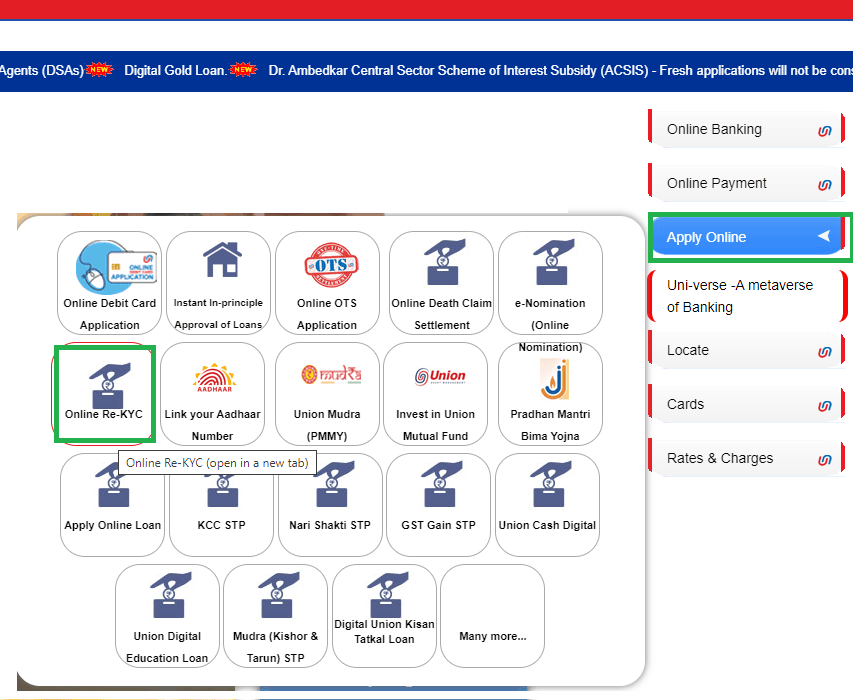

If you’re using this website for the first time, a pop-up will be generated for language preference. You can either select any preferred language to continue. From the home screen of the website, click on the ‘Apply Online‘ section from the right side of the screen. Sometimes, this section is not visible due to a chatbot popup. Click on ‘X‘ to close the chatbot and the required section will be visible.

Click on the ‘Online Re-KYC‘ button from the appeared menu. You’ll be redirected to another tab.

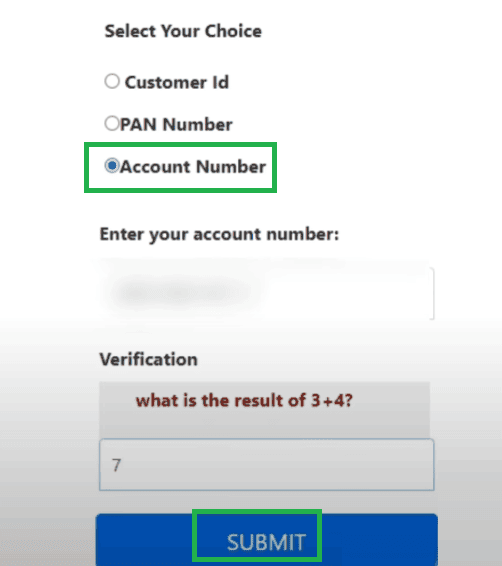

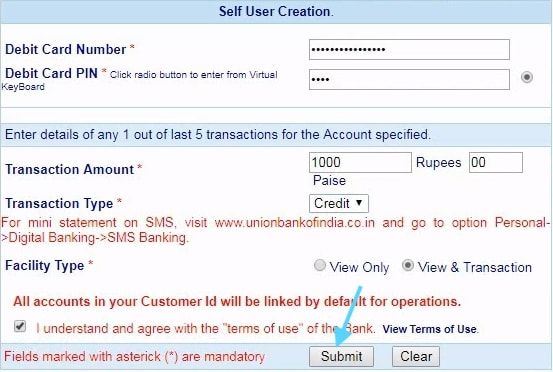

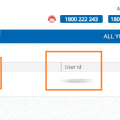

Step 2. You can choose any one option from the Customer ID, PAN Number or Account Number to continue your re-KYC for your Union Bank of India account. Then, enter the details that you selected (enter Customer ID if you selected that, PAN number if you selected that or Union bank account number if you selected that option. Customer ID and account number are available on your bank passbook).

Complete the verification test in the next field and click on the ‘Submit‘ button.

