In India, most of the people depend upon fixed deposits for investment and savings. As per the latest survey from SEBI, about 95% people rely on Fixed Deposits as a mean of investment and there are just 5% people who actually invest in stocks and mutual funds.

The percentage of people investing in stocks in a rural area is even less and it is close to 1%. In such a scenario it is important to understand different types of fixed deposits that are available with banks. There are some people who make fixed deposits for the saving purpose and they redeem the base capital as well as the interest at the maturity date.

Whereas there are some people who rely on interest income that is generated by fixed deposit. For them, they require the interest at end of every month or quarter.

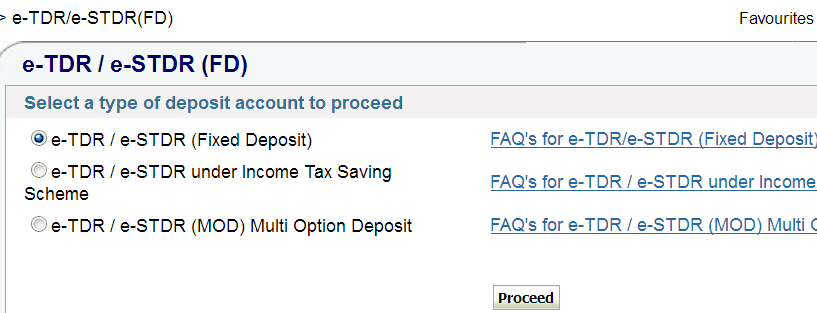

There are certain variations in both the cases and the rate of return can also vary slightly. In case of State Bank of India, TDR means Term Deposit and STDR means special term deposit. In this article, we have discussed the difference between the two.

What is TDR?

As mentioned above, TDR is Term Deposit and it is made in the case when people want the payment of the interest to be done monthly or quarterly. Bank pays the interest rate at end of every month or quarter and you can make the deposit under TDR scheme in such a scenario.

You can simply select the option of the frequency of interest payment to make a deposit under TDR. The interest generated by the deposit is credited to the savings account after every period and you can go ahead and withdraw the interest. For TDR in State Bank of India, Minimum tenure is 7 Days and maximum tenure is 3650 Days.

What is STDR?

STDR stands for Special Term Deposit and when a person makes an STDR deposit, he doesn’t get the interest every month or every year. The interest is credited at end of maturity period and in STDR the investor gets the additional benefit as the accumulating interest on the interest generated by the base capital every quarter.

The rate of return in case of STDR is a little higher because of the compounding interest. Hence it can be a little more beneficial for the investor. For STDR in State Bank of India, Minimum tenure is 180 Days and maximum tenure is 3650 Days.

Note:

The choice of the deposit is highly subjective and it totally depends on the goal of making a deposit. Also, these days, some of the banks like Axis Bank and HDFC bank pays the interest as per the normal interest rates under STDR whereas they deduct 10 bps from the normal interest rate when the investor choose to make a deposit under TDR scheme.

So if you make a TDR with a bank and you feel that you are getting a little variation in the interest which is being credited to your account, do not worry, simply go through the calculations as per the updated interest rate. In the case of any query, it is best to contact the branch manager. Moreover, there is tax deducted if the interest income exceeds Rs 10000 in a given financial year.

I don’t know what is tdr/stdr

Please explain to me in detail

What is range of interest in this

STDR is a nice scheme, one can close it in need and it takes in just an hour in the whole process. Rate of interest is moderate.