Federal Bank is one of the fastest-growing private sector banks. It offers a variety of banking products and services, such as internet banking, mobile banking, online fee collection, cash management services, depository facilities, etc. But, as the necessary financial product of Federal Bank, they offer different savings accounts to their customers.

There Are many different aspects of Federal Bank savings accounts, such as interest rates, different types of savings accounts, opening account process, minimum average balance, and a penalty charge.

Interest Rates on Federal Bank Savings Accounts are based on the RBI’s repo rate. If you have a savings account with Federal Bank, then you should know about Federal Bank saving account minimum balance and penalty charges.

What are the Federal Bank Saving Account Minimum Balance & Penalty Charges?

If you are still doubtful of the facts and regulations for the above-mentioned subject, this article will quench your query satisfactorily. However, you must keep reading this article until the end to learn the necessary information.

Here’s a detailed input on the types of Federal Bank Savings Accounts, Charges for Non-Maintenance of Average Minimum Balance, and penalty charges to be collected based on the actual Average Minimum Balance shortage in the account vis-à-vis scheme of accounts.

1. FedBook Selfie Account

To open this account, the customers are required to download the FedBook app. Then they should upload a selfie along with scanned copies of the required KYC documents. In addition, the account holders can receive a free International Gold Debit Card with ten cheque leaves in a year.

It is a zero-balance account; therefore, there is no need to maintain any Average Minimum Balance in this account.

2. Fed Excel Savings Account

The account holders of this savings account are provided with fabulous features for working professionals and entrepreneurs. They are offered a free international Gold Debit Card with a daily POS limit of Rs. 75,000. Besides free internet banking and mobile banking facilities, they also receive access to FedBook.

Instead of the Average Minimum Balance, Rs. 10000 initial remittances are required in this account.

3. SB Plus Savings Account

The account holders of this savings account enjoy many facilities like an international debit card, free DDs of up to Rs. 10,000 every month, and a 25% discount on the service charge of outstation cheque collection, etc.

The Average Minimum Balance required to be maintained in this account is Rs. 5000.

4. Mahilamitra Plus Savings Account

The account holders of this savings account are exclusively women, who can receive an International Gold Debit Card, can withdraw up to Rs. 75,000 per day through ATMs for no additional charges, can use free RTGS services with this account, and can avail some other facilities too.

The Average Minimum Balance required to be maintained in this account is

- Metro/Urban Branch – Rs. 10,000

- Semi-Urban Branch – Rs. 7,500

- Rural Branch – Rs. 5,000

5. Yuvamitra Savings Account

The account holders of this savings account are students. This account offers many benefits, such as an international debit card with a daily POS limit of Rs. 30,000 and other benefits.

It is a zero-balance account, therefore, there is no need to maintain any Average Minimum Balance in this account.

6. Fed Smart Savings Account

This savings account holder is provided with internet banking, mobile banking, daily email statements, and outstation cheque collection at no extra cost. Also, they are allowed daily withdrawals of up to Rs. 75,000 through ATMs for no additional charges.

The Average Minimum Balance required to be maintained in this account is Rs. 100000.

7. Club Savings Account

This account is available at Metro branches. The account holders of this savings account are provided with a RuPay Platinum Debit Card, free mobile banking, free internet banking, and free email alerts.

The Average Minimum Balance required to be maintained in this account is Rs. 5000.

8. Delite Savings Account

This account is available only at the Urban and Semi-Urban branches. The account holders of this savings account are provided with a Master Crown Debit Card, free email alerts, free mobile alerts, and some other facilities.

The Average Minimum Balance required to be maintained in this account is Rs. 3000.

9. Pride Savings Account

This account is available only at Rural branches. The account holders of this savings account are provided with a Master Crown Debit Card, free mobile alerts, free mobile banking, and free internet banking.

The Average Minimum Balance required to be maintained in this account is Rs. 2000.

10. Basic Savings Bank Deposit Account

This savings account holder gets a free Chequebook and ATM card. The government provides them subsidies and benefits through the Aadhaar card, which is credited to this account at no extra cost.

It is a zero-balance account, therefore, there is no need to maintain any Average Minimum Balance in this account.

11. FedFirst Savings Account

The account holders of this savings account are children. They are exempted from paying demand draft charges for paying educational fees of up to Rs. 50,000 per month and other benefits. If this account is opened with specific schemes like Fed Power+ or Mahila Mitra or Fed NRI Eve or Fed Select or Fed Smart, or Fed NRI Privilege, then there is no need to maintain any minimum balance in this account.

However, the Average Minimum Balance required to be maintained in this account is Rs. 1000.

13. SHRENI Savings Account:

This account is mainly designed for Clubs, Trusts, Associations, Committees, etc. However, this savings account holder gets many benefits: free account statements by email or postal mail, 50 free transactions every quarter, free mobile banking and SMS alerts, etc.