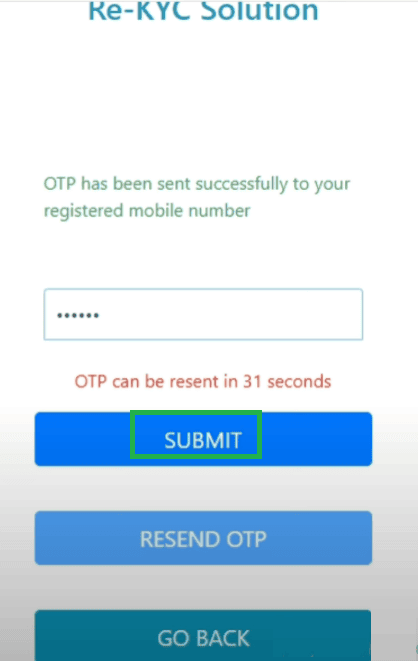

Step 3. An OTP (One-Time Password) will be sent to your registered mobile number. Enter that in the next field and click on the ‘Submit‘ button. If you didn’t receive any OPT, you can click on the ‘Resend OTP‘ button and enter the new OTP.

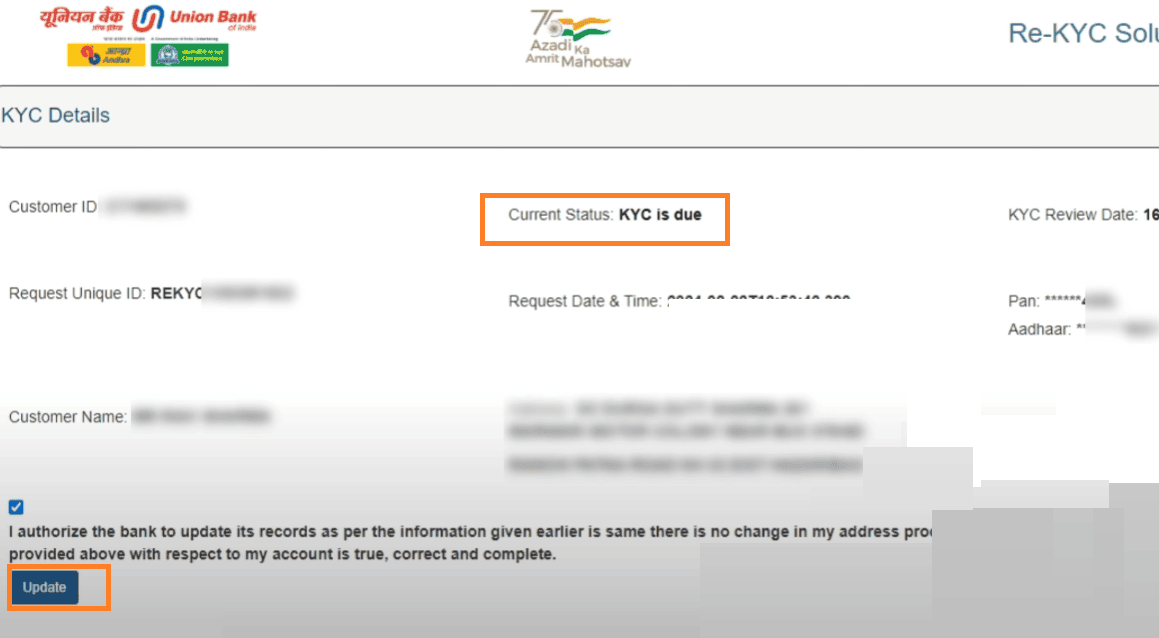

Step 4. The KYC details page will be opened on the next screen. All your details will be visible here. You can also notice your current status as ‘KYC is Due‘. If there is no change in your details then acknowledge the same by checking the box available at the bottom of the screen. Then, click on the ‘Update‘ button.

Your re-KYC application will be successfully submitted.

This is the only way to complete your re-KYC for Union Bank of India account online. There is no option to do it through their mobile application till now. Also, the duration to complete re-KYC on the portal is from 11 AM to 4 PM every day. If you can’t do it in this duration, you need to go to the ATM to complete the process.

Conclusion

Consumers who pose a high risk must undergo KYC at least every two years, medium-risk consumers at least every eight years, and low-risk customers at least every ten years. All of the formalities that are typically completed when opening an account will be included in this exercise. As you receive the message for re-KYC, complete it immediately to avoid any difficulty using the bank account for the transaction.

Also, note that if you have multiple ban accounts, you need to complete the re-KYC process for each of them when required. Re-KYC for one account to satisfy the requirement for any other account, even if you use the same mobile number for both.

how to update kyc online in union bank of india

i m allen monhit dont push any Onlinebanking under my name thank you