Your personal PAN (or Permanent Account Number) number for a home loan is required when you apply for a home loan. This is typically required to identify your financial ability and verify your income, tax payments, and overall financial history. Based on this information, one individual becomes eligible to apply for a loan amount to a certain extent.

However, while applying for the loan, you don’t require any bank’s or financial institute’s PAN number. There is only one distinct case where you might need your bank’s PAN details, that is, tax exemption.

What is the ICICI Bank PAN Number?

A tax exemption is a clause in the tax code that permits some forms of income, costs, or transactions to be subtracted from the amount of money that is considered taxable. This lowers the total amount of taxes owed by taxpayers since they are not required to pay taxes on income or transactions that meet the exemption criteria.

Aspects of taxation to which tax exemptions may be applicable include:

- Income: Some forms of income, such as those from municipal bonds or specific social security benefits, might not be subject to taxes.

- Expenses: Specific expenses, such as medical costs, charitable contributions, and mortgage interest payments, may be exempt from taxation under specific tax regulations.

- Transactions: Certain transactions, including sales tax exemptions for specific goods or services or capital gains exemptions on the sale of a principal property, may be free from certain taxes.

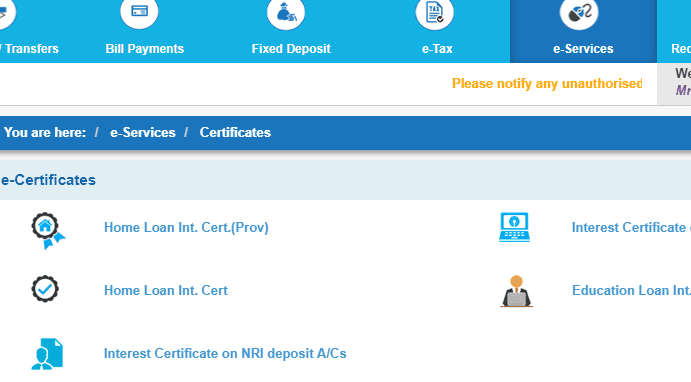

The ICICI Bank PAN number is AAACI1195H. Also note, that ICICI Home Finance Company Limited has a different PAN number, AAACI6285N. According to the official website of ICICI Bank, you can deduct taxes on the main amount you repay to the bank under Section 80C of the Income Tax Act. This rebate is also applicable to your home’s stamp duty and registration fees. In a fiscal year, the highest house loan tax deduction available per Section 80C is Rs. 1.5 lakh.

Be the first to comment