If you’ve recently applied for a home loan at Axis Bank or are planning to apply for one, the PAN number is one of the most important documents you need. While your personal PAN details are important for the bank to validate your credibility, the bank’s distinct PAN number can be helpful in some special scenarios.

This article will provide all the information about the Axis Bank PAN number for home loans, where to find it, and how to use it.

What is Axis Bank PAN Number?

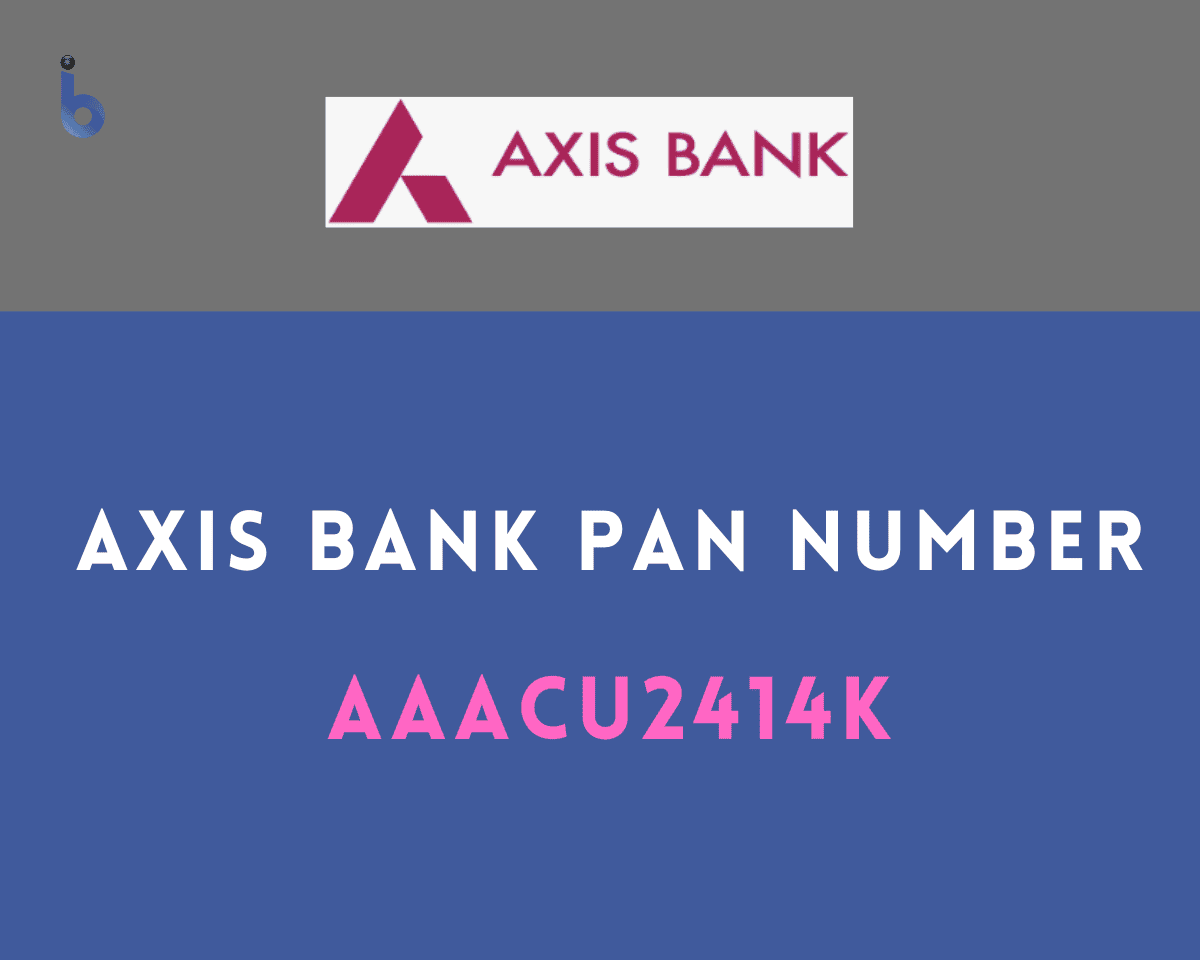

Axis Bank Pvt. Ltd.’s PAN number is AAACU2414K. Banks are also entities that are incorporated under the Societies Act for cooperative banks and the Companies Act for commercial banks. Government banks also use PAN cards. Since all artificial entities, including companies, are independent and distinct entities, including all living things, banks are likewise separate entities and have PAN cards. A PAN card in their own name is required for every individual subject to taxation, and banks are thus liable for taxes.

Where can I find Axis Bank PAN Number for Home Loan?

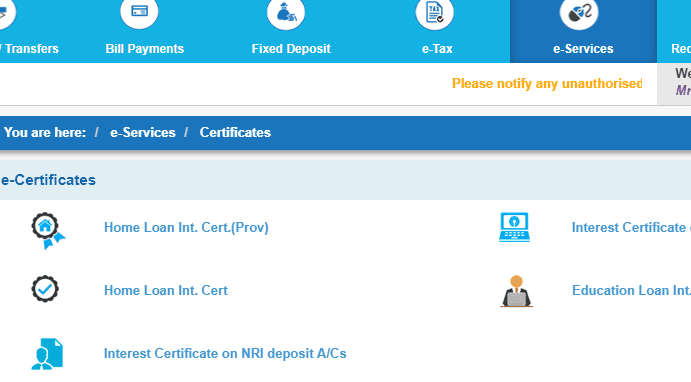

Generally, you can find the loan provider’s (bank or any other private loan provider) PAN details on the home loan interest certificate or loan sanction certificate. However, when applying for a loan, all you need is your personal PAN details. These details will help the bank authorise your application and give you credibility.

How do I use Axis Bank PAN Number for a Home Loan?

If you want to be eligible for a tax exemption on your home loan, you will need to provide the details of your bank’s PAN number. It needs to be the PAN of the specific financial institution that gave you the loan. In this case, it’s Axis Bank.

Tax exemptions on house loans are intended to encourage home ownership by offering financial relief to taxpayers who have obtained a mortgage. These exemptions can help homeowners decrease their overall tax liability. The specifics of these exemptions differ by country, but they typically entail deductions for interest and principal repayments.

- Taxpayers must own their home and have a mortgage secured against it.

- All interest and principal payments must be recorded accurately.

- Deductions must be claimed on annual tax returns, and special forms or schedules may be necessary.

Conclusion

Axis Bank’s PAN number for home loans can be needed while filing tax exemptions, according to Indian tax regulations. Before using this PAN number, you need to contact the branch manager (or someone equally responsible) for legal permission. Note that, while applying for a home loan at Axis Bank, you do not need to use the bank’s PAN details. Rather, your personal details are required. Make sure to fill up the details properly. Otherwise, your application might face a rejection.

Be the first to comment