The personal loan statement of IDFC First Bank is required to keep track of loan repayments. In addition, you can receive IDFC First loan statements physically as well as online. These loan statements mainly consist of these components: statement period, transaction activity, due amount, unpaid principal balance, total EMIs paid, interest rate, remaining loan tenure, etc.

However, you have nothing to worry about regarding your IDFC First Bank personal loan statements and loan repayment scheduled EMI. You can easily make your IDFC First Bank repayment. This article helps and guides you on how to download the IDFC First Bank loan Statement online.

Benefits of IDFC First Bank Personal Loan Statements

You can use IDFC First Bank personal loan statement for the following activities –

- With the help of the IDFC First Bank personal loan statement, the loan borrowers can keep a check on their personal loan activities. If a borrower customer has a statement, they can check their remaining loan tenure, balance EMIs due for payment, etc.

- They can also use these IDFC First Bank personal loan statements as proof of loan taken whenever required.

- If the loan borrower needs credit in the future, then IDFC First Bank’s personal loan statement can also be helpful for the same as the loan lender party will check the previous loan statement at that time.

- After receiving the IDFC First Bank personal loan statement, the loan borrower cannot ignore the late payment charges, as these statements will remind him to make the payments on time in the future.

The Process to Download IDFC First Bank Loan Statement Online

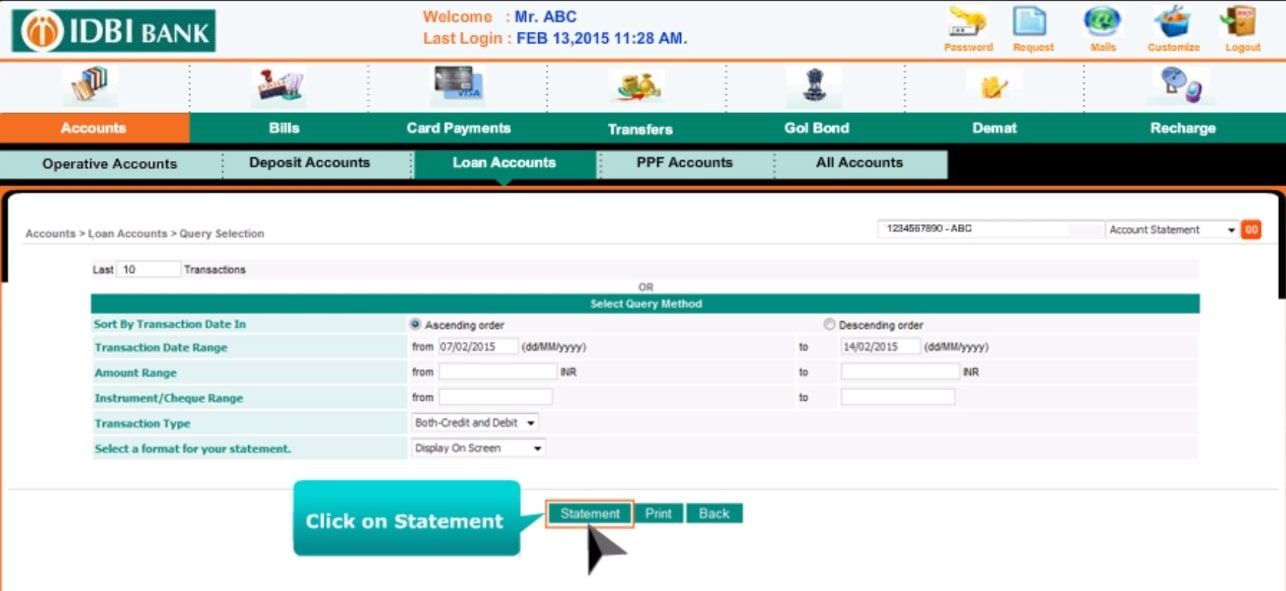

If you want to Check IDFC First Bank personal loan statements and loan repayment schedule on your mobile, you can do so easily. Follow the below-given fast and simple steps to check your IDFC First Bank personal loan statement within no time:

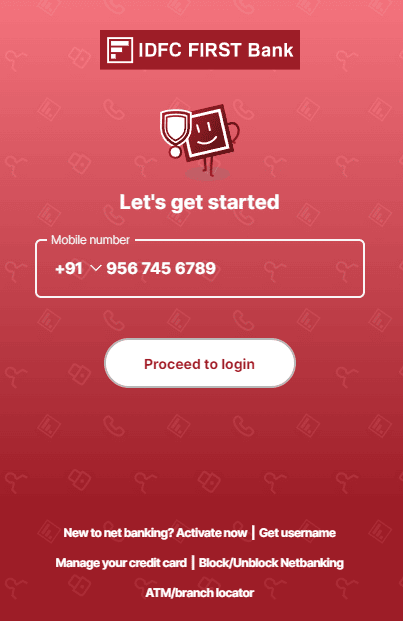

Step 1. Firstly, open your Google Chrome or any Web browser. Then type “IDFC first loan login consumer portal.” Then, you will see the official website link “Login-IDFC First Bank” on your mobile or device screen. Click on this official link https://my.idfcfirstbank.com/login.

Then, you will see the official website interface of IDFC First Bank, where you will see “Let’s get started” and a box to enter your Mobile number. Now you must write your registered mobile number in this box. Next, you will see “proceed to login.” You must click it.

Note: A registered mobile number means the mobile number where you receive all messages from IDFC First Bank.

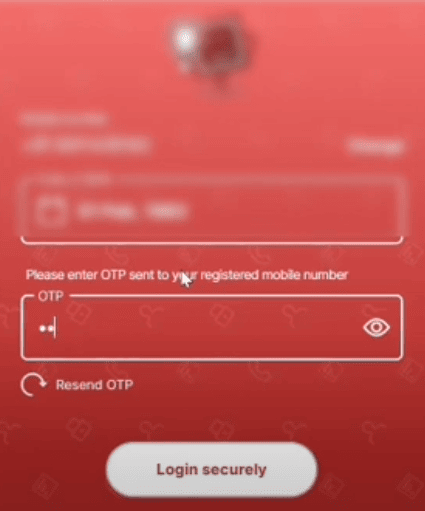

Step 2. After logging in, you will find a calendar of dates. You must select your date of birth from this calendar. Next, you will receive an OTP, type it and click on the “login securely” button.

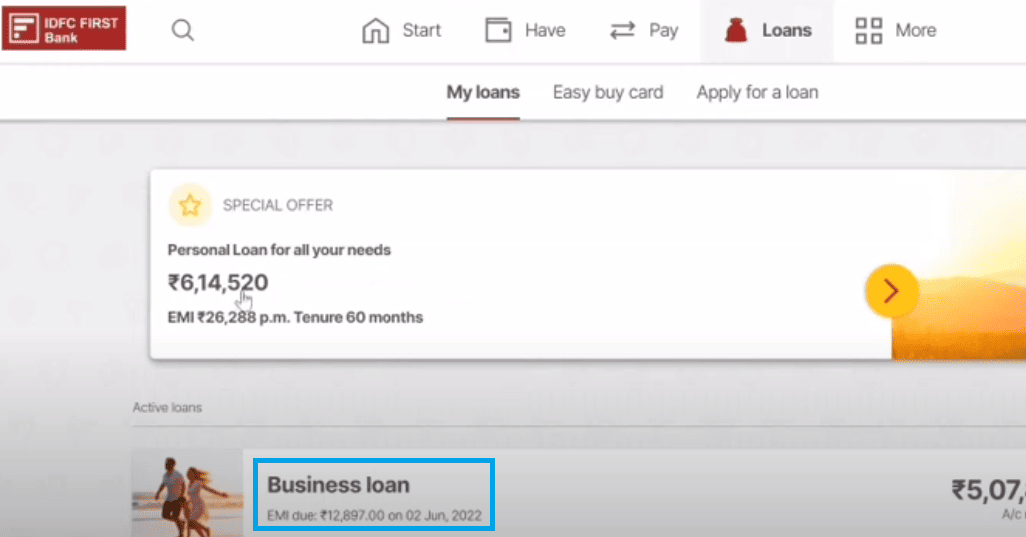

Step 3. Now, you will find an option for a “special offer.” For example, a “personal loan for all your needs for Rs. 6,14,520, EMI Rs. 28,800 p.m. Tenure 60 months”, and another option for “Active Loans,” where you will see “business loan,” which is your personal loan. You must click on the “business loan.”

