According to a 2022 study, domestic banks and housing finance businesses disbursed 34 lakh house loans totalling ₹9 trillion in India. Home loan is one of the most applied loans and that’s why you need to know the crucial details about it.

HDFC Bank is one of India’s largest banks in the private sector, with a wide range of financial products and services. Interestingly, the Home Development Finance Corporation (HDFC), India’s largest home finance firm, founded this bank.

Apart from sanctioning mortgage loans for purchasing or constructing homes, HDFC Bank also provides personal loans, car loans, two-wheeler loans, and education loans. This article will particularly provide information about the HDFC home loan PAN number.

Why do I need PAN Number of HDFC Home Loan?

Typically, you need a personal PAN number while applying for a home loan. The PAN card is a unique identifier for individuals in India. It allows the lender to verify your identification and confirm that you are who you claim to be. It also helps to avoid duplicate or fraudulent applications by guaranteeing that each loan applicant is individually identified.

Lenders like HDFC Bank use your PAN to verify your credit history and score with credit agencies. Your credit score is an important aspect in determining your eligibility for a loan and the interest rate charged. Note that, the Reserve Bank of India (RBI) and other financial regulatory authorities require the use of PAN for high-value transactions, such as home loans. This promotes transparency in financial transactions.

However, you need the bank’s PAN number only during tax exemption. Understand that, you will need the PAN number of your lender (the one who sanctioned your home loan) for this purpose, not any other bank’s PAN details where you might have a personal account.

Basically, you can pay a lower tax when you opt for a property purchase (like a house). Reduced taxes on loans aim to encourage the purchase of property by providing financial help to taxpayers who have obtained a mortgage. These exemptions can help to reduce a homeowner’s overall tax liability. The details of these exemptions vary by country, although they typically include deductions for principal and interest. Filing for tax exemption will need an HDFC PAN number.

What is the HDFC Bank PAN Number for Home Loan?

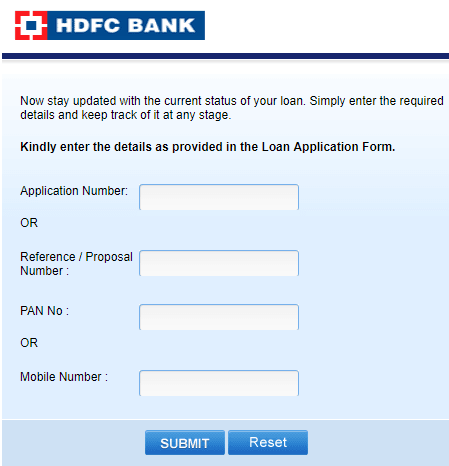

HDFC Bank home loan PAN number is AAACH0997E. This 10-digit number holds information about the bank, its financial status, and other related tax details. You may find this number on the tax sanction or tax interest certificate.

Note that HDFC Bank Limited has a different PAN number, AAACH2702H. Don’t get confused between these two numbers; they have separate purposes. It’s better to consult the bank manager before using the HDFC bank’s PAN number for home loan tax exemption.

Conclusion

This article contains everything you need to know before using an HDFC Bank Housing loan PAN number. As this number holds confidential information about the bank, you should consult the bank authority before using it for personal purposes. All the other information about the PAN number has already been explained to you here.

Be the first to comment