As you notice 295 rupees were deducted from your account in the State Bank of India, you should know about NACH (National Automated Clearing House). This process automatically debits any EMI amount from your bank account. If you fail to maintain the EMI amount before the deduction, a charge is marked by the bank.

In this article, you’ll learn the complete process of NACH and how you can avoid this 295 rupee charge.

What is NACH in SBI?

NACH or National Automated Clearing House is an automated process set up by NPCI for EMI deduction. For example, if you take a loan or buy anything against an EMI, you need to provide savings account details. If this is an SBI savings account, you need to keep the EMI amount before the due date. This is a fixed date of each month until the EMI is covered.

Why Rupees 295 is Deducted from SBI Account?

RS. 295/- is often deducted (95% of the time) when a NACH fails. If you have an RD or a loan from a lender other than SBI, and you approved the deduction of EMI or any other specified amount from that account.

If the EMI/mandate cannot be debited/fulfilled, an additional fee of Rs. 295/- is imposed. Also, the system does not always impose the penalty month by month; instead, it pools the penalty for a few months before debiting it altogether.

If you fail to maintain an adequate balance, the bank will levy a Rs 250 penalty. This penalty also carries an 18% GST. So, 18% of Rs 250 equals Rs 45. The final sum is Rs 250 plus Rs 45 = Rs 295. As a result, the bank deducts Rs 295 from your savings account as a charge for the insufficient amount that prompted the NACH EMI mandate to bounce.

How to Avoid 295 rupees Charge in SBI?

It’s important to know how to avoid the charge of 295 rupees. Not only it’s a charge you need to pay every time your EMI gets bounced, it’s not good in the customer profile. Here are a few things you need to keep in mind while you opt for an EMI and provide your SBI savings account details.

- Arrange the EMI amount at least 3 days before the due date. For example, if the due date is the 10th of each month, make sure the amount is in your savings account on or before the 7th of the month.

- When you opt for a loan or buy something on EMI, make sure to know the due date of each month so you never miss the deadline.

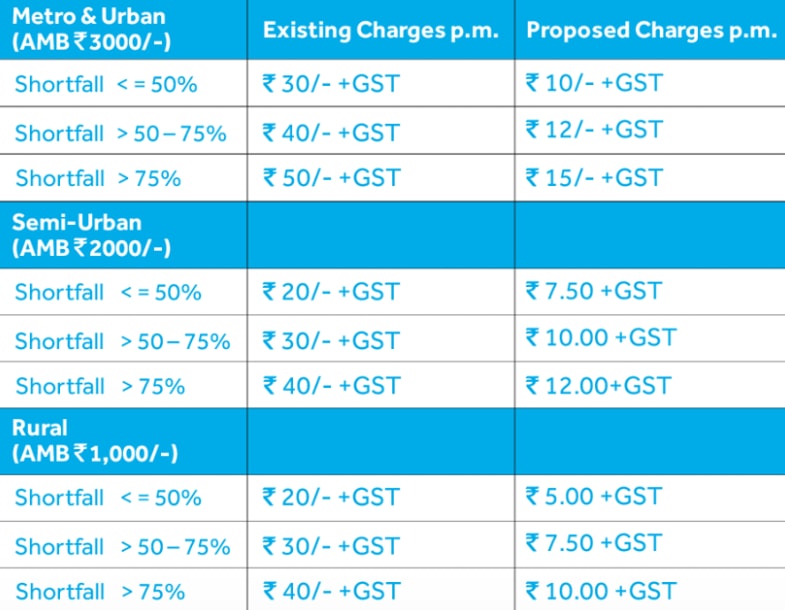

- Do not only keep the EMI amount but make sure after the EMI deduction, the balance amount is more than the required minimum balance. Otherwise, while 295 rupees will be saved, another charge of non-maintenance of the minimum balance can be levied.

- ECS is flexible, allowing you to terminate it whenever you choose for any reason. By completing the online NACH Hold/Cancellation form found in the post-login part of their web portal, you can terminate NACH service.

- You can also cancel the ECS mandates by contacting your bank’s customer service department or visiting the branch. In this case, you need to pay the EMI every month manually within the due date.

Conclusion

Dear Customer, Your A/C XXXX has a debit by a transfer of Rs. 295.00 on DD/MM/YYYY. Now, you know the meaning of this message. Also, you know what are the steps you should follow to stop this charge in future. Remember all the tips mentioned in this article.

Be the first to comment