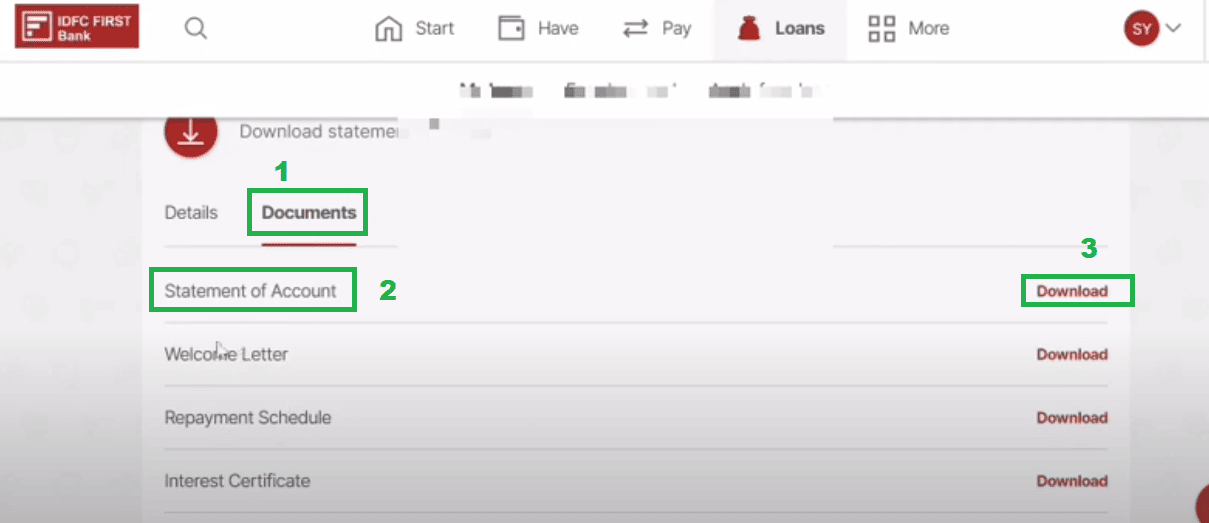

Step 4. Now, you will find your loan details: such as your personal loan and account number, on the top of your device’s screen and loan amount. You must scroll down to the bottom and see “documents.” You must click it.

Next, you will see “statement of account” and “repayment schedule” with the “download” icon in front of both of them. You can download your “statement of account” by clicking on the corresponding “download” icon. This statement of account shows the details of EMI, already paid by you. Similarly, you can download your “repayment schedule.”

Note: Sometimes, you may see an error: such as “download can not be completed,” But there is nothing to worry about. Instead, you can simply click on the “retry” button, and you will get your “repayment schedule” downloaded.

In addition to the downloads mentioned above, you can also download the “welcome letter” and “interest certificate” on your mobile, laptop, or computer device.

Important Note:

- You can also save all the downloads in PDF format and get their printout.

- If you do not have a registered mobile number, you must first call IDFC First Bank’s customer care in this regard. You can proceed with the process mentioned above only after your mobile number is registered.

Wrapping Up

Loans help us in our business and other essential needs in many ways. But we should always be careful about the repayment process and its due date to maintain our good CIBIL score. So, for example, if you wanted to know how to download the IDFC First Bank loan statement online, we have already shared the process.

Please note that you never fail to mention your loan account number and contact details with the IDFC First Bank. However, if you need further advice or help in this regard, you should approach their customer care service center.

IDFC Two Wheeler Loan statement download kaise kare