The Average Minimum Balance required to be maintained in this account is Zero.

| Type of Account | Required Average Minimum Balance |

|---|---|

| FedBook Selfie Account | zero |

| Fed Excel Savings Account | 10000 |

| SB Plus Savings Account | 5000 |

| Mahilamitra Plus Savings Account |

|

| Yuvamitra Savings Account | Zero |

| Fed Smart Savings Account | 100000 |

| Club Savings Account | 5000 |

| Delite Savings Account | 3000 |

| Pride Savings Account | 2000 |

| Basic Savings Bank Deposit Account | Zero |

| FedFirst Savings Account | 1000 |

| SHRENI Savings Account | Zero |

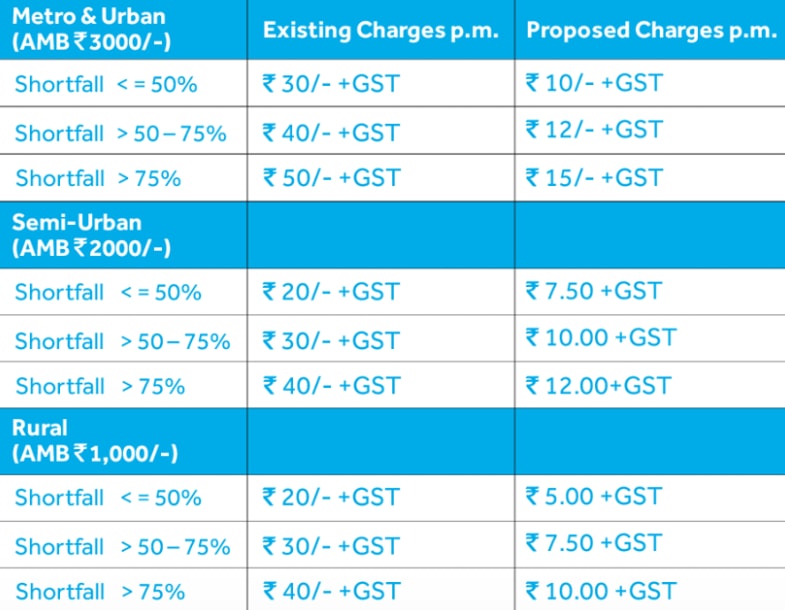

Penalty Charges for the Shortfall in Average Minimum Balance

You should know that Penalty Charges are collected as per the shortage in actual Average Minimum Balance in the account vis-à-vis scheme of accounts, such as:

Chart A

| The shortfall in Average Minimum Balance

(Pride & NR SB Accounts) |

Penalty Amount in Rupees |

|---|---|

| Upto 20% | 55 |

| Above 20% up to 40% | 95 |

| Above 40% up to 60% | 140 |

| Above 60% up to 80% | 185 |

| Above 80% up to 100% | 230 |

Chart B

| The shortfall in Average Minimum Balance

(Club, Delite & Resident SB schemes with AMB requirement of 5,000 & above) |

Penalty Amount in Rupees

(For Senior Citizens) |

Penalty Amount in Rupees

(For others) |

|---|---|---|

| Upto 20% | 55 | 55 |

| Above 20% up to 40% | 95 | 110 |

| Above 40% up to 60% | 140 | 65 |

| Above 60% up to 80% | 185 | 220 |

| Above 80% up to 100% | 230 | 275 |

Chart C

| The shortfall in Average Minimum Balance

(All other schemes) |

Penalty Amount in Rupees

(For Senior Citizens & Rural) |

Penalty Amount in Rupees

(For others) |

|---|---|---|

| Upto 20% | 45 | 55 |

| Above 20% up to 40% | 77 | 85 |

| Above 40% up to 60% | 110 | 120 |

| Above 60% up to 80% | 140 | 165 |

| Above 80% up to 100% | 185 | 200 |

Note: These penalty charges are not applicable for schemes for which the Average Minimum Balance is specifically exempted. So this way, you can learn about Federal Bank saving account minimum balance and penalty charges for not maintaining.

Conclusion

If you were in doubt, we hope we successfully cleared your query about Federal Bank saving account minimum balance and penalty charges for non-maintenance on the monthly average balance.

However, remember that non-maintenance of the average minimum balance will be intimated to the customer, and one month’s notice period will be given to restore the average balance to the stipulated level vis-à-vis scheme of account.

is this penalty for every month or every 3momths?

Every month they are charging minimum balance penalty, charges are not even as shown in the table, myself having an SB account in a federal bank, and I’m fed up with the inconvenience of the way they are charging penalties or fine,

For eg. 60, 100, 125 165… Like this they will charge, from 3 to 4 years I’m facing this problem,